![]()

As a potential Greek default looms once again, we take a look at 4 charts to see: 1, how likely is a Greek default in the short term; 2, could this affect other Eurozone countries? 3, what will be the fall-out for markets.

Chart 1: The bond market believes a default is likely

The three-year Greek yield is most sensitive to the latest fears that Greece won’t be able to pay back its debts. As you can see, this yield has surged to nearly 28% on Thursday, its highest level since 2012. Yields have been rising along the curve, with 2-year and 10-year yields also increasing in recent days, however, the 3-year is under the most pressure as it corresponds with the maturity of Greek bailout funds.

To put this in context, back in 2012 the 3-year yield surged above 120%, so this yield could have further to go if negotiations between Athens and its creditors continue to deteriorate in the coming days.

Chart 2: Although the cost to insure Greek debt from default has risen, it is still well below the levels reached in 2012.

The cost to insure Greek debt from default has also surged, although it remains below the levels reached earlier this month. At 2,377 basis points, this is the highest level it has reached since 2013. As with the 3-year bond yield, however, this is still significantly lower than it was in 2012, when the cost to insure Greek debt from default surged to nearly 26,000 basis points.

A couple of reasons why CDS spreads have not surged back to these levels include: 1, there are less investors who hold Greek debt as it has been receiving bailout funds in recent years. 2, Some of those investors who do own Greek debt may not want to purchase default insurance, presuming instead that European authorities would pave the way for a “managed default” for Greece, where creditors would receive their money back.

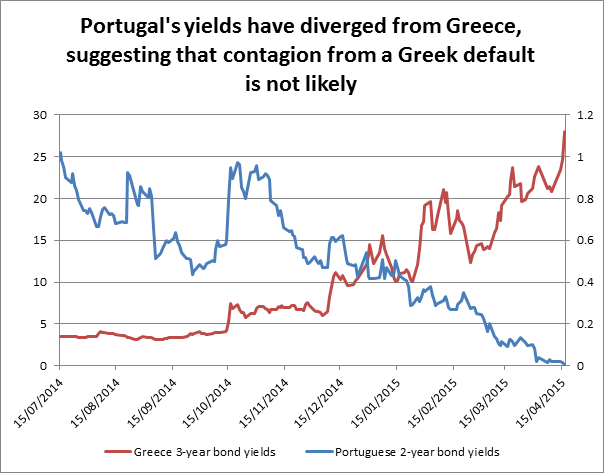

Chart 3: This time around there is no contagion from the Greek crisis to other peripheral Eurozone members.

This is one reason why financial markets are seemingly so calm about the prospect of a Greek default; it is unlikely to lead to a domino effect in other Eurozone markets. The chart below shows Greek and Portuguese yields of a similar maturity. As you can see, 2-year Portuguese yields barely yield anything, suggesting that the market is not tarring Lisbon with the same brush as Athens.

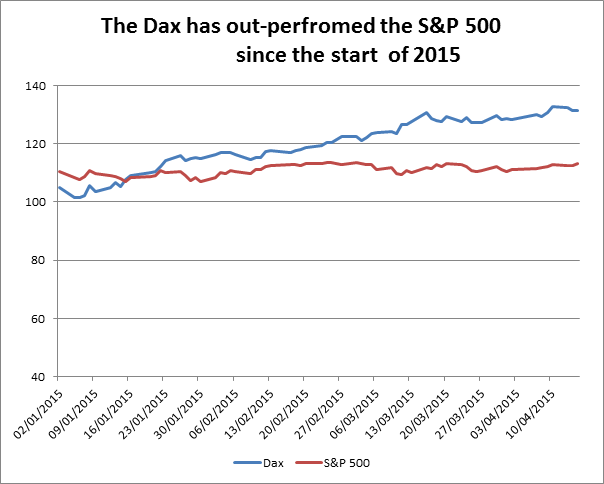

Chart 4: Could a Greek default make the German stock index, the Dax, more attractive?

We think yes. As Greece seems to be getting closer to the financial abyss, German bonds are attracting safe haven flows. Since bond prices and bond yields move inversely to each other, as demand for German bonds rise, it pushes down German yields. The 10-year yield is nearing zero per cent. Although not the first to have a 10-year yield below zero, the Swiss yield fell below 0% earlier this month, it is significant for Germany in this low yield environment and may continue to push investors into riskier assets in the coming weeks.

We think that European stocks, including the Dax index, could be the beneficiary. Although this index has reached a record high, it may outperform its US counterparts for a few reasons including:

Stocks can become more attractive in a low yield environment.

German stocks may benefit from the ECB’s QE programme, which is set to continue into next year.

US stocks, while still appreciating, could come under pressure later this year if the Fed decides to hike interest rates.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 after German IFO data

EUR/USD stays in a consolidation phase at around 1.0700 in the European session on Wednesday. Upbeat IFO sentiment data from Germany helps the Euro hold its ground as market focus shifts to US Durable Goods Orders data.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold price flat lines above $2,300 mark, looks to US macro data for fresh impetus

Gold price (XAU/USD) struggles to capitalize on the previous day's bounce from over a two-week low – levels just below the $2,300 mark – and oscillates in a narrow range heading into the European session on Wednesday.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin (WLD) price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.