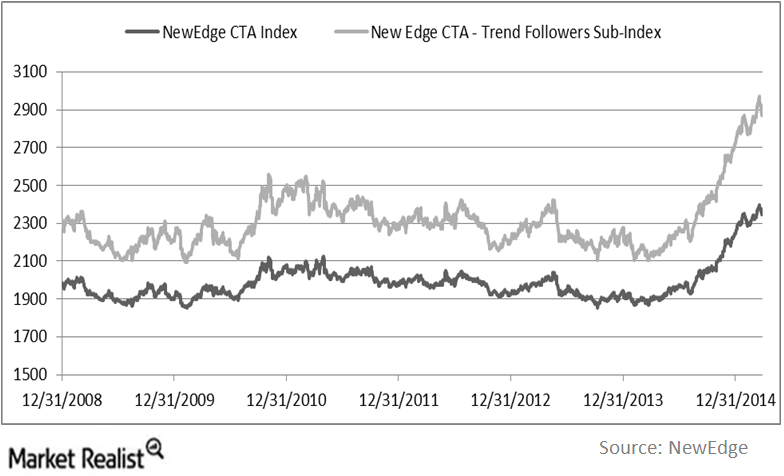

During trend following markets, it may be worthwhile to look at CTA (hedge funds) who follow trend following strategies. We use the NewEdge published trend indicator. Hedge fund observers understand that performance can be as cyclical as the markets themselves. The key driver of fund performance is rarely just skill. It’s driven by market conditions benefiting one type of strategy over another. Their performance also serves as an indicator. It reflects whether the market is changing. It also reflects the types of strategies that have the best chance of continuing to work. Capital3x Trade Copier has closed 117% return and is consistently outrunning market. This proves that trend following strategies will benefit traders.

Understanding CTAs

CTAs are generally thought of as systematic, quantitative funds that employ a lot of PhDs and data scientist types. No matter how well these guys map out markets, their “alpha” turns positive when strong directional trends develop. This is what allows them to systematically employ market making strategies that turn “easy” profit by adding liquidity at mathematically predetermined bid-ask levels. This is also what allows their trend following systems to work. They’re highly quantitative funds that perform best when trends are strongest to either the upside or downside. They’re able to participate in many different types of markets including global equity indices, commodities, and fixed income—the list goes on. It’s important to notice that their performance waned after 2009. This was primarily due to quick shifts in trends. The marketplace was finding an equilibrium after the Great Recession.

Global trends

Post 2012, Global trends have picked up and established. Infact in 2014/2015 global trends are at their strongest—whether the trends are positive or negative. Strong trend die hard. Strong triggers are needed to stop such trends. Currently there is nothing that can stop this trend. The likelihood of continuation is high. What can stop it? Will global central banks suddenly stop easing? Will commodities suddenly revert in a meaningful way? Will Putin and Greece announce that they’re Buddhist?

Current trends have been dominated by global easing. It pushed the dollar higher, but at maximum velocity. In turn, this poured fuel on the oversupplied commodity markets’ fire. It pushed them even lower. This continues to place a cap on inflation. Since the Fed is closely watching inflation as a signal to raise rates, current monetary policy will be here for a bit longer. Meanwhile, central banks around the world are easing at unprecedented levels. They’re all hoping for the same thing—an American style boost to their economy.

The effect of these prolonged policies and macro trends will continue to determine clear winners and losers. There will be some elements of risk sprinkled in. Mainly, this will involve geopolitical risks coming from Greece, Russia, and the Middle East.

Conclusion

Our clients will take cue from this and continue to invest in trend following strategies. We believe strong trends die hard and therefore there may be steam left in the current trends established.

Recommended Content

Editors’ Picks

AUD/USD rises to two-day high ahead of Aussie CPI

The Aussie Dollar recorded back-to-back positive days against the US Dollar and climbed more than 0.59% on Tuesday, as the US April S&P PMIs were weaker than expected. That spurred speculations that the Federal Reserve could put rate cuts back on the table. The AUD/USD trades at 0.6488 as Wednesday’s Asian session begins.

EUR/USD now refocuses on the 200-day SMA

EUR/USD extended its positive momentum and rose above the 1.0700 yardstick, driven by the intense PMI-led retracement in the US Dollar as well as a prevailing risk-friendly environment in the FX universe.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Ethereum continues hinting at rally following reduced long liquidations

Ethereum has continued showing signs of a potential rally on Tuesday as most coins in the crypto market are also posting gains. This comes amid speculation of a potential decline following FTX ETH sales and normalizing ETH risk reversals.

Australia CPI Preview: Inflation set to remain above target as hopes of early interest-rate cuts fade

An Australian inflation update takes the spotlight this week ahead of critical United States macroeconomic data. The Australian Bureau of Statistics will release two different inflation gauges on Wednesday.