![]()

With today’s UK Manufacturing PMI report coming out rather “ho-hum” at 54.4 against expectations of a 54.5 reading and a 54.0 print last month, FX traders have had little reason to push the pound sustainably higher or lower: the currency initially dipped in the wake of the report before recovering its losses a few hours later. With GBPUSD still trapped below major previous-support-turned-resistance in the 1.49-1.50 zone, the medium-term outlook remains bearish for that pair, but we’ve recently seen signs that GBPJPY could be taking a major turn lower as well.

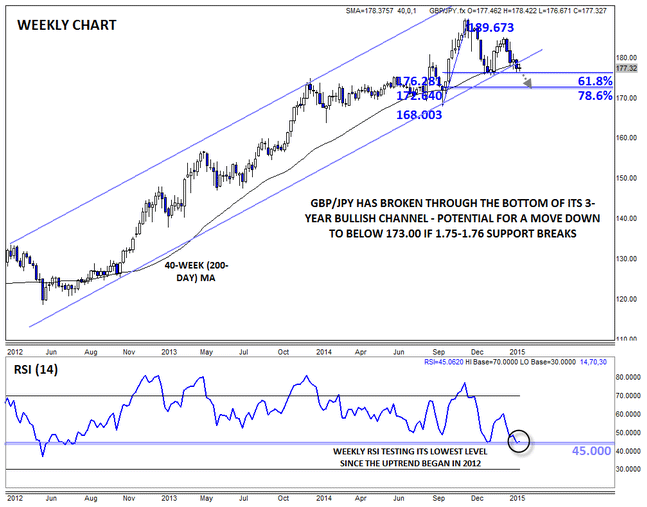

Since mid- 2012, GBPJPY had been steadily rising within a bullish channel…that is until last week. After putting in a lower high at 185.00, GBPJPY broke below both its channel support and its 200-day MA (approximated by the 40-week MA in the chart below) at 1.7825 last week. Rates are holding below those key levels thus far this week, suggesting that the move is less likely to be a false break. Meanwhile, the RSI indicator is also testing its lowest level since the uptrend began at 45, showing that the market’s momentum is clearly waning.

The next key zone to watch for GBPJPY bears will be 1.75-1.76, which marks the confluence of the 61.8% Fibonacci retracement and the year-to-date lows; if that support area gives way, another leg lower toward 172.60 (the 78.6% Fibonacci retracement of the Q4 2015 rally) may be seen. From a fundamental perspective, GBPJPY traders should keep a close eye on the UK Construction PMI report (tomorrow), Japanese Average Earnings data (Friday), and the always-impactful US NFP report (Friday) for near-term catalysts, but as long as the pair remains mired beneath its 200-day MA at 178.40, the path of least resistance will remain lower.

Source: FOREX.com

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.