![]()

FX performance in the last week has thrown up a lot of unanswered questions: is the EUR heading lower after a period of consolidation? Is the dollar rally back on? Is GBP able to shrug off future referendum storms? This all leads to one important question for the trader – what is the market’s favourite strategy right now?

Earlier this year the carry trade had been reaping fruit earlier this year, however, this strategy has stalled as former funding currencies start to recover. As a re-cap, funding currencies tend to be sold in favour of higher-yielding currencies, which can have a higher value. However, although interest rates in the Eurozone are negative (deposit rates, anyway), and the ECB has embarked on a large-scale QE programme, the EUR has been an unreliable funding currency. For example, although it is still lower versus the dollar since the start of this year, to the tune of 5%, it has managed to gain 6% vs. the USD since April. Thus, for anyone shorting the EUR in recent weeks, it has been a painful experience.

In contrast, the New Zealand dollar, the highest yielding currency out of the expanded majors with an interest rate of 3.5%, it has gained the only 0.5% vs. the USD since April, and has actually lost 0.5% of value versus the USD since the start of May.

Changing strategy

The conclusion from this is clear: in this environment the carry trade is dangerous. Trying to sell low yielding currencies and buy higher yielding currencies is a loss making trade. We believe the carry trade is struggling at this junction because there is a lot of uncertainty around the timing of rate increases from some of the world’s major central banks, including the Federal Reserve and the Bank of England. Even the ECB has felt it necessary to explicitly state that its QE programme will survive until September next year, after some doubted its longevity after a spate of better growth and inflation data from the currency bloc.

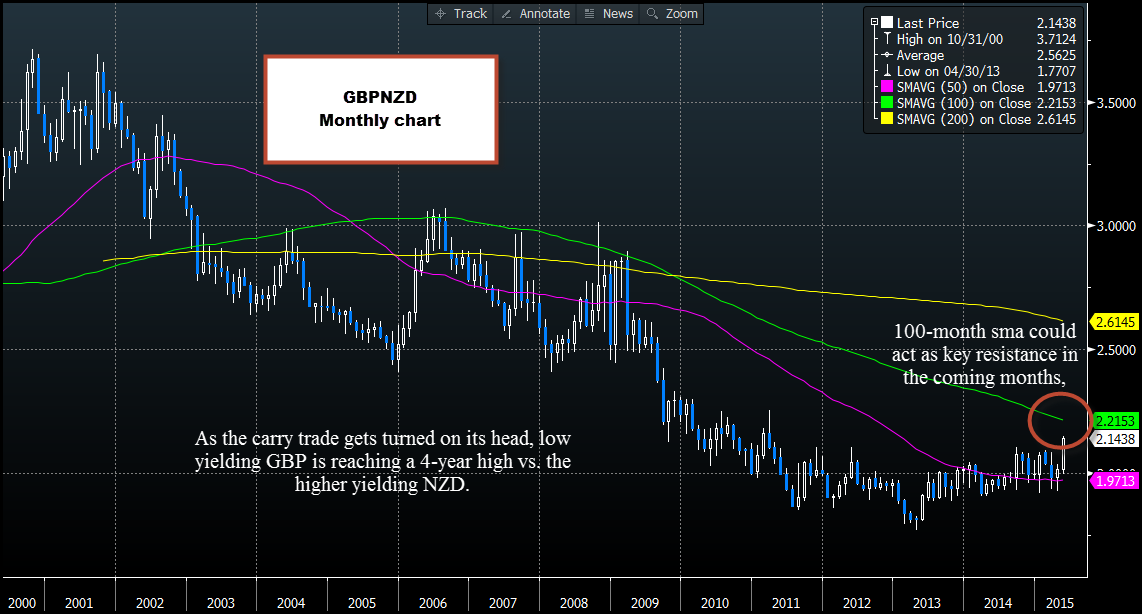

An example of the decline of the carry trade is the performance of GBPNZD. As the Kiwi has been languishing at the bottom of the pile, the pound has been getting its groove back in recent weeks; hence GBPNZD is approaching a 4-year high. The next key level to watch is 2.2153 – the 100-month moving average, as you can see in the chart below.

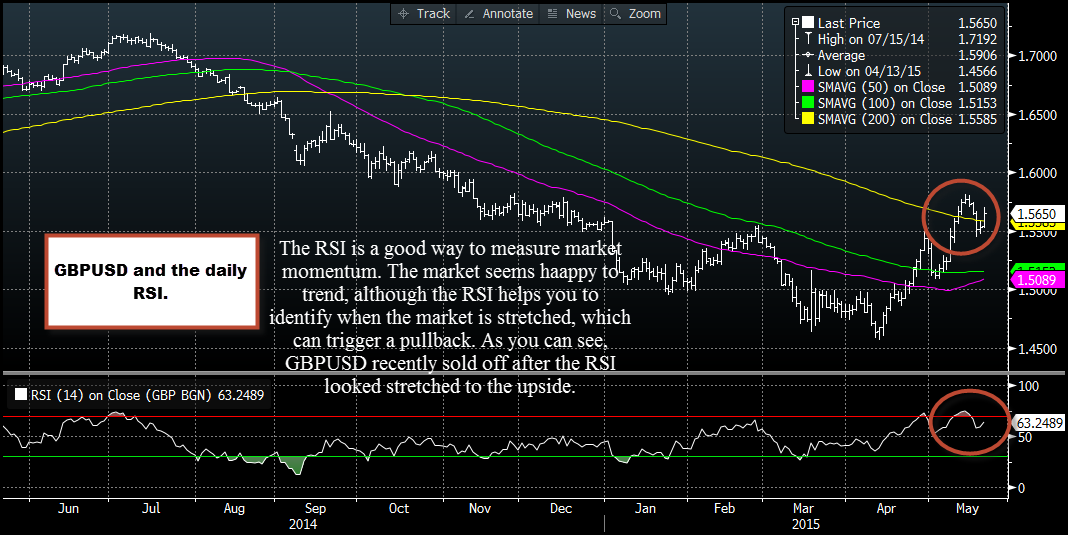

FX traders should not despair, the carry trade may not be working out, but the momentum trade is on track. There are different ways of measuring momentum in the FX market, one way that we like here at FOREX.com is using the Relative Strength Index (RSI). As you can see in figure 2, which shows GBPUSD and its daily RSI, GBPUSD had been trending higher after making a low in April, until it looked stretched to the upside, when GBPUSD reversed course. Based on recent price data, the sell-off in GBPUSD earlier this week coincided with the RSI moving into overbought territory above 70.

Take Away:

The EUR has been an unreliable funding currency in the last 2 months.

In fact, the carry trade has been turned on its head in recent weeks, with higher yielding currencies weakening, and low yielding currencies gaining strength vs. the USD.

This is why GBPNZD is at a 4-year high.

Momentum strategies have been more reliable in this environment, including RSI strategies.

Overall, until the Fed and the BOE decide when they will raise interest rates the carry trade is a difficult sell. In contrast, momentum strategies appear to be king for now.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.