![]()

Heading into the tomorrow’s conclusion of the Federal Reserve’s October monetary policy meeting, traders have almost completely priced out any possibility of action from the central bank, despite Fed Chair Janet Yellen’s comments that this would be a “live” meeting. To wit, the CME’s FedWatch tool shows that Fed Funds futures traders believe there’s just a 5% chance of the central bank raising interest rates tomorrow.

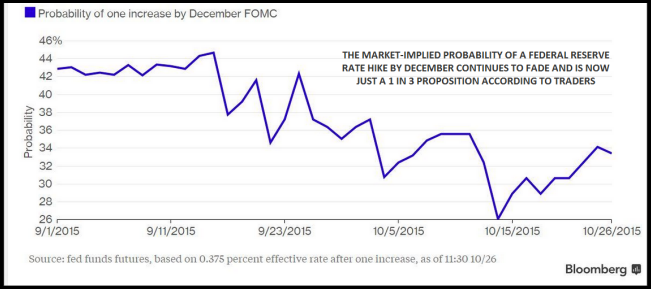

Indeed, the far more important figure to watch around the FOMC statement will be the likelihood of an interest rate hike come December. As we go to press, the market views a December rate increase as a minority proposition as well, with an implied probability of just 30%, though economists are predictably more optimistic, with 64% expecting a rate hike by December according to a recent Wall Street Journal poll.

From a communication perspective, the Fed’s shift toward a more transparent decision-making process has been an abject failure. As recently as June, the Fed’s Summary of Economic Projections (SEP), including the infamous “dot chart” of interest rate expectations, implied an interest rate hike was almost certain this year, with 15 of 17 FOMC participants anticipating such a move.

As the central bank has backed away from these hawkish views, it clarified that voters needed to see sufficient progress on the job market and rates would rise when the voters were “reasonably confident” that inflation would rise back to the bank’s 2% target. Of course, “sufficient progress” and “reasonable confidence” are fairly nebulous terms, and this has led to even more confusion among traders. There are even growing fissures among the inner-circle of FOMC policymakers, with Yellen’s right- and left-hand men, Stanley Fischer and William Dudley, recently publicly disagreeing on whether interest rates should rise this year.

Looking at the recent economic figures, the market’s pessimism is understandable. The marquee Non-Farm Payrolls jobs report showed that a disappointing 142k jobs were created in September, and negative revisions drove the August jobs total down to just 136k. In addition, retail sales came in weaker-than-expected at just 0.1% m/m, while the Producer Price Index (PPI) figure for September dropped by -0.5%, the weakest reading since January. The subdued consumption and producer prices suggest there is minimal inflation in the pipeline, meaning that the Fed can afford to be more cautious about raising rates.

In our view, the central bank will make only minimal changes to its monetary policy statement. In particular, traders will latch on to any optimistic comments about financial markets stabilizing or “transitory” weakness in the labor market (potentially supporting a December hike), as well as any concern with the recent increase in the value of the US dollar (which could help push a rate hike back into 2016).

As we noted last week, even a neutral statement could still lead to more dollar strength as the market sentiment pendulum recently swung to a potentially bearish extreme on the greenback (see “Fed policy: Riding the market sentiment pendulum and the tail wagging the dog” for more). That said, we believe that the overall market reaction to the Fed statement may be more subdued than usual and that Thursday’s Q3 Advance GDP report could be even more market-moving, as it will heavily influence (not just relay) Fed policy views heading into the December meeting.

Source: Bloomberg, FOREX.com

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.