![]()

EUR/JPY bounced modestly on Thursday afternoon as global equity markets took a breather and rebounded off their recent lows. This alleviated some pressure from EUR/JPY as the safe haven yen eased off its latest highs.

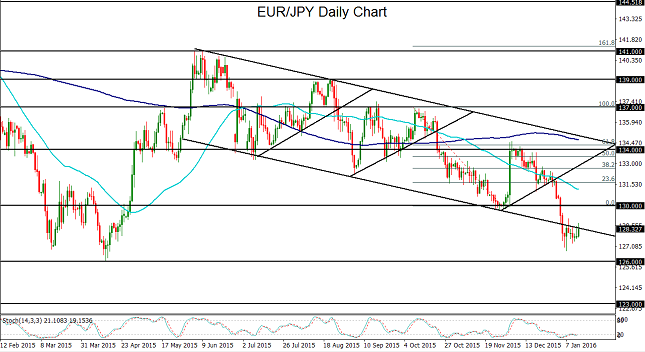

Despite Thursday’s rise for EUR/JPY, the currency pair continues to trade within a tight consolidation just off last week’s eight-month low of 126.77. This consolidation has currently formed an inverted pennant pattern, which is generally seen as a potentially bearish chart formation.

The pennant pattern began to form after price action in the past week, during the first trading week of the New Year, plunged below a major down trend channel that extends back to last June’s 141.00-area high. Since that high, EUR/JPY has fallen steadily within this channel, forming progressively lower lows and lower highs. Last week’s breakdown below the channel signifies an acceleration, or intensification, of the bearish momentum.

Having consolidated within the inverted pennant pattern under this descending trend channel, EUR/JPY continues to display a significant bearish bias. This should especially be the case if further volatility in the global equity markets continues to prompt safe haven flows towards the Japanese yen.

With major resistance to the upside continuing to reside around the recently broken 130.00 level, any breakdown below the current pennant pattern should target key support around the important 126.00 level, which was last approached to the downside last April. Any further bearish momentum could then begin to target the 123.00 support level.

Recommended Content

Editors’ Picks

EUR/USD comes under pressure near 1.0630

Further gains in the Greenback encourage sellers to maintain their control over the risk complex, forcing EUR/USD to retreat further and revisit the 1.0630 region as the US session draws to a close.

GBP/USD stays firm amid BoE, Fed commentary and US data

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.