![]()

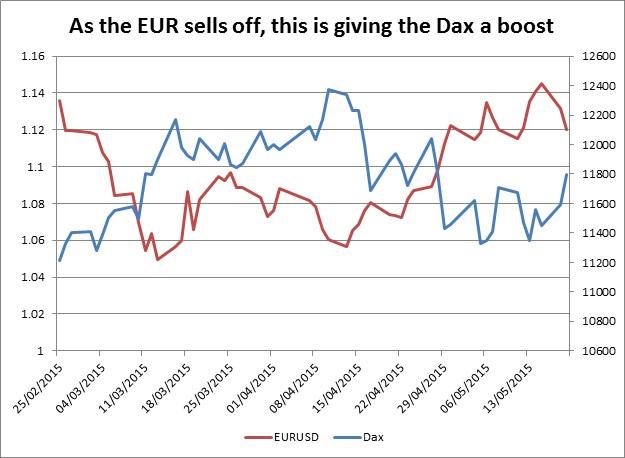

As the EUR continues to pullback from prior highs vs. the dollar of 1.1450, the Dax is off to a flying start this week. In the last 2 days, the Dax is up more than 3%, and is testing its 50-day sma at 11,822, the highest level since the end of April. If the index continues to rally at this current pace then we could see back to 12,000, and maybe the record high of 12,390.

The Dax can thank the EUR for its recent rise, as the negative correlation between the two has surged in recent days. To put this into some perspective:

Since the start of this year the Dax and EURUSD has had a negative correlation of -0.36.

This has risen to -0.51 since the start of May.

Since 10th May this correlation has surged to -0.66.

Thus, when EURUSD falls, the Dax rises 66% of the time. Read our technical update on the Dax on our website, but the fundamental reason for the increase in the Dax is closely tied to the EUR for the following reasons:

EUR weakness helps Germany’s exporters, including its car manufacturers, which are its best performers on Tuesday.

The EUR has weakened on the back of comments from ECB officials that its QE programme will not end prematurely, and that the ECB may front-load asset purchases this summer, which could heavily on the EUR in the coming weeks.

Stock markets love the liquidity provided by QE, hence why Europe’s largest index is rallying on the back of news that the ECB’s programme is here to stay.

To conclude, if you are trading the Dax, make sure you watch what the EUR is doing, a break below 1.10 in EURUSD could help the Dax regain recent record highs.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price treads water near $2,320, awaits US GDP data

Gold price recovers losses but keeps its range near $2,320 early Thursday. Renewed weakness in the US Dollar and the US Treasury yields allow Gold buyers to breathe a sigh of relief. Gold price stays vulnerable amid Middle East de-escalation, awaiting US Q1 GDP data.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.