![]()

After massively disappointing traders’ high hopes back in December, “Super” Mario Draghi and company were not going to make the same mistake again. Expectant traders and analysts were looking for the ECB to cut its deposit rate by 10bps and increase its quantitative easing program by €10B per month, but the so-called “whisper numbers” were even more aggressive than that. Regardless, the ECB busted out its big bazooka at the conclusion of today’s monetary policy meeting, enacting a series of aggressive proposals.

In the words of the ECB itself, these are the six actions taken by the central bank:

“At today’s meeting the Governing Council of the ECB took the following monetary policy decisions:

(1) The interest rate on the main refinancing operations of the Eurosystem will be decreased by 5 basis points to 0.00%, starting from the operation to be settled on 16 March 2016.

(2) The interest rate on the marginal lending facility will be decreased by 5 basis points to 0.25%, with effect from 16 March 2016.

(3) The interest rate on the deposit facility will be decreased by 10 basis points to -0.40%, with effect from 16 March 2016.

(4) The monthly purchases under the asset purchase programme will be expanded to €80 billion starting in April.

(5) Investment grade euro-denominated bonds issued by non-bank corporations established in the euro area will be included in the list of assets that are eligible for regular purchases.

(6) A new series of four targeted longer-term refinancing operations (TLTRO II), each with a maturity of four years, will be launched, starting in June 2016. Borrowing conditions in these operations can be as low as the interest rate on the deposit facility.”

In other words, the central bank drastically exceeded the markets expectations for easing. In terms of the most widely-watched changes, the ECB cut its deposit rate by the anticipated 10bps and expanded its QE program by €20B per month, twice as much as traders were looking for. Additionally, Draghi and company reduced two of its other key interest rates, expanded its universe of eligible securities to purchase through its QE program, and enacted another series of operations to increase bank liquidity. This is the “big bazooka” that many traders were expecting to see back in December, and as the saying goes, “it’s better late than never” for euro bears. As we go to press, Dr. Draghi is taking the stage for his press conference, which will hopefully shed more light on the ECB’s decision.

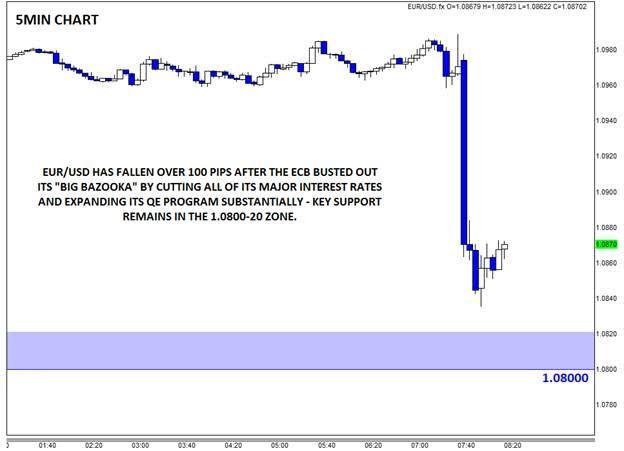

Technical view: EUR/USD

Another cliché maxim that you may have heard before is “once burned, twice shy” and that’s exactly how those euro bears felt heading into today’s ECB announcement. Short positioning in the euro was definitively less aggressive than back in December, leaving plenty of room for the single currency to fall on the ECB’s aggressive action.

From about 1.0975 before the release, EUR/USD has collapsed to a low of 1.0835 as of writing. In the short term, additional moves will depend heavily on any revelations in the upcoming press conference, but strong support, dating back to the ECB’s last big meeting in December, comes in the 1.0800-20 zone, so bears may want to tap the brakes as long as we remain above that key support level. That said, any near-term bounces may stall out quickly now that the ECB is back in a definitively dovish posture.

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.