![]()

The European equity markets are trading mixed to slightly lower this morning. Stocks are consolidating their recent advances ahead of a busy week of data and earnings from both sides of the pond, and more central bank action. Last Thursday’s decisively dovish message from the ECB caused stocks to surge higher and Friday’s easing measures from China gave the markets another shot in the arm. Although not much is expected to come out of the Federal Reserve’s policy statement on Wednesday, the Bank of Japan’s meeting could be an interesting one to watch on Friday as there is a possibility it will either announce its intentions to or expand the bond buying programme. If seen, this will likely further depress Japanese bond yields and force more yield-seekers into the equity markets even if valuations might appear expensive in some places, though the lack of other real alternatives means investors do not have a lot of choice.

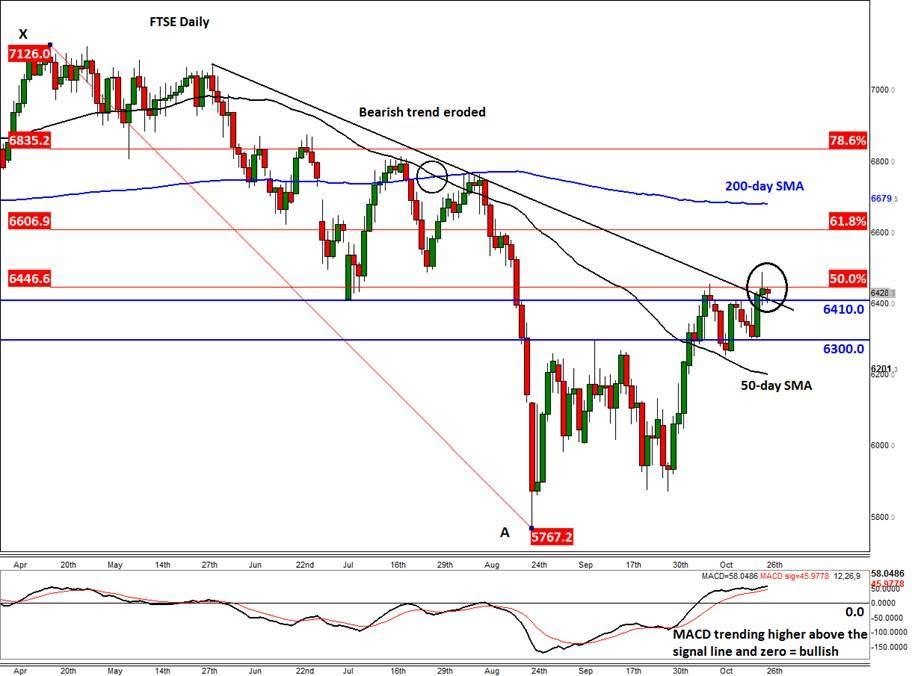

The FTSE has now made back about 50% of the losses it has suffered since dropping from the intra-day record high of around 7125 achieved in late April. It has unperformed against the US equities, where the major indices have made back more than 3/4 of their losses from their own record or multi-year highs. The UK index had been outperforming European peers until last week, but after the ECB more or less paved the way for introducing more stimulatory policy measures in December, euro-denominated stocks have surged higher. As a result, they too have now leapfrogged UK stocks on percentage basis, relative to the prior record highs.

In addition to no such commitment from the Bank of England, the FTSE has been held back by underperforming commodity and energy stocks due to the on-going weakness in metal and oil prices. With the impact of China’s latest rate cuts evaporating fairly quickly and the US dollar regaining its poise, the buck-denominated commodities could fall back and further weigh on miners and energy stocks that dominate the FTSE 100.

However, given the promise of further support from the ECB, and possibly from the BOJ this week, sentiment across the stock markets is likely to remain upbeat this week. Indeed, the FTSE could even outperform this week as lots of London-listed heavyweights are scheduled to report their earnings results or trading statements over the next several days. Among the highlights are BP, Lloyds, Next, GSK, Barclays, BT, Shell, RBS, GB and ICAG (see the table below for a more comprehensive list). In addition, the official third quarter UK GDP estimate (i.e. from the Office for National Statistics) will be published on Tuesday. So it could be a big week for UK-listed assets.

| 26-Oct-15 | 07:00 | WPP PLC | Sales/Trading Statement |

| 27-Oct-15 | BMO | Bloomsbury Publishing PLC | Earnings |

| 27-Oct-15 | BMO | St. James's Place PLC | Sales/Trading Statement |

| 27-Oct-15 | 07:00 | BP PLC | Earnings |

| 27-Oct-15 | 07:00 | DS Smith PLC | Sales/Trading Statement |

| 27-Oct-15 | 07:00 | International Personal Finance PLC | Sales/Trading Statement |

| 28-Oct-15 | NTS | Petra Diamonds Ltd | Sales/Trading Statement |

| 28-Oct-15 | BMO | British American Tobacco PLC | Sales/Trading Statement |

| 28-Oct-15 | BMO | Lloyds Banking Group PLC | Sales/Trading Statement |

| 28-Oct-15 | BMO | Next PLC | Sales/Trading Statement |

| 28-Oct-15 | BMO | Redefine International PLC | Earnings |

| 28-Oct-15 | 07:00 | Telecity Group PLC | Sales/Trading Statement |

| 28-Oct-15 | 07:00 | Standard Life PLC | Sales/Trading Statement |

| 28-Oct-15 | 12:00 | GlaxoSmithKline PLC | Earnings |

| 28-Oct-15 | 12:30 | Murray Income Trust PLC | Shareholder/Annual Meetings |

| 28-Oct-15 | ~14:30 | JPMorgan Mid Cap Investment Trust PLC | Shareholder/Annual Meetings |

| 29-Oct-15 | BMO | Millennium & Copthorne Hotels PLC | Earnings |

| 29-Oct-15 | BMO | National Express Group PLC | Sales/Trading Statement |

| 29-Oct-15 | BMO | KAZ Minerals PLC | Sales/Trading Statement |

| 29-Oct-15 | BMO | Playtech PLC | Sales/Trading Statement |

| 29-Oct-15 | 07:00 | Barclays PLC | Sales/Trading Statement |

| 29-Oct-15 | 07:00 | BT Group PLC | Earnings |

| 29-Oct-15 | 07:00 | Smith & Nephew PLC | Sales/Trading Statement |

| 29-Oct-15 | 07:00 | Aviva PLC | Sales/Trading Statement |

| 29-Oct-15 | 07:00 | Henderson Group PLC | Sales/Trading Statement |

| 29-Oct-15 | 07:00 | Royal Dutch Shell PLC | Earnings |

| 29-Oct-15 | 10:00 | Genesis Emerging Markets Fund Ltd | Shareholder/Annual Meetings |

| 30-Oct-15 | BMO | Elementis PLC | Sales/Trading Statement |

| 30-Oct-15 | BMO | Pets at Home Group PLC | Sales/Trading Statement |

| 30-Oct-15 | 07:00 | Royal Bank of Scotland Group PLC | Sales/Trading Statement |

| 30-Oct-15 | 07:00 | BG Group PLC | Earnings |

| 30-Oct-15 | 07:00 | International Consolidated Airlines Group SA | Earnings |

From a technical point of view, the FTSE has broken its bearish trend line now, confirming the change of the near-term bullish direction. It has therefore paved the way for a potential rally towards the next levels of resistance at 6600/10 (previously support and the 61.8% Fibonacci retracement of the downward move from the record high) and then 6680 (200-day moving average). The short-term bullish outlook would become weak however if the FTSE breaks back below the trend line and 6410 on a closing basis. And a potential close below support at 6300 would completely invalidate the short term bullish setup.

Trading leveraged products such as FX, CFDs and Spread Bets carry a high level of risk which means you could lose your capital and is therefore not suitable for all investors. All of this website’s contents and information provided by Fawad Razaqzada elsewhere, such as on telegram and other social channels, including news, opinions, market analyses, trade ideas, trade signals or other information are solely provided as general market commentary and do not constitute a recommendation or investment advice. Please ensure you fully understand the risks involved by reading our disclaimer, terms and policies.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.