![]()

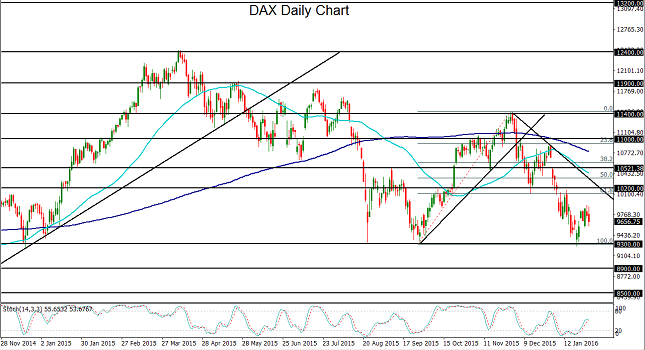

Germany’s DAX index has been languishing not far above its recent lows after having rebounded last week off a major support area around the 9300 level.

Like its global equity index counterparts, the DAX has suffered significant losses since the beginning of the year as a result of heightened volatility driven in part by turmoil in China’s financial markets.

The drop in the DAX for the past couple of months has clearly been severe. From its high above 11400 in early December down to its new one-year intraday low below 9300 last week, the benchmark German stock index has fallen by around 19% in less than two months.

The sharp rebound from the noted 9300 support level last week was prompted in part by dovish comments from ECB President Mario Draghi during the ECB’s closely-watched press conference. Those comments hinted at a potentially more aggressive easing stance from the central bank, as well as the possibility of lower interest rates due to a weak inflation outlook along with a host of global economic risk factors. As might have been expected, this dovish outlook led to a drop for the euro currency and a surge for equity indices, most notably the DAX.

Immediately following that rebound for the German index, however, there was little in the way of further upside follow-through, as the remainder of last week into this week has seen mostly choppy trading within a tight range.

Despite its long-term uptrend, the DAX is displaying a bearish trend bias on both a short-term and medium-term basis. These downtrends would be confirmed on any sustained breakdown below the noted major support area around 9300. The 9300 level has been repeatedly tested and respected within the past several months, so any breakdown would be highly significant from a technical perspective. In the event of this breakdown, key downside support targets remain at 8900 and 8500.

Recommended Content

Editors’ Picks

EUR/USD consolidates recovery below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery but remains below 1.0700 in early Europe on Thursday. The US Dollar holds its corrective decline amid a stabilizing market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD advances toward 1.2500 on weaker US Dollar

GBP/USD is extending recovery gains toward 1.2500 in the European morning on Thursday. The pair stays supported by a sustained US Dollar weakness alongside the US Treasury bond yields. Risk appetite also underpins the higher-yielding currency pair. ahead of mid-tier US data and Fedspeak.

Gold appears a ‘buy-the-dips’ trade on simmering Israel-Iran tensions

Gold price attempts another run to reclaim $2,400 amid looming geopolitical risks. US Dollar pulls back with Treasury yields despite hawkish Fedspeak, as risk appetite returns.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network price is defending support at $1.80 as multiple technical indicators flash bearish. 21.67 million MANTA tokens worth $44 million are due to flood markets in a cliff unlock on Thursday.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.