![]()

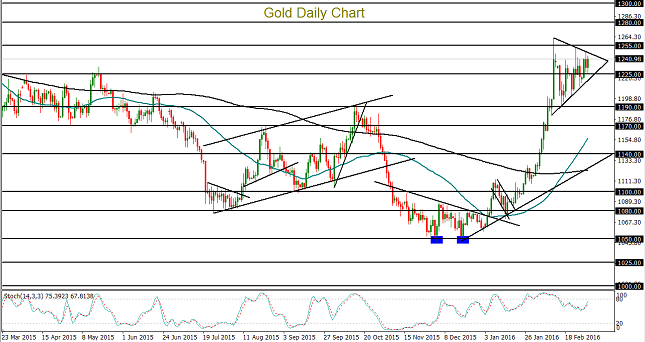

Gold has been trading within a large triangle consolidation pattern for the past three weeks since it hit a one-year high at $1263 in mid-February. Price action within this consolidation has fluctuated widely between that $1263 high and a low at $1190 support. As characteristic of triangle patterns, the price range within has progressively tightened and converged to the point where a directional breakout has become increasingly likely.

With respect to the global financial markets, some of the key characteristics of gold are that: it is denominated in US dollars, it is a non-interest-paying asset, and it is a key “safe haven” asset. Generally-speaking, these characteristics have resulted in an inverse correlation between the precious metal and both the US dollar as well as global equity markets. Though these inverse relationships are far from precise, gold generally rises when the dollar falls, and vice versa. Likewise, the metal often rises when stocks fall, and vice versa.

As a case in point, when the dollar was plunging during the first half of February, gold surged for the first two weeks of that month to hit its noted one-year high at $1263. During the same time span, global stock markets plummeted to new lows, stimulating safe haven flows back to gold. This combination of factors boosting the price of gold at that time prompted a swift and unexpected recovery for the precious metal.

Since that high was reached, a relative stabilization for both the dollar and equity markets resulted in the pullback and current consolidation in the price of gold. Consolidation patterns are all eventually broken, oftentimes by some fundamental catalyst that pushes the market in a particular direction.

One such catalyst may be this Friday’s US non-farm payrolls employment report for February. Any reading significantly above the consensus expectation of 195,000 jobs added could likely have a significant impact on boosting the dollar due to its potential role in helping to shape the Federal Reserve’s decision to implement future interest rate hikes. A positive employment reading could also help lift equity markets further. In this scenario, a rising stock market and appreciating dollar could have the correlative effect of prompting a breakdown in the price of gold below the current triangle consolidation. In this event, the next major downside target on a triangle breakdown is around the noted $1190 support level.

In the opposite event of a return to volatility in the global stock markets and/or another pullback for the dollar, any breakout to the upside for gold would confirm a continuation of the strong uptrend that has been in place since the beginning of the year. In this event, the next major upside target resides at the key $1300 resistance level.

Recommended Content

Editors’ Picks

EUR/USD steadies above 1.0600, awaits German ZEW and Powell speech

EUR/USD is holding above 1.0600 in the European morning on Tuesday, having hit fresh five-month lows. The pair draws support from sluggish US Treasury bond yields but the rebound appears capped amid a stronger US Dollar and risk-aversion. Germany's ZEW survey and Powell awaited.

GBP/USD stays below 1.2450 after UK employment data

GBP/USD trades marginally lower on the day below 1.2450 in the early European session on Tuesday. The data from the UK showed that the ILO Unemployment Rate in February rose to 4.2% from 4%, weighing on Pound Sterling.

Will Gold reclaim $2,400 ahead of Powell speech?

Gold price consolidates the rebound below $2,400 amid risk-aversion. Dollar gains on strong US Retail Sales data despite easing Middle East tensions. Bullish potential for Gold price still intact on favorable four-hour technical setup.

SOL primed for a breakout as it completes a rounding bottom pattern

Solana price has conformed to the broader market crash, following in the steps of Bitcoin price that remains in the red below the $65,000 threshold. For SOL, however, the sensational altcoin could have a big move in store.

Canada CPI Preview: Inflation expected to accelerate in March, snapping two-month downtrend

The Canadian Consumer Price Index is seen gathering some upside traction in March. The BoC deems risks to the inflation outlook to be balanced. The Canadian Dollar navigates five-month lows against the US Dollar.