![]()

Plenty of ink has been spilled about ECB President Mario Draghi’s dovishness last week, especially in contrast to the more-hawkish-than-expected Federal Reserve meeting. Given the big fundamental shift over the last two weeks, we thought it would be worthwhile to check in on the pair’s longer-term technical outlook.

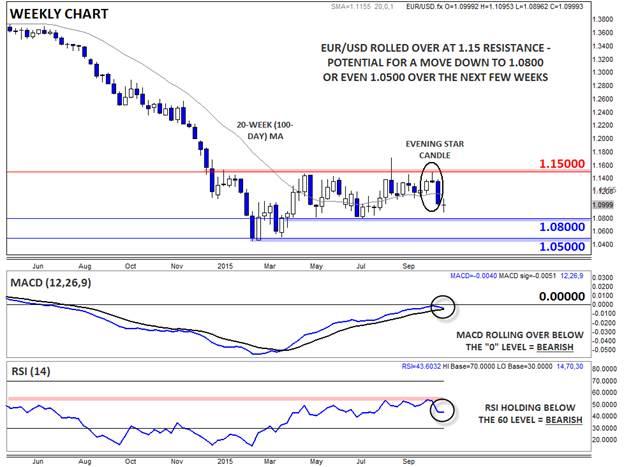

Looking at the weekly chart reveals a mixed picture for EUR/USD. The unit is undoubtedly in a long-term downtrend since peaking near 1.40 midway through last year, though rates have been generally rangebound between 1.05 and 1.15 for most of this year. Looking at the last six months specifically, the range has been even tighter from 1.0800-1.1500.

After testing resistance at 1.1500 in mid-October, the pair formed a clear Evening Star* candlestick pattern. This relatively rare 3-candle reversal pattern shows a gradual shift from buying to neutral to selling pressure and is often seen at important tops in the market. While we haven’t seen much continuation to the downside this week, with price merely forming a weekly Doji candle**, the technical outlook is still bearish below the 20-week (100-day) MA near 1.1200.

Meanwhile, the secondary indicators are also pointing lower. The MACD is rolling over beneath the “0” level and about to cross back below its signal line, signaling the return of bearish momentum. For its part, the RSI indicator remains pinned below the 60 level that typically serves as resistance within an established downtrend.

At this point, medium-term bears should be eyeing the 1.0800 level as the next major level to watch. Buyers could certainly step in to defend that level, as they did in May and July, but if it gives way, a continuation down to the 13-year low around 1.0500 could be next. Based on the weekly chart, it’s hard to have a bullish long-term outlook on EUR/USD as long as rates are pinned below 1.1500 resistance.

* An Evening Star candle formation is relatively rare candlestick formation created by a long bullish candle, followed a small-bodied candle near the top of the first candle, and completed by a long-bodied bearish candle. It represents a transition from bullish to bearish momentum and foreshadows more weakness to come.

**A Doji candle is formed when rates trade higher and lower within a given timeframe, but close in the middle of the range, near the open. Dojis suggest indecision in the market.

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Bitcoin price could be primed for correction as bearish activity grows near $66K area

Bitcoin (BTC) price managed to maintain a northbound trajectory after the April 20 halving, despite bold assertions by analysts that the event would be a “sell the news” situation. However, after four days of strength, the tables could be turning as a dark cloud now hovers above BTC price.

Bank of Japan's predicament: The BOJ is trapped

In this special edition of TradeGATEHub Live Trading, we're joined by guest speaker Tavi @TaviCosta, who shares his insights on the Bank of Japan's current predicament, stating, 'The BOJ is Trapped.'