![]()

As we noted in our FOMC preview report, analysts and traders were unanimous in their expectation that the central bank would leave interest rates unchanged in the 0.00-0.25% range, and the Fed provided no surprises on that front. That said, the world’s most important central bank still gave traders plenty to chew over in its first monetary policy statement of Q3.

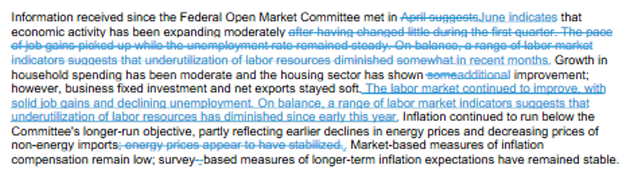

First, the headlines from this month’s statement [emphasis mine]:

- FED SAYS LABOR MARKET CONTINUED TO IMPROVE, JOB GAINS `SOLID'

- FED SAYS LABOR SLACK `HAS DIMINISHED' SINCE EARLY THIS YEAR

- FED REPEATS ECONOMY `EXPANDING MODERATELY' IN RECENT MONTHS

- FED REPEATS RISKS TO ECONOMY, JOB OUTLOOKS `NEARLY BALANCED'

- FED: RATE TO RISE AFTER `SOME FURTHER' JOB MARKET IMPROVEMENT

- FOMC VOTE WAS UNANIMOUS

- FED SAYS BUSINESS INVESTMENT, NET EXPORTS STAYED SOFT

- FED REPEATS MKT-BASED INFLATION COMPENSATION GAUGES REMAIN LOW

- FED REPEATS IT WANTS TO BE `REASONABLY CONFIDENT' ON INFLATION

Earlier today, analysts coalesced around watching for one word in the statement, mirroring the intense focus on the phrase “considerable time” from earlier this year. In this case, the word was “nearly,” as in “The Committee continues to see the risks to the outlook for economic activity and the labor market as nearly balanced,” with some commentators suggest that the central bank could remove this word as a nod toward a possible rate hike in September. As the above headlines show, the FOMC left that word in the statement, marking a potential negative sign for the prospects of a September rate hike.

Beyond that one word, there were a few other seemingly dovish tidbits in today’s statement. For one, the committee declared it still wanted to see “some further” improvement in the labor market before raising rates, despite the stellar growth over the last several months. More to the point, the decision to leave interest rates unchanged was unanimous, disappointing hawks who were hoping that at least one member could dissent in favor of hiking interest rates immediately.

As ever, the central bank remains “data dependent,” and with the highly-anticipated September meeting a mere seven weeks away, markets could turn more volatile as traders update their expectations for Fed liftoff and (over)react to every headline.

Market Reaction

In our view, the most important market to watch in the wake of key economic data for the next few months will be the Fed Funds Futures market, which shows the probability that traders assign to an interest rate hike. In the lead up to the release, these traders were pricing in just a 19% chance of a rate hike in September, 36% odds of an increase in October, and a 55% probability of a hike in December; as of writing, these odds have shifted to 17%, 35% and 54%, respectively. In other words, traders were rather nonplussed by today’s statement, only marginally pushing back their expectations for a rate hike.

There was hardly more volatility in other markets, with the US dollar ticking higher in a possible “sell the rumor, buy the news” reaction, US equities spiking before pulling back to essentially unchanged, and the yield on the benchmark 10-year treasury bond falling 3bps from the day’s high to trade back at 2.27%.

Source: FOREX.com

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

GBP/USD remains on the defensive below 1.2450 ahead of UK Retail Sales data

GBP/USD remains on the defensive near 1.2430 during the early Asian session on Friday. The downtick of the major pair is backed by the stronger US Dollar as the strong US economic data and hawkish remarks from the Fed officials have triggered the speculation that the US central bank will delay interest rate cuts to September.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Israel vs. Iran: Fear of escalation grips risk markets

Recent reports of an Israeli aerial bombardment targeting a key nuclear facility in central Isfahan have sparked a significant shift out of risk assets and into safe-haven investments.