![]()

The current surge in EUR/USD may have been somewhat difficult to imagine just a few months ago when it seemed that most market participants had a strong bearish outlook for the currency pair. That bearish bias stemmed logically from the argument that the prevailing monetary policy stances between the European Central Bank (ECB) and the US Federal Reserve remained highly divergent, with a consistently dovish ECB pressuring the euro and an increasingly hawkish Fed supporting the dollar.

Fast forward to February of 2016, and the dynamics for at least one side of this currency pair have shifted dramatically. Now, with the Fed not only unsure about further interest rate hikes but also potentially entertaining the possibility of rate cuts and negative interest rates on the hazy horizon, the previously-rising US dollar has made an abrupt U-turn.

The Fed’s progressively more dovish trajectory since December’s long-anticipated rate hike has recently begun to weigh heavily on the US dollar and has been the primary driver of EUR/USD’s sharp surge in February thus far.

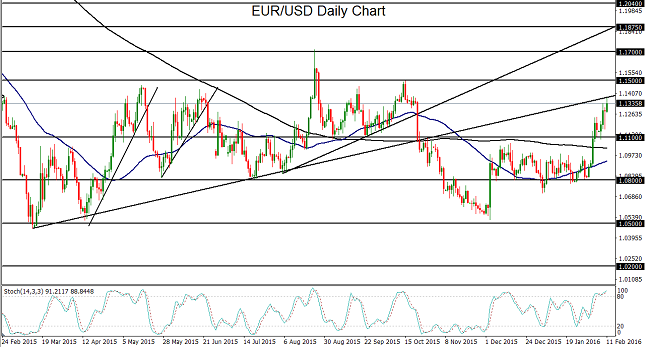

Whereas the months of December and January saw the currency pair consolidate within a tight trading range just above the key 1.0800 support level, the arrival of February brought increased concerns over turbulent financial markets, plunging crude oil prices, and slowing economic growth on a global basis. In turn, these concerns severely dampened speculation over future Fed rate hikes and led to broad-based dollar-selling.

This has been manifested as a strong surge in the EUR/USD that broke out above the key 1.1100 resistance level, and then followed-through to the upside to rise well above 1.1300 as of Thursday.

As the probability of further rate hikes by the Fed in the foreseeable future continues to diminish, the dollar could continue to undergo increased selling pressure, which could propel EUR/USD further up towards major resistance areas around 1.1500 and then 1.1700. To the downside, any sustained move back below 1.1100 support (previous resistance) would be a significant bearish indication that would invalidate the recent upside breakout.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.