![]()

Some people have been looking for the Fed to hike interest rates to help reignite the dollar rally. Bad news, some fairly basic analysis suggests that the dollar is not that closely related to the Fed’s rate hiking cycles.

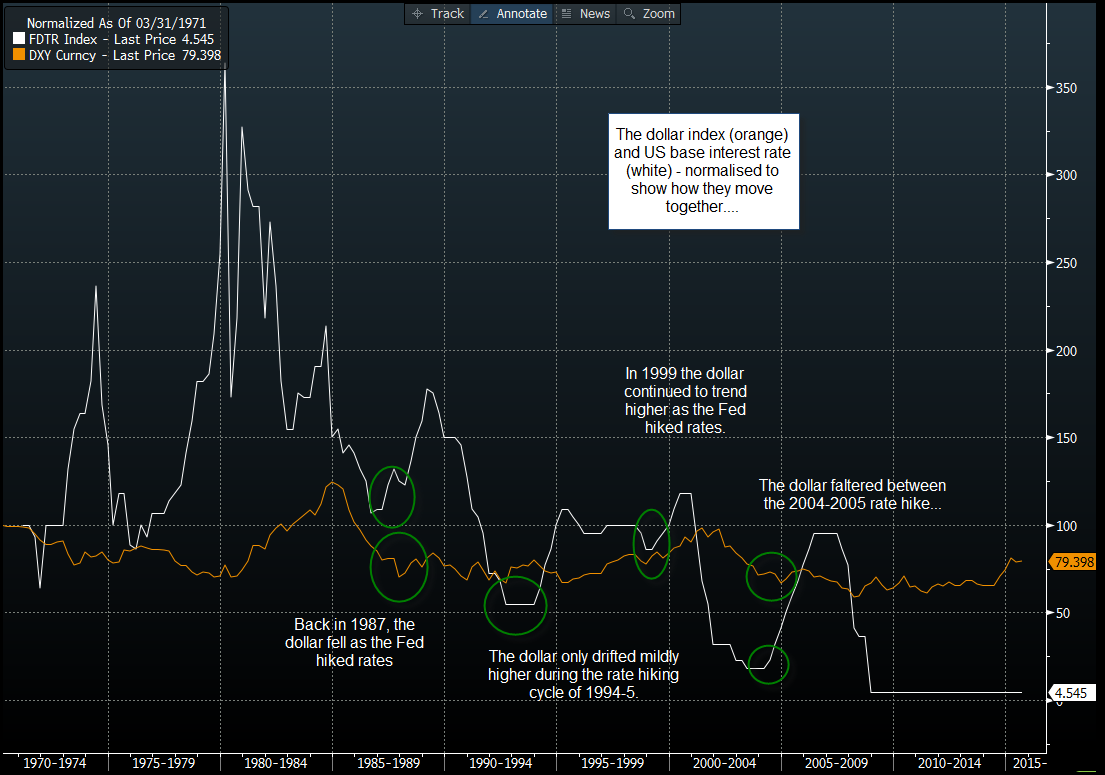

We looked at previous hiking cycles in 1987, 1994, 1999, and 2004, here are the results:

1987: dollar fell in the first few months of hikes.

1994: Dollar drifted sideways, before embarking on a mild upward trend.

1999: the dollar continued with its mild uptrend, which had started before the Fed began raising interest rates.

2004: The dollar fell as the Fed embarked on a rate hiking cycle.

You can see a visual representation of this in the chart below, which shows the dollar index and the US Base rate, this chart has been normalised to show how the two move together.

So what does this mean for traders?

· Do not rely on the Fed to determine the direction of the dollar in the coming months.

· The dollar tends to follow its predominant trend when the Fed starts to hike rates.

· There is no direct link between the Fed hiking rates and the dollar falling, when a weak dollar has coincided with a Fed hiking cycle it has been falling for some time already.

· Due to this, we may see a muted reaction to a potential Fed rate hike next month.

Where could the dollar go this time?

If the Fed does hike rates next month (the jury is still out with only a 50% chance of a hike priced in by the Fed Funds futures market), history tells us not to expect too much of a reaction in the buck. However, because the dollar has rallied into this rate hike, it has been in an uptrend since mid-2014, there is a chance that the buck could rally alongside a Fed rate hiking cycle, although our analysis tells us that this may have little to do with the Fed actually hiking rates.

Figure 1:

Source: Gain Capital, Data: Bloomberg

Recommended Content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Bitcoin price could be primed for correction as bearish activity grows near $66K area

Bitcoin (BTC) price managed to maintain a northbound trajectory after the April 20 halving, despite bold assertions by analysts that the event would be a “sell the news” situation. However, after four days of strength, the tables could be turning as a dark cloud now hovers above BTC price.

Bank of Japan's predicament: The BOJ is trapped

In this special edition of TradeGATEHub Live Trading, we're joined by guest speaker Tavi @TaviCosta, who shares his insights on the Bank of Japan's current predicament, stating, 'The BOJ is Trapped.'