Gold continued to be weighed down along with other major commodities on Monday despite persisting weakness in the US dollar and lowered expectations for further Fed rate hikes.

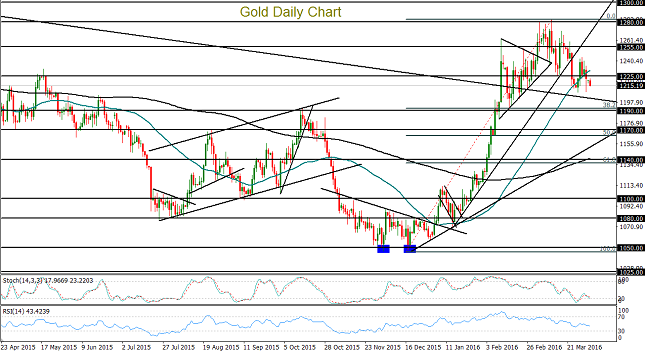

Since a 13-month high around $1280 was reached just over three weeks ago in mid-March, the price of gold has fallen in a series of lower highs and lower lows. This steady retreat has occurred even as the US dollar has also steadily lost ground during the same period due to progressively diminishing anticipation of additional US monetary policy tightening in the near-term. Since gold is denominated in dollars and is a non-interest-bearing asset, conventional wisdom would suggest the opposite – low interest rates and a falling dollar should lead to a boost for gold.

However, another characteristic of gold – that it is considered a safe haven asset in times of market turmoil and volatility – has helped to place some pressure on gold prices for the past several weeks. Specifically, US stock markets have been in a prolonged rally, sharply reversing the heavy losses incurred during the early part of the year. This has helped to decrease the attractiveness of gold as a safe haven.

Technically, during the course of gold’s decline within the past three weeks, price has broken down below several factors that have helped define its recent steep uptrend. These include both an uptrend line extending back to January lows as well as the key 50-day moving average.

If gold has indeed formed an intermediate top, any continued strength in equity markets could lead to a further loss in value for the precious metal. In this event, the next major target below the $1200 psychological level is at key $1190 support. With any continued downside momentum, further bearish support targets reside at $1170, followed by $1140, where the 200-day moving average is currently situated.

Investopedia does not provide individual or customized legal, tax, or investment services. Since each individual’s situation is unique, a qualified professional should be consulted before making financial decisions. Investopedia makes no guarantees as to the accuracy, thoroughness or quality of the information, which is provided on an “AS-IS” and “AS AVAILABLE” basis at User’s sole risk. The information and investment strategies provided by Investopedia are neither comprehensive nor appropriate for every individual. Some of the information is relevant only in Canada or the U.S., and may not be relevant to or compliant with the laws, regulations or other legal requirements of other countries. It is your responsibility to determine whether, how and to what extent your intended use of the information and services will be technically and legally possible in the areas of the world where you intend to use them. You are advised to verify any information before using it for any personal, financial or business purpose. In addition, the opinions and views expressed in any article on Investopedia are solely those of the author(s) of the article and do not reflect the opinions of Investopedia or its management. The website content and services may be modified at any time by us, without advance notice or reason, and Investopedia shall have no obligation to notify you of any corrections or changes to any website content. All content provided by Investopedia, including articles, charts, data, artwork, logos, graphics, photographs, animation, videos, website design and architecture, audio clips and environments (collectively the "Content"), is the property of Investopedia and is protected by national and international copyright laws. Apart from the licensed rights, website users may not reproduce, publish, translate, merge, sell, distribute, modify or create a derivative work of, the Content, or incorporate the Content in any database or other website, in whole or in part. Copyright © 2010 Investopedia US, a division of ValueClick, Inc. All Rights Reserved

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.