![]()

With today’s UK Manufacturing PMI report coming out rather “ho-hum” at 54.4 against expectations of a 54.5 reading and a 54.0 print last month, FX traders have had little reason to push the pound sustainably higher or lower: the currency initially dipped in the wake of the report before recovering its losses a few hours later. With GBPUSD still trapped below major previous-support-turned-resistance in the 1.49-1.50 zone, the medium-term outlook remains bearish for that pair, but we’ve recently seen signs that GBPJPY could be taking a major turn lower as well.

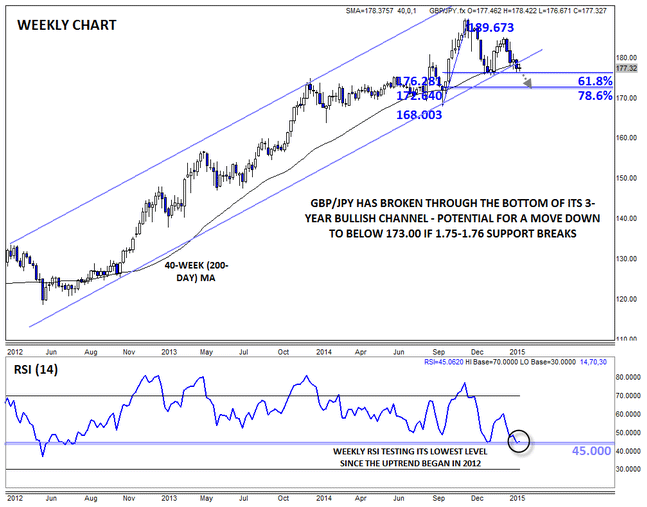

Since mid- 2012, GBPJPY had been steadily rising within a bullish channel…that is until last week. After putting in a lower high at 185.00, GBPJPY broke below both its channel support and its 200-day MA (approximated by the 40-week MA in the chart below) at 1.7825 last week. Rates are holding below those key levels thus far this week, suggesting that the move is less likely to be a false break. Meanwhile, the RSI indicator is also testing its lowest level since the uptrend began at 45, showing that the market’s momentum is clearly waning.

The next key zone to watch for GBPJPY bears will be 1.75-1.76, which marks the confluence of the 61.8% Fibonacci retracement and the year-to-date lows; if that support area gives way, another leg lower toward 172.60 (the 78.6% Fibonacci retracement of the Q4 2015 rally) may be seen. From a fundamental perspective, GBPJPY traders should keep a close eye on the UK Construction PMI report (tomorrow), Japanese Average Earnings data (Friday), and the always-impactful US NFP report (Friday) for near-term catalysts, but as long as the pair remains mired beneath its 200-day MA at 178.40, the path of least resistance will remain lower.

Source: FOREX.com

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.