![]()

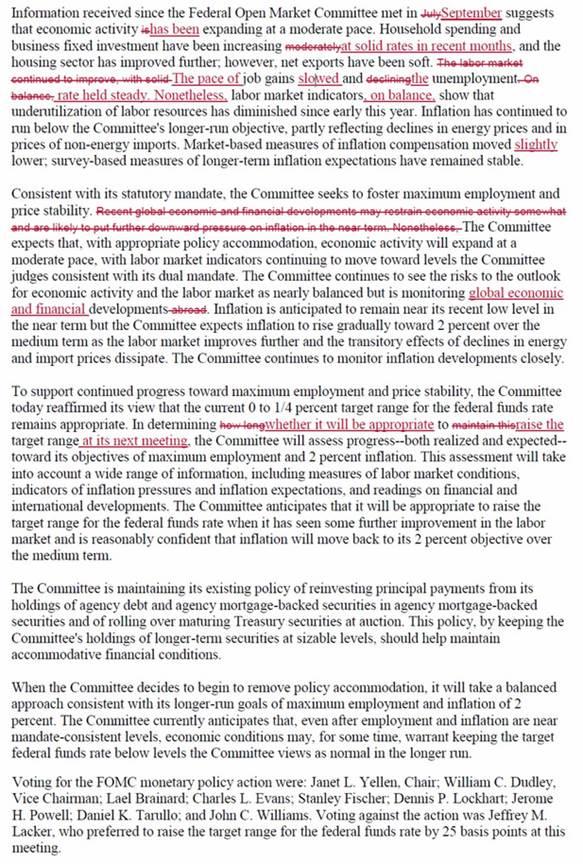

As we (along with everyone else who was paying attention) anticipated, the Federal Reserve did not make any changes to monetary policy in its October monetary policy meeting. Despite the lack of action, the Fed’s accompanying statement still managed to come off as hawkish, as the key comments below illustrate (emphasis mine):

- FED REMOVES LINE THAT GLOBAL DEVELOPMENTS MAY RESTRAIN GROWTH

- U.S. ECONOMY `HAS BEEN EXPANDING AT A MODERATE PACE'

- LABOR MARKET SLACK HAS DIMINISHED SINCE EARLY THIS YR

- ECONOMIC RISKS NEARLY BALANCED, MONITORING GLOBAL DEVELOPMENTS

- SURVEY-BASED MEASURES OF INFLATION OUTLOOK REMAINED STABLE

- SEES INFLATION RISING TOWARD 2% IN MEDIUM TERM

- PACE OF JOB GAINS `SLOWED,' UNEMPLOYMENT `HELD STEADY'

- HOUSING IMPROVED FURTHER, EXPORTS BEEN `SOFT'

On balance, today’s monetary policy statement keeps a potential rate hike on the table. This means that economic data over the next six months will be meticulously dissected through the lens of Fed policy, and that we could see a big move over the low-liquidity holiday period, regardless of what the Federal Reserve decides. With the pendulum of market sentiment still coming back from a dovish-Fed/bearish-dollar extreme, the greenback could remain supported at the expense of global equities, especially if US economic data improves.

Market Reaction

The market reaction to the Federal Reserve’s statement was logical, if a bit more extreme than many had expected. The US dollar immediately strengthened across the board, driving EUR/USD 120 pips lower to trade in the mid-1.0900s as of writing. Meanwhile, stock indices have been the big losers, with both the S&P 500 and Dow Jones Industrial Average (DJIA) dropping back to unchanged on the day. Yields on the benchmark 10-year treasury bond have also edged higher to 2.09%. As we noted above, these moves may run further as the excessive anti-dollar sentiment continues to unwind.

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold stays in consolidation above $2,300

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.