Technical Developments

- EUR/USD has risen up against major resistance and could be poised for a breakout to continue its uptrend from December.

- GBP/USD continues to be pressured as sterling has fallen against most other major currencies, and has re-approached its recent long-term lows.

- USD/JPY has broken down to hit a key support target at 108.00, establishing a new 17-month low, and could see further weakness towards 105.00.

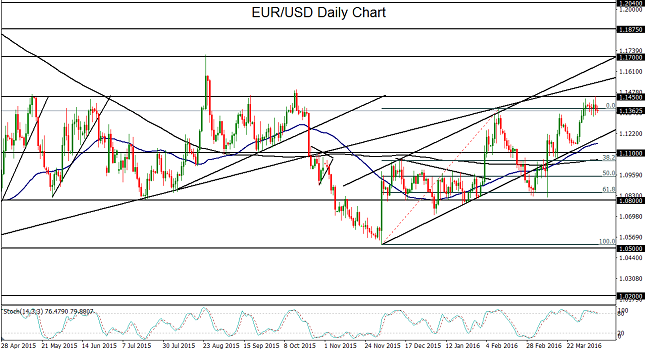

EUR/USD

This past week saw a prolonged consolidation for EUR/USD up against major resistance around the 1.1450 area. This consolidation is the latest culmination of a rising trend characterized by higher highs and higher lows since December’s lows near 1.0500. During the course of this uptrend, the currency pair has broken out above major resistance areas, including the key 1.1100 level, largely as a result of a weakening of the US dollar. In mid-March, the 50-day moving average crossed above the 200-day moving average, suggesting a bullish outlook for the near term. Currently just off the noted key resistance level around 1.1450, EUR/USD is at a critical technical juncture. Any sustained breakout above this resistance could go on to target the next major upside target at the 1.1700 level, which was the area of the high reached in August 2015.

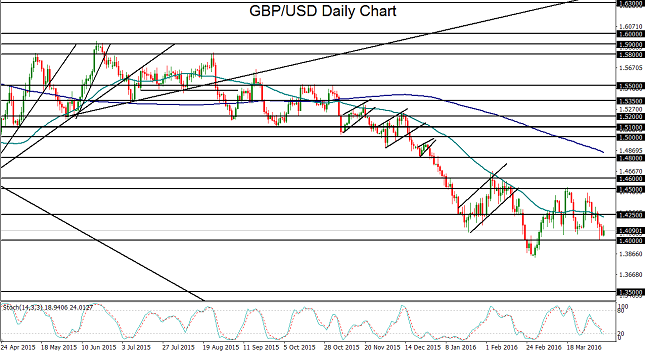

GBP/USD

GBP/USD has continued to trade under pressure as of late. Sterling has fallen considerably against other major currencies, including the dollar, euro, and yen, due not only to a rather consistently dovish Bank of England, but also by a looming June referendum that draws ever closer, in which the UK will decide whether or not it will remain in the European Union. This pressure on GBP/USD has occurred despite general weakness in the US dollar, which suggests that the pound could have considerably further to fall in the run-up to the referendum. Recently, GBP/USD has continued to trade in a weakened state, consolidating not far above its near-7-year low below 1.4000 that was just established in late February. Next week, the Bank of England will announce its official bank rate and monetary policy summary. Although the central bank is not expected to change interest rates at that meeting, the policy summary will, as always, be scrutinized closely for any clues as to the bank’s stance on interest rates going forward. From a technical perspective, GBP/USD appears once again to be poised for an impending breakdown below the key 1.4000 psychological level. With any further breakdown below February’s multi-year low of 1.3835, a continuation of the long-term downtrend will have been confirmed, with the next major downside target considerably lower at the key 1.3500 support level.

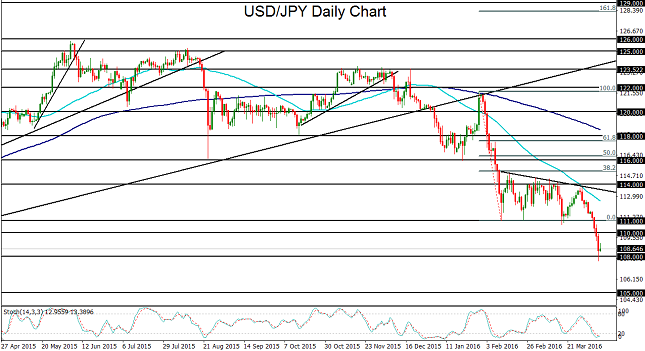

USD/JPY

USD/JPY continued its plunge this past week, falling well below the 110.00 psychological level to hit a major downside support target at 108.00. In the process, the currency pair established a new 17-month low. USD/JPY’s sharp fall within the past week-and-a-half has been primarily because of weakness in the US dollar due to ongoing caution on the part of the Federal Reserve in hiking interest rates further, along with skepticism with regard to the Bank of Japan’s effectiveness in intervening to weaken the yen. This past Wednesday’s release of meeting minutes from last month’s FOMC meeting indicated debate among Fed members regarding the conditions for another rate hike, but highlighted the group’s persistent concern over weak economic growth, which will pose a major obstacle to raising interest rates further. The Fed’s continuing dovish stance on monetary policy have placed increasing pressure on the US dollar as of late. Although the surging yen has raised speculation that the Bank of Japan may soon intervene to weaken its currency, skepticism remains over the efficacy of the central bank’s attempts to do so, especially in light of its recent easing into negative interest rate territory, which had no lasting impact on restraining yen appreciation. After retreating from both its 50-day moving average and the upper border of a large descending triangle pattern, USD/JPY broke down below major support at 111.00 early this past week. After doing so, the currency pair quickly followed-through by dropping down to key psychological support at 110.00. Then, as previously noted, price action plunged further on Thursday to hit the major support target at 108.00. In the absence of a successful attempt by the Bank of Japan to intervene in the strong yen, a weakening dollar could push USD/JPY lower in the short-term. In the event of a sustained breakdown below the 108.00 level, the next major downside target is at the 105.00 support level.

Investopedia does not provide individual or customized legal, tax, or investment services. Since each individual’s situation is unique, a qualified professional should be consulted before making financial decisions. Investopedia makes no guarantees as to the accuracy, thoroughness or quality of the information, which is provided on an “AS-IS” and “AS AVAILABLE” basis at User’s sole risk. The information and investment strategies provided by Investopedia are neither comprehensive nor appropriate for every individual. Some of the information is relevant only in Canada or the U.S., and may not be relevant to or compliant with the laws, regulations or other legal requirements of other countries. It is your responsibility to determine whether, how and to what extent your intended use of the information and services will be technically and legally possible in the areas of the world where you intend to use them. You are advised to verify any information before using it for any personal, financial or business purpose. In addition, the opinions and views expressed in any article on Investopedia are solely those of the author(s) of the article and do not reflect the opinions of Investopedia or its management. The website content and services may be modified at any time by us, without advance notice or reason, and Investopedia shall have no obligation to notify you of any corrections or changes to any website content. All content provided by Investopedia, including articles, charts, data, artwork, logos, graphics, photographs, animation, videos, website design and architecture, audio clips and environments (collectively the "Content"), is the property of Investopedia and is protected by national and international copyright laws. Apart from the licensed rights, website users may not reproduce, publish, translate, merge, sell, distribute, modify or create a derivative work of, the Content, or incorporate the Content in any database or other website, in whole or in part. Copyright © 2010 Investopedia US, a division of ValueClick, Inc. All Rights Reserved

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.