Unchanging Rates Lead to Changing Markets

Three major central bank policy decisions occurred this past week that followed in the footsteps of the European Central Bank’s (ECB) decision during the previous week. The three were, in chronological order, the US Federal Reserve, the Reserve Bank of New Zealand (RBNZ), and the Bank of Japan (BoJ). In summary, every one of these four central banks opted to keep interest rates unchanged. While this was expected for both the ECB and Fed, there was some prior speculation over potential further easing by the RBNZ, and certainly much anticipation that the BoJ would act with additional stimulus measures in attempts to halt the strengthening of the Japanese yen. In the end, however, non-action was the theme of the week, and it affected the markets in sometimes drastic ways.

The primary case in point occurred with the Bank of Japan. Despite the previous week’s reports that the BoJ was considering potentially more aggressive easing actions in the form of additional stimulus measures, which had led to an immediate drop in the yen, Japan’s central bank issued its decision on Thursday that it would hold off on any monetary easing. Interest rates remained unchanged and the BoJ was seen as taking the unexpected path of non-action, with nothing in the way of guidance or indication of any future action. This prompted an exceptional surge for the Japanese yen. This further strengthening of an already soaring yen is undoubtedly problematic for the BoJ, and continues to beg the question as to when the central bank will intervene with measures to weaken its currency. But it also presents the equally valid question of whether any intervention measures implemented by the BoJ would actually be effective in stemming yen strength. When the central bank pushed interest rates into negative territory in late January, the yen initially tumbled according to plan. Immediately thereafter, however, the currency embarked on a period of major strengthening for the ensuing months. The current situation appears to be similar, at least from a price action perspective. As of this writing, USD/JPY has plunged dramatically to drop below key 108.00 support as the yen has extended its surge and the dollar has continued to slide.

As for the dollar, the FOMC statement that preceded the BoJ decision was essentially a non-event. As expected, US interest rates were left unchanged. Aside from this, the Fed reiterated once again that its policy outlook will continue to be dependent upon economic data going forward, and that its pace of tightening would likely be gradual. The statement went on to provide mixed assessments of economic conditions, mentioning improvements in the labor market but a slowdown in economic growth indications. The one modestly hawkish aspect of the statement occurred not in its actual content, but in its omission of a key assertion from the previous statement in March. This time, the FOMC left out reference to global economic and financial risk, which indicated the Fed’s acknowledgement of a recent stabilization in world markets, especially when compared to the turmoil that occurred earlier in the year. Despite the fact that the FOMC statement did not introduce any new information, this omission of the key phrase on global risk was seen as somewhat of a hawkish signal that potentially increases the possibility of a rate hike at the FOMC’s next meeting in June. The immediate market reaction to the Fed’s statement was a spike in the dollar and a fall in gold, followed by a short period of whipsaw for both. In the following days, however, it became clear that the Fed’s consistently cautious stance could severely impede future rate increases, especially in light of a recent series of soft economic data releases, including Thursday’s weaker-than-expected US GDP report. This has placed significant pressure on the dollar, leading to a further downturn for the US currency.

To continue on with the central bank theme, the Reserve Bank of Australia will be issuing its rate and policy statements next week. Also of particular note will be several important employment data releases which could have significant bearing on central bank decision-making, including New Zealand early in the week followed by Canada and the US Non-Farm Payrolls simultaneously on Friday morning.

Technical Developments

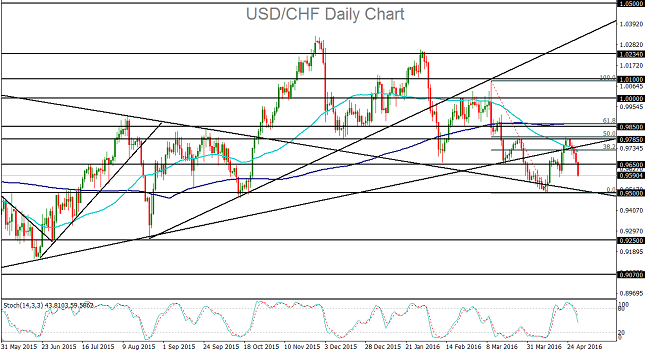

- USD/CHF has extended its fall from resistance on a significantly weakened dollar, and could be poised to confirm a continuation of its medium-term downtrend.

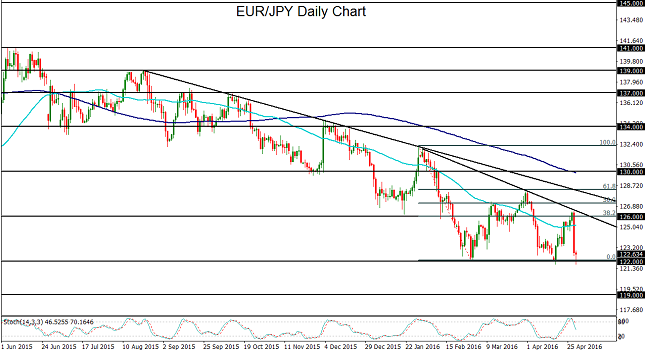

- EUR/JPY has plunged to major support at 122.00 on a sharp surge in the Japanese yen after the Bank of Japan opted not to act during this past week’s monetary policy meeting.

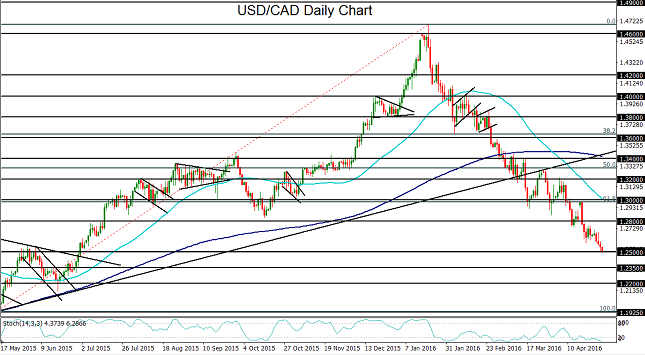

- USD/CAD has dropped down to major psychological support at 1.2500 on rising crude oil prices and a falling US dollar, and could soon break down to further lows.

USD/CHF

Pressure on the dollar stemming from the Fed’s consistently cautious stance and lackluster US economic data in recent weeks, including the recent weaker-than-expected GDP reading, has resulted in an extended retreat from major resistance for USD/CHF. At the start of the past trading week, the retreat began at a critical level for USD/CHF, turning the currency pair down right around the key 0.9785 resistance area, which is also around the 50% retracement level of the last major bearish run from March’s high to April’s low. That price level has served as a major support and resistance area since late 2015. From a slightly longer-term technical perspective, USD/CHF has been in a general decline since December, printing consistently lower highs and lower lows as the dollar has suffered from an increasingly dovish Fed after December due to continued weakness in economic conditions and inflation. With continued bearish momentum on the current USD/CHF retreat, the next major downside target is at the 0.9500 support area, which is the level of April’s lows. In the event of a further breakdown below 0.9500, a continuation of the medium-term downtrend will have been confirmed, with a further downside target around the 0.9250 support area.

EUR/JPY

The rise of EUR/JPY in the previous week on reports and speculation over potential easing by the Bank of Japan, followed by its subsequent plunge on the BoJ’s actual decision to avoid action, is somewhat reminiscent of the currency pair’s rise in late January around the central bank’s foray into negative rates followed by the extended fall that resulted. The only major difference is that the current drop has begun in a significantly more severe manner. Current yen strength as of Friday has pushed EUR/JPY back down to hit and dip slightly below major support around 122.00, which is the level of the recent double-bottom low. This double-bottom pattern developed with the first 122.00-area low occurring in late February and early March, and the second one having been established just in the previous week after hitting a new three-year low. Since mid-year of last year, EUR/JPY has been forming a clearly-defined downtrend with progressively lower highs and lower lows. Any sustained breakdown below the noted 122.00 support level would confirm a continuation of this bearish trend and could likely lead to a significant extension of the downtrend. With any such breakdown, the next major downside target resides at the key 119.00 support level.

USD/CAD

USD/CAD dropped to hit its 1.2500 downside target late this past week, establishing a new 9-month low on a sliding US dollar and consistently buoyant crude oil prices. The current lows for USD/CAD have been the latest culmination of a strong downtrend that has been in place since January’s long-term highs near 1.4700. This downtrend has largely resulted from the combination of a generally weakening US dollar and a strengthening Canadian dollar boosted by recovering crude oil prices within the past three months. During the course of this downtrend, the currency pair has broken down below multiple key support factors, including the 1.4000 and 1.3000 psychological levels, as well as a major uptrend line that extends back to the lows of July 2014. In the previous week, USD/CAD turned down sharply from the key 1.3000 psychological resistance level as crude oil prices rebounded strongly. Since then, the currency pair has continued to move lower as crude oil has remained well-supported and the US dollar has resumed its downturn. Further indicating a bearish environment for the currency pair, for the first time since 2014 its 50-day moving average crossed below its 200-day moving average several weeks ago, forming a technical “death cross” and suggesting strong bearish momentum. Having just reached down to the noted 1.2500 psychological support level, USD/CAD has reached a critical juncture. With any sustained breakdown below 1.2500, the next major downside target is at the 1.2200 support level, which would confirm a continuation of the sharp downtrend that has been in place for the past three months.

Investopedia does not provide individual or customized legal, tax, or investment services. Since each individual’s situation is unique, a qualified professional should be consulted before making financial decisions. Investopedia makes no guarantees as to the accuracy, thoroughness or quality of the information, which is provided on an “AS-IS” and “AS AVAILABLE” basis at User’s sole risk. The information and investment strategies provided by Investopedia are neither comprehensive nor appropriate for every individual. Some of the information is relevant only in Canada or the U.S., and may not be relevant to or compliant with the laws, regulations or other legal requirements of other countries. It is your responsibility to determine whether, how and to what extent your intended use of the information and services will be technically and legally possible in the areas of the world where you intend to use them. You are advised to verify any information before using it for any personal, financial or business purpose. In addition, the opinions and views expressed in any article on Investopedia are solely those of the author(s) of the article and do not reflect the opinions of Investopedia or its management. The website content and services may be modified at any time by us, without advance notice or reason, and Investopedia shall have no obligation to notify you of any corrections or changes to any website content. All content provided by Investopedia, including articles, charts, data, artwork, logos, graphics, photographs, animation, videos, website design and architecture, audio clips and environments (collectively the "Content"), is the property of Investopedia and is protected by national and international copyright laws. Apart from the licensed rights, website users may not reproduce, publish, translate, merge, sell, distribute, modify or create a derivative work of, the Content, or incorporate the Content in any database or other website, in whole or in part. Copyright © 2010 Investopedia US, a division of ValueClick, Inc. All Rights Reserved

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.