![]()

The latter half of the North American trading day was much less exhilarating than the first half as the bulk of the gains in US equities were made in the first half. The USD enjoyed a little more strength and WTI did the same as well on the back of a few fundamental factors working in its favor. In fact, the only distressing news of the day came from Washington DC which saw blackouts in the White House and other government buildings that ruffled a few feathers, but turned out to be nothing egregious.

Turning to events that will be happening this evening, the Bank of Japan will be making a monetary policy decision merely one day after the Reserve Bank of Australia surprisingly decided to leave their rates steady. The immediacy of the RBA decision could weigh heavily in currency value terms when considering the AUD against the JPY. While the Bank of Japan isn’t expected to do much when it comes to their interest rates or their Quantitative and Qualitative Easing program, the option to do something is still on the table. In fact, there are some analysts who believe that the BoJ will be increasing their QQE program by the next meeting, which is occurring a little later this month on April 29th. If that is the case, they could hint that something is in the works at this meeting so the actual announcement isn’t such a big surprise.

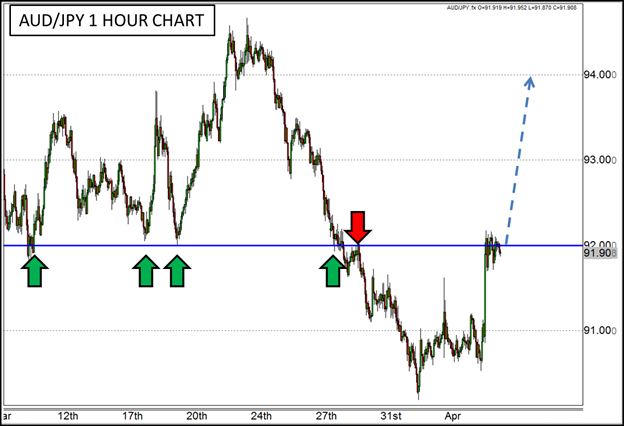

If the BoJ were to drop their insistence that there is no need for further easing at the present time and acknowledge that more could be coming, the AUD/JPY may be the most prime suspect for a strong rally. The prior belief that the RBA was cutting rates severely depressed this pair which was only partially recovered yesterday. The current price where the pair resides is an intriguing level where both support and resistance has been found recently and could act as a staging ground for a move in either direction, however, recent sturdiness from the RBA and the potential for frailty from the BoJ make it look more like a launch pad than a ceiling.

Figure 1:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.