![]()

Crude oil prices started the day on the back foot as traders responded to the movements in the dollar and last night’s supply report from the American Petroleum Institute (API) which had shown a surprise drawdown in inventories. The US currency initially rose after the ADP employment report revealed that just over 200 thousand non-farm private sector jobs were added into the economy last month which was a touch more than expected. But then a surprisingly sharp drop in the ISM non-manufacturing PMI to 55.7 from 57.8 caused the dollar bulls to rush for the exits, leading to a bounce back in some buck-denominated commodities such as crude oil and gold. The official oil supply data from the US Energy Information Administration (EIA) then hit the wires, causing WTI prices to initially jump before quickly heading back lower. Traders were initially relieved to see that crude inventories fell for the fifth time in as many weeks which contradicted the build of 1.8 million barrels that had been reported by the API. However the EIA report also revealed a couple of bearish points too. Firstly, the drawdown of 0.3 million barrels in gasoline inventories was lower than expected while the build of 3.8 million barrels in distillates were more than expected. On top of this, the EIA said crude oil production rose to 9.59 million barrels last week, up from 9.57 million in the week prior. So, overall the EIA oil report wasn’t as bullish as it initially appeared to be, hence the lack of buying interest in WTI.

Traders are now looking ahead to the OPEC meeting on Friday. Although the cartel is not expected to make any changes in its production quota of 30 million barrels per day, there have been some suggestions that it may actually increase it to 31 million barrels per day which would therefore bring it closer to the current output levels. Such a move may unnerve the oil bulls as it would indicate that the cartel will be willing to exceed its production target in the future. Indeed, if Iran were to make a full return the oil market, and with Saudi and co unwilling to lose further market share, production levels from this group may have to increase far beyond this target. In fact, Iran’s oil minister has said that his country can rump up oil production by a further 1 million barrels per day in 6-7 months’ time if the sanctions are lifted. Thus, the oil market may remain more than sufficiently supplied for the foreseeable future and any notable increases in oil prices will have to come from changes in the demand side of the equation. As such, future economic data from the likes of China and the euro zone will become even more relevant for oil traders.

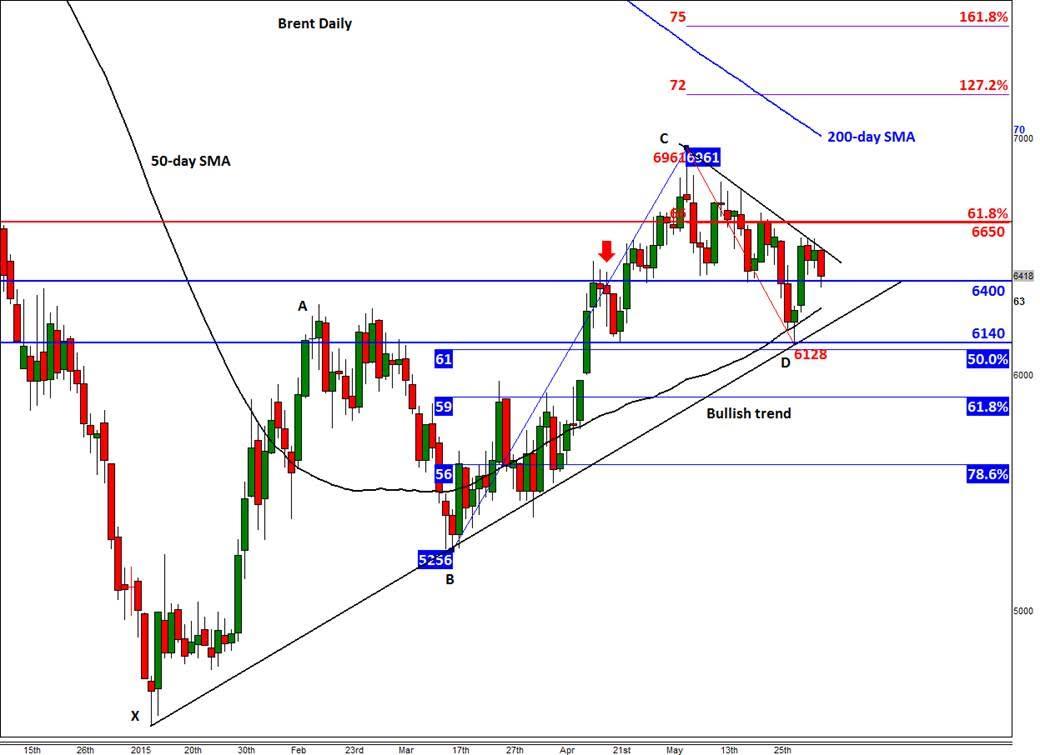

Ahead of the OPEC meeting, Brent crude is in consolidation as it hovers around the $64 mark. A bullish trend line is clearly established and if OPEC’s actions, further appreciation in the dollar or some other factor cause oil to drop below this trend then that could lead to further technical selling over time – especially if horizontal support at $61.30/40 is also taken out. In contrast, a break above the short-term bearish trend may see oil rally towards the 61.8% Fibonacci level at $66.50, the prior high at $69.60 or even the 200-day moving average at $70 in the coming days and weeks. In short, the volatility in oil could increase sharply in the coming days. Speculators may want to let price action guide them and then trade in the direction of the trend.

Figure 1:

Source: FOREX.com. Please note, this product is not available to US clients}

Figure 2:

Source: FOREX.com. Please note, this product is not available to US clients

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD flirts with 1.0700 post-US PMIs

EUR/USD maintains its daily gains and climbs to fresh highs near the 1.0700 mark against the backdrop of the resumption of the selling pressure in the Greenback, in the wake of weaker-than-expected flash US PMIs for the month of April.

GBP/USD surpasses 1.2400 on further Dollar selling

Persistent bearish tone in the US Dollar lends support to the broad risk complex and bolsters the recovery in GBP/USD, which manages well to rise to fresh highs north of 1.2400 the figure post-US PMIs.

Gold trims losses on disappointing US PMIs

Gold (XAU/USD) reclaims part of the ground lost and pares initial losses on the back of further weakness in the Greenback following disheartening US PMIs prints.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.