![]()

Dorothy, “The Wizard of Oz”

At the deus ex machina conclusion of the 1939 movie The Wizard of Oz, the protagonist Dorothy learns that her magical silver shoes will take her wherever she wants to go as long as she repeats her destination three times.

In many regards, it seems like some traders think they have their own version of magical shoes: as long as they repeat a mantra enough times, it will become true. One dubious trading theory that is currently seeing its day in the sun is that the US dollar and US stocks move together, or in other words, that they are positively correlated. After all, both the US dollar index and S&P 500 have rallied in each of the last five months as the US has become the proverbial “best house” in bad global economic “neighborhood.”

Interestingly, the recent positive correlation actually runs against the Economics 101 textbooks, which will tell you that a strong dollar will hurt the overseas earnings of large multinational companies, leading to weakness in those stocks. Perhaps growing chorus of companies blaming the strong dollar for their weak profits, along with the Fed’s downward revision to growth estimates, has reminded traders of this effect, with stocks on track to close lower amidst further dollar strength this month.

But even this inverse correlation has little relationship to actual markets.

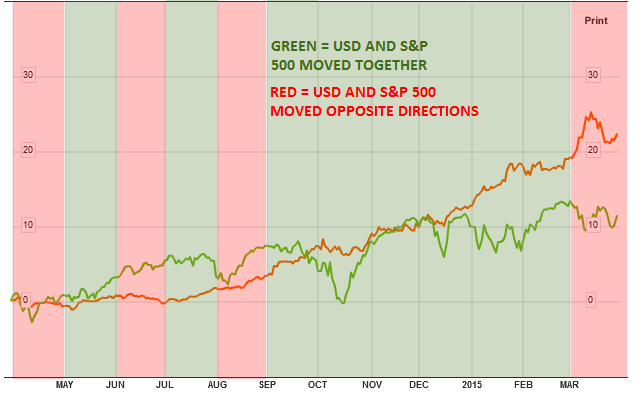

Looking at the actual data, the US Dollar and US equities do not have a consistent relationship whatsoever. The 21-day (1-month) correlation coefficient, which mathematically measures the extent to which two data series move together, is currently -0.54; this means that over the last month, US stocks have tended to fall when the dollar rises. That said, the 1-month correlation was actually positive at the start of March (indicating that the dollar and S&P 500 were moving in the same direction). More to the point, the 1-month correlation has “flipped” from positive to negative five times already this year, showing no consistent relationship between the USD and US equities. The 6-month rolling correlation (not shown) has also flipped from mostly negative in 2012 to positive in the middle of 2013, then back to negative until midway through last year, and it’s now showing a positive relationship once again.

Source: Stockcharts.com, FOREX.com

For the more visual readers, the below overlay chart of the S&P 500 and US dollar index shows similar monthly directional movements (up or down) highlighted in green and opposite monthly directional movements highlighted in red:

Source: Bloomberg, FOREX.com

So what is the upshot of this analysis? Many traders and analysts (logically) argue that the recent strength in the US dollar will hurt stock market performance moving forward, and to some extent, it probably will provide a headwind. But even if the dollar continues to trend higher, the ever-changing correlation between the US dollar and stocks suggests that the S&P 500 could also strengthen further. Conversely, even if the US economy continues to perform strongly, it doesn’t necessarily mean that either the dollar or S&P 500 will necessarily strengthen in lockstep.

Unlike Dorothy, we all live and trade in the real world, so it’s worthwhile to analyze the actual data and come up with a plan of action, rather than rely on a wish and a pair of magic shoes.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.