![]()

Highlights

- Greece is the Word as Political Risks Heat Up

- EURUSD in Freefall...Is Parity in the Cards?

- The Impact of the Greek Election on Stocks

- Market Movers: Weekly Technical Outlook

- Global Data Highlights

Greece is the Word as Political Risks Heat Up

1) Greek Election Risks

On 25th January the Greek people will head to the polls for the second election in less than three years. Early elections were called after the Greek government did not manage to get a majority of the parliament to vote for its choice of president by 29th Dec 2014.

As we have found out over the last few years, the political situation in Greece is extremely complex. Not only are there a range of political parties and players, but the election could have a big impact on the Greek bailout program and on relations between Athens and its Troika of bailout partners. Some are even calling this election a referendum on Greece’s membership in the Eurozone.

The main players:

- New Democracy: Center-right senior partner in the incumbent coalition government. Antonis Samaris, New Democracy leader, is the prime minister of Greece.

- Syriza: The coalition of the radical left is the main opposition party. It came first in the EU elections in May 2014, and is led by Alexis Tsipras. It is currently ahead in opinion polls.

- PASOK: A social Democratic party, which was in power in Greece until June 2012. It is the junior coalition partner in the current government.

- George Papandreou: Former prime minister of Greece and former head of the PASOK party. He has formed a new center-left party called the Democrat Socialists Movement, seemingly as a reaction to the collapse in support for PASOK. It could be a threat to Syrizia.

The main issues at stake in this election:

- Greece’s position in the Eurozone

- The bailout plan and austerity

- The economy: unemployment continues to rise and is currently at 25.8%, the country is in deflation, prices have fallen 2.6% YoY, but the economy has been growing for the last three quarters and Greece is expected to outperform overall Eurozone GDP for 2014

Potential outcomes from the poll:

Opinion polls suggest the Syriza are in the lead, with about 33-35% of the vote, with New Democracy in second place at 29-31%; Pasok is polling less than 4%. Opinion polls suggest that Syriza has seen some of its support dwindle in recent weeks, and even if Syriza is the winner on the night, it is unlikely to win a large enough majority. This means that it would most likely need to form a coalition, which could prove tricky. Assuming Syriza does win the largest number of votes on the 25th but is unable to form a coalition government, there is a risk of a second election, as we saw in 2012.

As you can see, nothing about this election is easy. Rather than try to make a call on who wins, we have come up with three potential scenarios:

- a. Syriza win and form a coalition government: They would likely form a government with Pasok and other left-leaning parties. This could trigger a market panic as the market questions whether a left-leaning coalition will adhere to the terms of Greece’s bailout package. This could trigger a sharp drop in Greek stocks, a rise in Greek bond yields and credit-default swaps, and it may trigger contagion to other struggling economies in Europe. (See below).

- b. Syriza win a majority but cannot form a government: this would likely trigger another election. Although initially the market may not like the political uncertainty in Greece, it could give centre-right New Democracy a chance to win a second round election, like it did in 2012.

- c. A win for New Democracy and PASOK: This may not be the most likely outcome according to the latest opinion polls, but there is still a large proportion of voters who are undecided (approx. 10%). If the status-quo bias plays out in this election then we could see New Democracy retain power.

Worth noting…

- In the event that no party wins the Majority of the vote then the three parties with the largest share of the vote will be given three days each to form a coalition (e.g., the party with the largest share of the vote gets the first chance to form a coalition, if this fails then the party with the second largest share of the vote gets the chance to do the same thing, etc.)

- If there is a second-round election it needs to take place within 30 days

- The winner will have four years in power

- Greece still does not have a President, a legal requirement. Once the new government is formed, it will have to propose a new candidate that will be voted on by the Greek Parliament, so Greece’s election saga could continue for some time yet

2) Greece’s future in the Eurozone:

As we mention above, this election is seen by some as a referendum on Greece’s Eurozone membership. However, it is worth noting that Greek bond yields and credit default swaps are nowhere near their 2012 highs. So is the market being too complacent? We don’t think so for these reasons:

a. Popular support is still in favor of Greece remaining in the Eurozone:

The majority of the Greek public wants to stay in the Eurozone, and nearly three-quarters of people support remaining in the Eurozone at all costs. Thus, it is unlikely that the Greek public will vote for a party who could trigger a Grexit.

b. Syriza’s stance about Eurozone membership has moderated:

The leader of Syriza, Alexis Tsipras, listened to the public and has changed his tune from 2012. He is now publically advocating remaining part of the Eurozone. Whether the rest of the Eurozone will allow him to change the bailout program remains to be seen, but with public support in favor of Greece staying in the Eurozone it will be in Tsipris’s best interests to try and compromise with the Troika if he wins power, potentially avoiding a Greek default.

c. Growth has picked up:

Although Greece faces many economic challenges in the year ahead, the economy is growing once more and it even has a primary budget surplus (it is spending less than it brings in). This could boost the status-quo bias for this election.

3) If Greece decides to ditch the EUR, is it that bad?

The short answer is yes as the initial shock could send Greece into default, a new currency could trigger an inflationary spiral, and the unemployment rate could jump even higher than it is now. Greece owes EUR 17bn to its creditors in the first few months of 2015, so it would most likely have to default, making its future access to credit even harder than it is now.

Although there would probably be a timeline drawn up to avoid the worst of the fallout from Greece leaving the currency bloc, there could be no getting away from the initial pain.

However, there could be a silver lining. Eurozone banks have much less exposure to Greece than they did pre-2012, and Grexit fears could force the ECB into a more radical QE program than the market currently expects, which could help out other struggling Eurozone nations.

The market impact:

It is worth noting that the market seems more sanguine about the potential outcome of this election compared to 2012. The markets have, in some ways, become used to political and Grexit risks in Athens, and EUR based assets could avoid panic mode as we get closer to the 25th January.

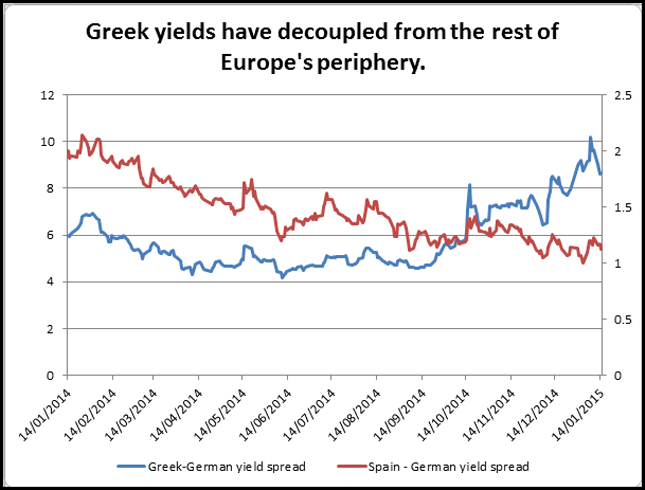

Also worth noting, there has been a decoupling in Europe’s peripheral bond market and stock markets. When Greek yields started to increase in September, Portuguese, Irish, Spanish and Italian yields did not follow suit.

Likewise, Greece’s stock market fell nearly 40% in 2014.Portugal’s index had a fall of a similar magnitude, however, Spain and Italy were much more resilient, suggesting that contagion in Europe’s periphery could be a thing of the past. But if the Greek elections on the 25th trigger a political crisis and there is a real risk of a Grexit then we would expect panic to spread to all European markets. However, if, as we expect, we get a less dramatic outcome to this election then Europe’s other struggling economies may be able to shrug off Greek political risk in the coming days.

Source: FOREX.com

EURUSD in Freefall – Is Parity in the Cards?

As we approached the European close last week, the EUR had fallen more than 3% versus the USD. The driver was the ECB’s decision to embark on a QE program to combat deflationary forces at work in the Eurozone. In the past the EUR has rallied when the ECB had taken steps to help the struggling currency bloc, think back to the LTRO in early 2012 or the bailout announcements at the peak of the sovereign debt crisis, not so this time.

The EUR is weak because of two main factors: firstly, the ECB’s bailout program may be open-ended if inflation does not stabilize by September 2016 and could be worth significantly more than EUR 1 trillion; secondly, the dollar is on a rampage, rising significantly against all G10 currencies apart from the CHF and JPY.

The dollar seems to be rallying due to interest-rate differential. Essentially the ECB threw everything apart from the kitchen sink at its deflation problem, so we all know the data points to watch out for to determine the success (or otherwise) of this program: CPI.

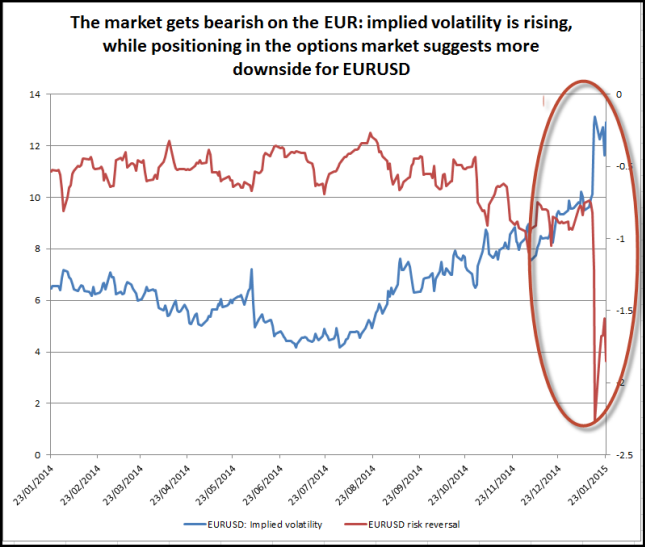

But how low can the EUR go? Just because we have already fallen nearly 7% versus the dollar does not mean that we have had all the EUR weakness for 2015 in the first month of the year. We had expected a break in EUR selling pressure on the back of the QE announcement on Thursday, however, when this didn’t happen, we decided to do some digging into the options market to see what sentiment towards the single currency is like.

The result makes for some uncomfortable viewing for EUR bulls. The chart below shows implied volatility and risk reversals for one-month EURUSD options, another measure of volatility. The chart shows that implied volatility (blue line) is moving higher, while the risk reversal has turned bearish. In layman’s terms this means that the market is taking a directional view that the EUR will fall further. The options market suggests that the euro is expected to remain volatile, with a bias to further weakening. Overall, this analysis suggests that there could be further EUR weakness, and there could be further wild moves, even after the EUR weakness we witnessed last week.

Source: FOREX.com

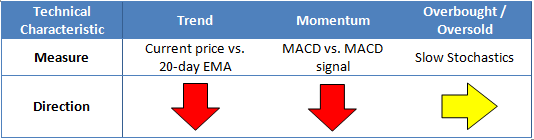

The technical picture is also looking decidedly bearish, as you can see in the chart below; however, EURUSD is approaching a major level of support – 1.12 – the 61.8% retracement of the EUR’s entire life. This could stem some of the selling pressure, and acted as good support earlier on Friday. However, if this level is breached, then we could see back to 1.10, a key psychological level, or even 1.0765—a low from 2001.

Source: FOREX.com

The Greek Election’s Impact on Stocks

On Thursday, the European stock markets came to life after the ECB unveiled QE. Although question marks were immediately raised about the risk-sharing aspect of bond buying, the fact that these purchases will be a huge 60 billion euros per month until – and potentially beyond – September 2016, rather than merely the end of this year, has clearly cheered investors. The reaction of the market makes sense as QE is designed to make the already-low rates even less appealing, causing yield-seeking investors to move funds into other, riskier, assets. In theory, this should be good news for stocks, especially export-oriented ones, which make Germany’s DAX index particularly attractive.

While it can be argued that the bullish enthusiasm should continue for the foreseeable future, the market’s focus is likely to shift to the Greek election on Sunday. Although “Grexit” worries have been put to the back burner, they could come back to the forefront next week if the Greeks choose to elect the anti-austerity Syriza party into power. Thus, it can be argued that investors may be underestimating the risks of Greece eventually exiting the euro zone. That said, the leader of Syriza has changed tack recently; instead of forcing his country to exit the Eurozone, he has instead promised to negotiate the terms of the bailout if he wins. Although the Germans have been vocal in their opposition for negotiation, the feeling in the market is that they may have to come to a compromise should Syriza win because the Eurozone is still better off with rather than without Greece.

On top of this, it is widely believed that a vast majority of the European companies that were previously heavily exposed to Greece have now reduced their exposure and are therefore better papered for its potential exit. Nevertheless, European banks may still have some direct and indirect exposure to the troubled nation, which could potentially halt the European stock market rally.

DAX

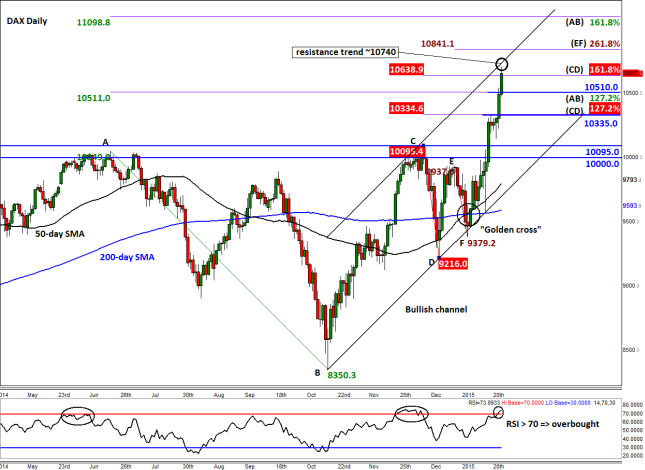

Ahead of the Greek vote, the most heavily traded European stock index, Germany’s DAX, was looking very bullish. What it may do next will depend – at least to some degree – on the outcome of the Greek elections:

1. A victory for the New Democracy Coalition may keep the bullish momentum going for the foreseeable future and we could see the DAX move into fresh unchartered territories as a result. In this scenario, the index could break through the upper trend of the bullish channel around 10740 and rally towards the 161.8% extension of the last major downswing (AB) around 11100 over the next several weeks, before making its next move. Both the technical and fundamental pictures are clearly very bullish, even if the RSI is suggesting that the DAX may be at an overbought level.

2. If Syriza wins but keeps Greece in the Eurozone then the index could initially show a negative reaction, before potentially bouncing back again. This may mean that the upper trend of the bullish channel around 10740 will hold as resistance, causing the DAX to potentially fall back towards the support levels shown in blue on the chart (i.e. 10510, 10335, 10095 and 10000). These levels were all previously resistance. We think that in this scenario the DAX may remain inside the bullish channel and will thus continue in its upward trajectory over the long term.

3. Syriza wins and threatens that Greece will leave the Eurozone: this could be the worst outcome for the DAX and indeed European stocks in general. We could easily see the DAX break the support levels mentioned in scenario 2 above, and also take out the lower trend of the bullish channel. The potential fallout in this scenario could be huge and the consequences difficult to predict. That said, our long-term bullish view on the DAX won’t change as we think the Eurozone will survive even without Greece and that the ECB’s QE stimulus program will continue to support European equities.

Source: FOREX.com. Please note this product is not available to US clients.

CAC

The CAC is also likely to respond to the outcome of the Greek elections as some of its constituents – particularly banks such BNP Paribas, Credit Agricole and SocGen – have direct and indirect exposure to the troubled nation. As can be seen on the chart, the CAC has responded particularly well to the 78.6% Fibonacci retracement levels of the past couple of price swings. This has helped us to identify a developing Fibonacci-based pattern: a Butterfly, which also incorporates an AB=CD pattern. This pattern suggests the index may form a (near-term) top around point D, which is either at 4740 or slightly higher at 4820. But the CAC has already broken above a long-term bearish trend line and so the path of least resistance is to the upside going into the weekend. Like the DAX index, there are three potential scenarios to consider:

1. A victory for the New Democracy Coalition should be good news for the markets as it will undoubtedly remove one major source of uncertainty. In this case, the CAC index could easily reach point D of the above-mentioned pattern at 4740 (161.8% of BC) or 4820 (127.2% of XA). It could even go on to break above this area, in which case we could see the emergence of fresh buyers.

2. Syriza wins but Greece remains in the Eurozone. Depending on where the CAC might be trading once the markets open on Sunday evening, the sellers could drive the index back below 4600, a level which corresponds with the 2014 peak. In this case, a move back towards old resistance levels at 4500, 4430 or 4320 could be on the cards. It is possible that the CAC will find support at one of these levels and head higher again.

3. Syriza wins and Greece exits the Eurozone. If Grexit becomes a reality, the markets could tank as worries about the future of the Eurozone itself comes into question. In this case, it would be anyone’s guess how far the markets could drop. Short-term traders should watch key supports and the 200-day SMA at 4320 closely. A closing break below this level could give rise to further follow-up technical selling.

Source: FOREX.com. Please note this product is not available to US clients.

Market Movers: Weekly Technical Outlook

Technical Developments to Watch:

- EUR/USD testing long-term Fib support at 1.12 after last week’s collapse

- GBP/USD holding psychological support at 1.50…for now

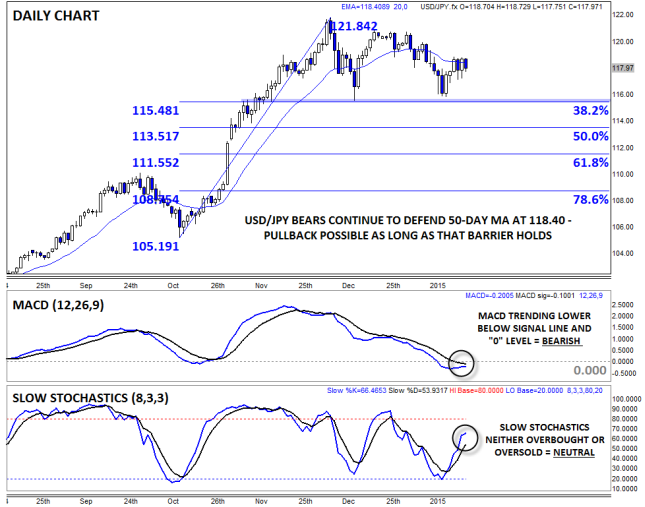

- USD/JPY bears defending 50-day MA at 118.40

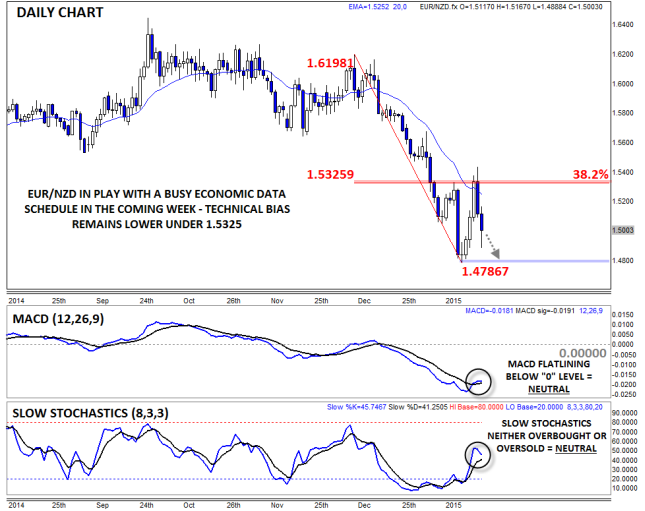

- EUR/NZD in play, bias lower beneath 1.5325

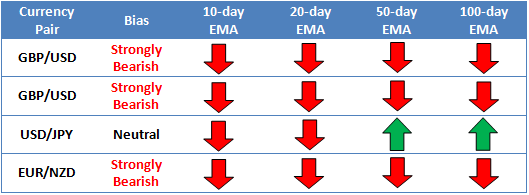

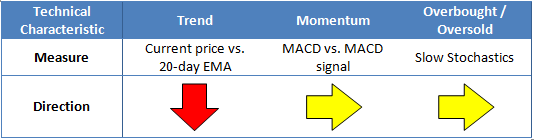

* Bias determined by the relationship between price and various EMAs. The following hierarchy determines bias (numbers represent how many EMAs the price closed the week above): 0 – Strongly Bearish, 1 – Slightly Bearish, 2 – Neutral, 3 – Slightly Bullish, 4 – Strongly Bullish.

** All data and comments in this report as of Friday’s European session close **

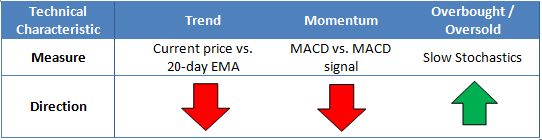

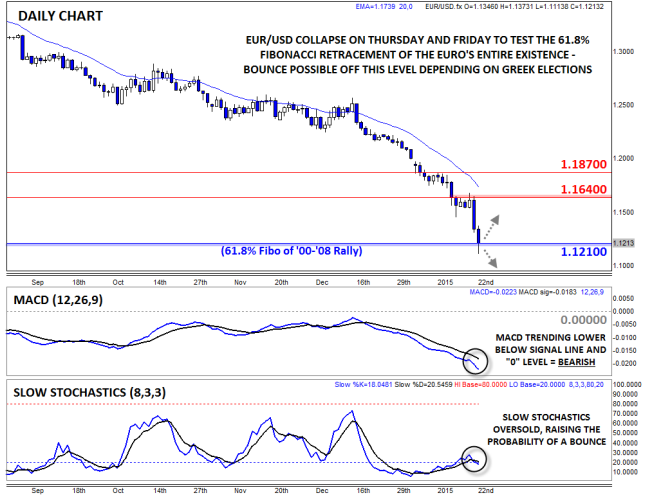

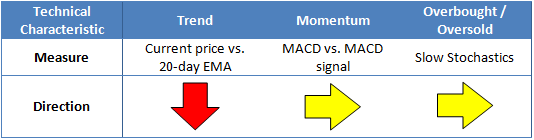

EUR/USD

- EURUSD collapsed Thursday after the ECB announced a new QE program

- MACD strongly bearish, but Slow Stochastics in oversold territory

- Greek election may determine whether EURUSD holds 1.12 support

EURUSD held steady below 1.1640 resistance for the first three days of last week before the bottom dropped out on Thursday. The larger-than-expected QE announcement from the ECB caused EURUSD to crater down to a fresh 11-year low in the 1.11s, though rates have bounced back to 1.1200 as of writing Friday afternoon. , The secondary indicators are showing the same thing they have for weeks now: the MACD is trending down below both its signal line and the “0” level, indicating strongly bearish momentum, while the Slow Stochastics are in oversold territory once again. While bears are clearly in control, rates are testing significant technical support at the 61.8% Fibonacci retracement of the entire 2000-08 rally around 1.12, so a bounce is possible if the Greek elections are not as negative as feared.

Source: FOREX.com

GBP/USD

- GBPUSD got caught up in the EURUSD selloff Thursday

- The MACD and Slow Stochastics show balanced, two-way trade

- All eyes on remain on key psychological support at 1.50

After moving sideways for the past two weeks, GBPUSD got caught up in Thursday’s EURUSD downdraft and dropped down to test key psychological support at 1.50. The overall outlook in the pair is generally neutral, with both the MACD and Slow Stochastics indicating balanced, two-way trade. For this week, traders will be watching to see if the critical 1.50 level holds: if buyers step in to defend that level, a bounce back toward 1.52 is possible, while a break below that floor could quickly target 1.49 or 1.48.

Source: FOREX.com

USD/JPY

- USDJPY bounced from 115.50 to test its 50-day MA last week

- The MACD is still modestly bearish, but that could easily change this week

- A move back above the 50-day MA would open the door for a continuation toward 120.00

The Japanese yen is the one currency pair that held up relatively well against the greenback this week. USDJPY did bounce modestly to test its 50-day MA at 118.50, but bears are successfully defending that barrier as we go to press. Meanwhile, the MACD is modestly bearish, with the indicator below both its signal line and the “0” level, suggesting that the momentum is still pointing lower. For this week, the outlook will hinge on the 50-day MA: if USDJPY can break above that barrier, bulls could look to target the 120.00 level or higher next.

Source: FOREX.com

EUR/NZD

- EURNZD bounced early last week before reversing on the ECB’s announcement

- MACD has started to turn higher, but hasn’t clearly shifted in favor of the bulls yet

- The path of least resistance remains lower under the 38.2% Fib retracement at 1.5325

EURNZD is our currency pair in play due to a number of high-impact economic reports out of Europe and New Zealand this week (see “Data Highlights” below for more). Looking to the chart, the pair bounced early in the week before reversing sharply back lower in the wake of the ECB’s QE announcement on Thursday. While both the MACD and Slow Stochastics are essentially neutral at this point, last week’s shallow retracement suggests that the bears remain in control of trade. Therefore, the path of least resistance for EURNZD remains to the downside as long as rates hold below 1.5400 this week.

Source: FOREX.com

Global Data Highlights

Monday, January 26, 2015

AUSTRALIA DAY

9:00 GMT German IFO – Expectations, Business Climate, and Current Assessment (January)

- It’s still a little early to gauge the reaction in the business community to the actions taken by the European Central Bank this past week. While Quantitative Easing was widely expected, the ECB did go above and beyond expectations of €50B per month with a €60B per month infusion. If QE in Europe has a similar path to that in the US, then businesses in not only Germany, but across the Eurozone should be ecstatic. The US stock market rose substantially during QE’s 1, 2, and 3 from the Federal Reserve which, in theory, helped US businesses increase revenues and add value to their overall being. Despite the grumblings from German politicians and finance gurus, businesses may very well be popping their collective champagne corks as the future for them looks mighty bright.

Tuesday, January 27, 2015

2:00 GMT Conference Board’s Chinese Leading Economic Index (December)

- This is the only release of any consequence coming out of China for this week, but that doesn’t necessarily mean they will be staying out of the headlines. The People’s Bank of China has a nasty habit of making unscheduled changes to their monetary policy over weekends and times of relative calm, so keep a lookout for potential easing actions from them which could give the floundering AUD and NZD a boost higher. As for the Leading Index though, there may not be much to go on. Each of the last three months has given a 0.9% rise, and beyond that, the deviations from that point aren’t substantial. So despite this being on this wrap of fundamental events, don’t expect too much to come of it.

9:30 GMT UK Preliminary Gross Domestic Product (Q4)

- The preliminary reading of GDP for the UK if the first official read we get for how the UK economy fared in the previous quarter. That being the case, it is typically one of the more important releases once the quarter ends. Overall, the UK economy hasn’t been doing too bad as the last six quarters have given between 0.6% and 0.8% growth each, but that doesn’t mean that Q4 will repeat the trend. Economic figures have been falling in the UK over the last couple months, so much so that the Bank of England has put the market on notice with a couple of their more hawkish members relenting their hawkish positions. Concerns over European QE are evident and inflation continues to decline, both are factors that could have led to a disappointing GDP read in the UK.

13:30 GMT US Durable Goods Orders (December)

- This is often one of the more volatile economic releases in the US due to its seemingly unpredictable nature. It isn’t out of the ordinary to see consensus off by more than 1% as orders for jetliners and washing machines is erratic. For what it’s worth, consensus is expecting somewhere around a 0.5% rise and after seeing a -0.9% disappointment last month, a bounce back would be par for the course.

Wednesday, January 28, 2015

0:30 GMT Australian Consumer Price Index (Q4)

- The AUD has been one of the more unpopular currencies this past week and it has largely gone unnoticed thanks to the ECB’s QE actions and the fallout from the Swiss National Bank pulling their currency peg on the EUR/CHF. All of the euro-centric attention overlooked the AUD/USD falling from over 0.82 to start the week to sub 0.79 to end it. Strangely enough, it wasn’t really driven by anything released economically out of Australia, but more on commodities that are closely associated to the nation. Much like the falling oil prices are forcing US oil producers in North Dakota and Texas to make some tough decisions on their future drilling decisions; falling copper prices are doing the same for Australian miners. If CPI in Australia follows the path of most other developed nations across the globe by falling further, the AUD may continue to be an unpopular currency.

19:00 GMT Federal Open Market Committee’s Interest Rate Decision & Monetary Policy Statement

- The Fed won’t be holding a press conference at this meeting, and NOBODY expects them to increase interest rates at this meeting, so it may be more of a dud than anything else. However, a lot of interest will be heaped upon this meeting due to the changes in monetary policy over in Europe. The statement may change slightly to reflect on the ECB’s QE program as well as falling inflation across the developed world, but not likely enough to change a lot of minds on what they will be doing going forward.

20:00 GMT Reserve Bank of New Zealand Interest Rate Decision

- The RBNZ is in a precarious position currently as they are one of the smaller nations on the list of developed economies. The ECB’s QE policy and falling commodities have a larger effect on them in comparison to their larger cousin across the Tasman Sea, and that may cause the RBNZ to act more aggressively in response to global balances. That being the case, it isn’t out of the realm of possibility for them to cut interest rates at this meeting to more easily protect themselves from the global blowback of ECB QE and SNB peg pulling, much like the Bank of Canada did this past week.

Thursday, January 29, 2015

23:30 GMT Japanese Consumer Price Index & Household Spending (December)

- There are a bunch of releases coming out simultaneously at this time for Japan which is akin to the Chinese data dump, and CPI and Household Spending are the most vital of those releases. Inflation is something that is on every central bank’s radar as of late, and has been for quite a while for the Bank of Japan, and since the income tax increase in Japan back in April 2014, consumer spending has been as well. Some central bank observers expected the BoJ to increase QE once again this past week in response to the SNB and ECB, but they decided to wait for the fallout before making any additional moves. If neither inflation nor spending are heading in the right direction though, the BoJ may not have the luxury of waiting for another meeting to take action.

Friday, January 30, 2015

9:30 GMT UK Net Lending to Individuals (December)

- Much like the US, the UK is highly dependent upon their consumers actually consuming to keep their economy humming along; therefore, lending becomes an integral part of their economy. Last month’s £3.3B read was the second highest reading since 2008 with the highest occurring in Sept 2014. If GDP provides a strong reading earlier in the week, expectations for this may naturally increase as consumers likely came out in droves to consume. However, if GDP is disappointing, this figure may be low as well.

10:00 GMT Eurozone Preliminary Consumer Price Index (January)

- One of the main reasons the ECB decided to unleash the QE monster is due to their dismal inflation figures over the last several months. In ECB President Mario Draghi’s statement about their Large Scale Asset Purchase program, he mentioned that end-September 2016 would be the earliest they end it, but inflation has to be in their excepted range – otherwise it’ll last longer. With oil prices continuing to fall of late, inflation likely isn’t getting any help heading higher, so this may be more of a confirmation that the ECB did the right thing than anything else.

13:30 GMT Canadian Gross Domestic Product (November)

- In a surprise action this past week, the BoC decided to cut interest rates from 1.0% to 0.75% thanks in large part to the precipitous fall in oil over the last few months. Of course, that action may also be a warning that the economy in Canada isn’t performing all that well either. Most likely the BoC had figured out GDP before their meeting, so an interest rate cut could have been in preparation for leaner times to come for growth as well. The last two readings were surprisingly strong at 0.4% and 0.3%, but those feel good numbers could become a distant memory if this number ends up in the red.

13:30 GMT US Advance Gross Domestic Product (Q4)

- The growth in the US economy over the last couple quarters was well above what most people were expecting as 4.6% and 5.0% were the eventual official outcomes. In addition, the Final figures for each were higher than originally reported by the Advanced number months beforehand. So does that mean we should discount the Advanced reading in anticipation that the Final will be different? Not really. The Advanced number is the first look we have at the previous quarter, and typically has a very large impact; the strong revisions we’ve seen lately is more of an anomaly than anything else, therefore, this read could have a VERY large impact. Since the US is being viewed as the global growth savior lately, the prospect for disappointment could be severe; however, unlike last year around this time, the Polar Vortex wasn’t around to keep people from venturing outside their homes. If US GDP can produce another 3.0%+ reading, that may be enough to keep the USD in the driver seat for the time being.

General Risk Warning for stocks, cryptocurrencies, ETP, FX & CFD Trading. Investment assets are leveraged products. Trading related to foreign exchange, commodities, financial indices, stocks, ETP, cryptocurrencies, and other underlying variables carry a high level of risk and can result in the loss of all of your investment. As such, variable investments may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall Witbrew LLC and associates have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to investment trading or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.