![]()

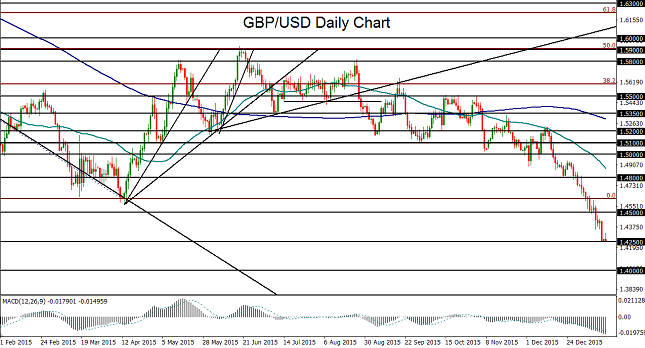

GBP/USD slid down on Monday to dip below a key support target around the 1.4250 level ahead of a relatively data-heavy week for the UK. In the process, the currency pair established yet a new 5½-year low.

While the US has only a couple of major economic data releases scheduled for this week, most notably Wednesday’s Consumer Price Index (CPI) and Core CPI readings that assess the crucial inflation situation, the UK has several important events on its economic data calendar that could very likely affect the course of the embattled British pound. These data events include the UK’s own CPI reading on Tuesday, average earnings and unemployment claims on Wednesday, and UK retail sales figures on Friday.

Last week, the Bank of England (BoE) opted to keep its main interest rate unchanged at 0.50%, as widely expected, but also went on to issue a rather dovish statement underlining the global economic conditions that precluded a rate hike, including depressed economic growth both in the UK and in emerging markets, as well as low oil prices placing pressure on global inflation. As such, this week’s inflation, unemployment, and retail sales data out of the UK could set the stage for either additional pressure on the pound or a relief rebound.

While a relief rebound in the short-term could well be possible, the overwhelming trend for the past several months has been undeniably to the downside, with an acceleration of that bearish momentum occurring in mid-December and following through for the first half of January thus far. During this past month’s plunge, GBP/USD swiftly broke down below progressively lower key support levels, including 1.5000, 1.4800, 1.4600, and most recently, 1.4500.

Now that the currency pair has reached all the way down to dip below its 1.4250 support target, which was last hit in mid-2010, the bearish trend bias has once again been strongly confirmed. With any sustained weakness under this 1.4250 level, the next major downside target resides around the 1.4000 psychological support level.

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.