At the recent height of global market volatility last week, the yen had been rising at a swift clip due to accelerating asset flows towards the perceived safety of the Japanese currency.

At the same time, last week marked new long-term lows for the British pound against several other major currencies, including the euro, the US dollar, and the noted Japanese yen. Sterling had been dropping sharply within the past several weeks, partly due to speculation that the Bank of England’s intended rate hike might be postponed for significantly longer than expected as a result of low inflation and weak economic growth.

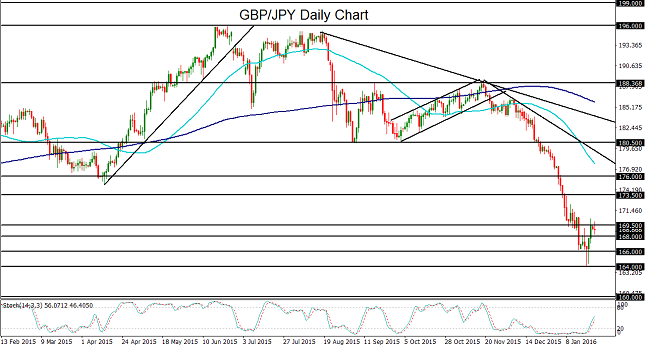

This combination of a volatility-driven surge for the yen along with a sinking pound prompted the GBP/JPY currency pair to plunge slightly below the 164.00 support level last week. This was its lowest level in nearly two years – since early February of 2014 – when GBP/JPY bounced off this same 164.00 support area.

The similar bounce off this level that occurred last week formed a “hammer candle,” or “pin bar,” pattern that generally gives an indication of intensified buying activity around oversold price levels, especially if it occurs near major support areas. After this pattern formed, GBP/JPY did indeed rebound in a relief rally as global stock markets stabilized late last week. That rebound reached a high above 170.00 before paring its gains.

Volatility in the equity markets returned on Monday, however, as global stock indices pulled back significantly from last week’s highs, along with another large drop in the price of crude oil.

Despite the noted hammer candle, jittery investors are still highly vulnerable to global market volatility, and the Japanese yen could continue to benefit further, pressuring currency pairs like GBP/JPY. Adding to this pressure is the steep downward spiral that the British pound has experienced and could continue to experience if the Bank of England remains as dovish as it has been recently.

Any re-breakdown below the 168.00 support level could once again target the noted 164.00 support. A further breakdown below 164.00 would then confirm a continuation of the current downtrend, with the next major target at the 160.00 psychological support level.

-------

Who were the best experts in 2015? Have your say and vote for FXStreet's Forex Best Awards 2016! Cast your vote now!

-------

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD mired near 1.0730 after choppy Thursday market session

EUR/USD whipsawed somewhat on Thursday, and the pair is heading into Friday's early session near 1.0730 after a back-and-forth session and complicated US data that vexed rate cut hopes.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: Slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.