AUD/USD has been falling in a sharp downtrend for the past month from its late April high above 0.7800. The initial drop was accelerated after a surprisingly low Australian inflation (CPI) reading was released near the end of April and then was followed up in early May by a Reserve Bank of Australia interest rate cut to a record low 1.75%. Subsequently, the central bank lowered inflation forecasts and hinted at further potential rate cuts.

At the same time that the Australian dollar has been heavily pressured this month, the US dollar has been in recovery mode as increased anticipation of a near-term rate hike by a more hawkish Federal Reserve has fueled a rebound in the US dollar. This, in turn, has helped prompt a drop in gold prices, with which the Australian dollar is often positively correlated.

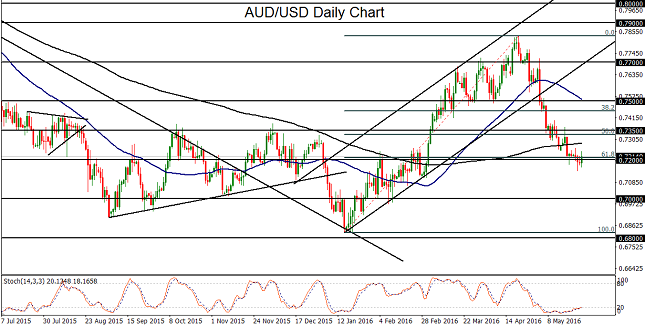

With these factors affecting both the Australian and US dollars in recent weeks, there should be little surprise that the AUD/USD has been in such a sharp slide this month. Since early May, this slide has led to strong breakdowns below major support levels, including: the 50-day moving average, an uptrend channel extending back to January’s multi-year lows near 0.6800, the key 0.7500 and 0.7350 support levels, and most recently, the 200-day moving average. The latest culmination of this precipitous decline has seen AUD/USD reach down to hit its key downside support target at 0.7200, around which the currency pair has fluctuated for the past week.

Looking ahead, the persistent contrast between an increasingly dovish Reserve Bank of Australia and a seemingly more hawkish Federal Reserve is likely to lead to a continuation of both the short-term and long-term downtrends for AUD/USD. Key risk events on the US side will be presented on Friday, when US GDP data will be released and Fed Chair Janet Yellen will be making a speech. With any further US dollar strengthening in the event of better-than-expected GDP data and/or a hawkish Yellen speech, a decisive breakdown below 0.7200 could occur, in which case the next major downside target is at the 0.7000 psychological support level.

Investopedia does not provide individual or customized legal, tax, or investment services. Since each individual’s situation is unique, a qualified professional should be consulted before making financial decisions. Investopedia makes no guarantees as to the accuracy, thoroughness or quality of the information, which is provided on an “AS-IS” and “AS AVAILABLE” basis at User’s sole risk. The information and investment strategies provided by Investopedia are neither comprehensive nor appropriate for every individual. Some of the information is relevant only in Canada or the U.S., and may not be relevant to or compliant with the laws, regulations or other legal requirements of other countries. It is your responsibility to determine whether, how and to what extent your intended use of the information and services will be technically and legally possible in the areas of the world where you intend to use them. You are advised to verify any information before using it for any personal, financial or business purpose. In addition, the opinions and views expressed in any article on Investopedia are solely those of the author(s) of the article and do not reflect the opinions of Investopedia or its management. The website content and services may be modified at any time by us, without advance notice or reason, and Investopedia shall have no obligation to notify you of any corrections or changes to any website content. All content provided by Investopedia, including articles, charts, data, artwork, logos, graphics, photographs, animation, videos, website design and architecture, audio clips and environments (collectively the "Content"), is the property of Investopedia and is protected by national and international copyright laws. Apart from the licensed rights, website users may not reproduce, publish, translate, merge, sell, distribute, modify or create a derivative work of, the Content, or incorporate the Content in any database or other website, in whole or in part. Copyright © 2010 Investopedia US, a division of ValueClick, Inc. All Rights Reserved

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold stays in consolidation above $2,300

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.