![]()

The German index has taken a battering in the last few sessions, falling some 4.5% since Wednesday. The trigger has been Greek default fears; however, surely it is starting to look oversold after such a sharp move to the downside?

The tech view:

Yes and no. From a technical perspective, this index could still have further to fall. It attempted to form a bottom on Wednesday when it made an inverted hammer on the daily candle chart, however this did not stop the sellers coming in on Thursday as news about the IMF rebuffing Greece’s alleged pleas to delay its debt repayment next month were made public.

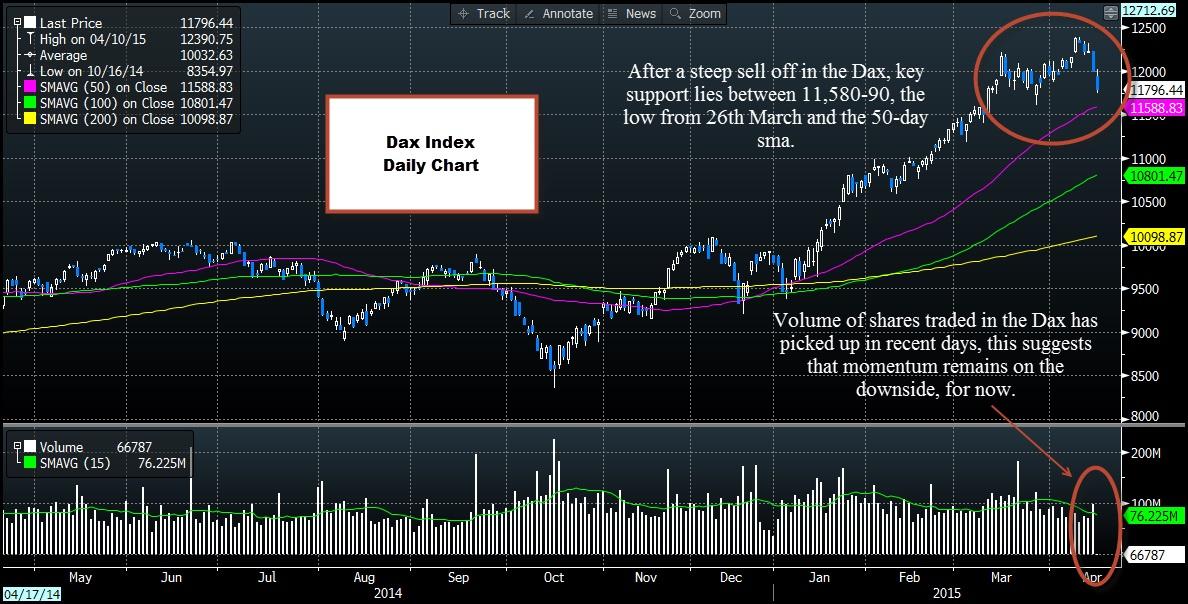

Although this index looks oversold from an RSI perspective, especially on the shorter term charts, the selling may continue until we reach a key support zone between 11,592 – 11,588, the low from 26th March and the 50-day sma respectively.

Turnover in Dax shares has picked up in recent sessions, as you can see in the chart below, which suggests that market momentum is on the side of the sellers, for now. This suggests caution amongst those looking for a near-term bounce higher. We do expect the selling to end, but unless we close higher than today’s extreme low at 11,743, then the selling may not end until we get into next week.

The fundo view:

From a fundamental perspective, the outlook is more Dax-friendly for a few reasons:

Strong economic data in Europe’s largest economy, including a strong composite PMI for March.

Decent trade and exports data for Feb, which could boost Q1 growth.

Greece: even if Greece does default, we expect a managed “exit” from both debts and the Eurozone, which could limit the fall-out from another Greek tragedy in the coming weeks and months.

However, it’s worth noting that the Dax has a fairly strong inverse correlation with the EURUSD, at -0.6%, thus, as the EUR is rallying on Friday this could add to the selling pressure on the Dax. The pick-up in inflation in the currency bloc could also undermine the German index as it could threaten the longevity of the ECB’s QE programme, which has been a key driver of the Dax this year.

Takeaway:

As you can see, the fundamental outlook for the Dax index is cloudy at the moment, so it may be worth looking at the technical picture before making a decision to buck the selling trend.

Although we think that the sell –off in the Dax will come to an end, momentum seems to be on the sellers’ side right now.

Key support lies between 11,592-11,588, which may stem the decline if the selling pressure keeps up over the weekend.

We mention above that we think the market will, eventually, be able to take a Greek default/Grexit in its stride. However, during this messy negotiation phase we would be wary of going long the Dax right now as potential event risk could build over the weekend, which may trigger another sell off at the beginning of next week.

So, patience could be a virtue for Dax sellers right now.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

AUD/USD favours extra retracements in the short term

AUD/USD kept the negative stance well in place and briefly broke below the key 0.6400 support to clinch a new low for the year on the back of the strong dollar and mixed results from the Chinese docket.

EUR/USD now shifts its attention to 1.0500

The ongoing upward momentum of the Greenback prompted EUR/USD to lose more ground, hitting new lows for 2024 around 1.0600, driven by the significant divergence in monetary policy between the Fed and the ECB.

Gold ascends but remains shy of testing $2,400 amid hawkish Fed remarks

Gold prices edged higher late in North American session, gaining 0.22% following a hawkish tilt by Fed Chair Jerome Powell. Economic data from the United States was mixed, though Monday’s Retail Sales report and Powell’s remarks kept US Treasury yields higher, capping the yellow metal’s advance.

Bitcoin price outlook amid increased demand and speculation pre-halving

Bitcoin price is edging lower as markets count only days to the halving. Nevertheless, the dump has not shaken the faith of large holders as they continue to cling to their holding even after a month of steady dumps.

UK CPI inflation data ahead: Sterling hovering north of key support

Following today's mixed bag of employment and wages data, today’s attention is directed to the March UK CPI inflation release. Both headline and core measures have surprised to the downside in the previous two releases and are expected to demonstrate further evidence of disinflation.