![]()

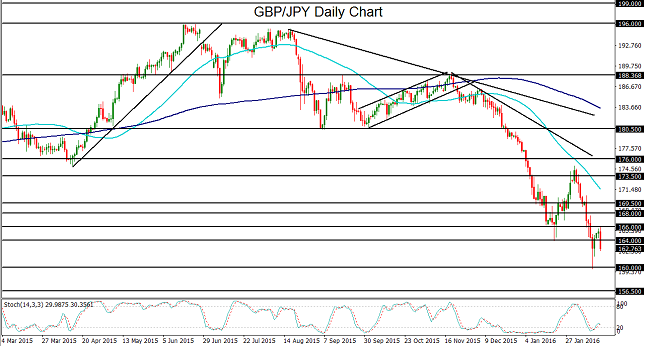

GBP/JPY resumed its freefall on Tuesday by dropping below 164.00 once again, as the pound fell sharply against most major currencies and the yen rallied on a tentative return of risk aversion.

One of the catalysts of this lowering of risk appetite and resumed flight towards the safe haven yen was crude oil’s downside reversal on Tuesday. This occurred after the announcement of a potential deal to freeze crude output by Saudi Arabia, Russia and others, was largely seen as a weak stopgap proposal that would be ineffective in its aim to curb a massive oversupply situation. While equity markets were still able to rally moderately, crude oil prices plunged once again, paring much of the gains made from late last week to early this week.

The British pound’s continued fall has been prompted primarily by an increasingly dovish Bank of England that was previously expected to begin its own monetary tightening cycle at some point following the initiation of the US Federal Reserve’s rate hike in December. These expectations have since diminished dramatically, and even reversed to accommodate the potential for a rate cut, given recent concerns over economic growth, financial market stability, and low inflation.

The combination of this pressure on the pound due to interest rate expectations and a Japanese yen propped up by continued fear and volatility in global markets, has weighed heavily on the GBP/JPY currency pair. Late last week saw a drop down to multi-year lows and major psychological support around the 160.00 level after more than a week of precipitous falling. Despite the fact that the currency pair rebounded soon after dropping to 160.00, current price action is beginning to point towards those lows once more.

With any continued equity market and crude oil volatility that sustains a “risk off” market sentiment, further yen buying could result. When coupled with a persistently pressured British pound, this could lead to a further GBP/JPY breakdown below the noted 160.00 support. In this event, which would confirm a continuation of the current downtrend, the next major downside targets are at the 156.50 and then 154.00 support levels.

Recommended Content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Runes likely to have massive support after BRC-20 and Ordinals frenzy

With all eyes peeled on the halving, Bitcoin is the center of attention in the market. The pioneer cryptocurrency has had three narratives this year already, starting with the spot BTC exchange-traded funds, the recent all-time high of $73,777, and now the halving.

Billowing clouds of apprehension

Thursday marked the fifth consecutive session of decline for US stocks as optimism regarding multiple interest rate cuts by the Federal Reserve waned. The downturn in sentiment can be attributed to robust economic data releases, prompting traders to adjust their expectations for multiple rate cuts this year.