![]()

Highlights

- NFP Prep: Wages to Set the Agenda for Fed’s March Meeting

- Another View: We’re Going Streaking!

- View How Our NFP Forecasts Compare

NFP Prep: Wages to Set the Agenda for Fed’s March Meeting

By: Matt Weller, CMT, Senior Technical Analyst

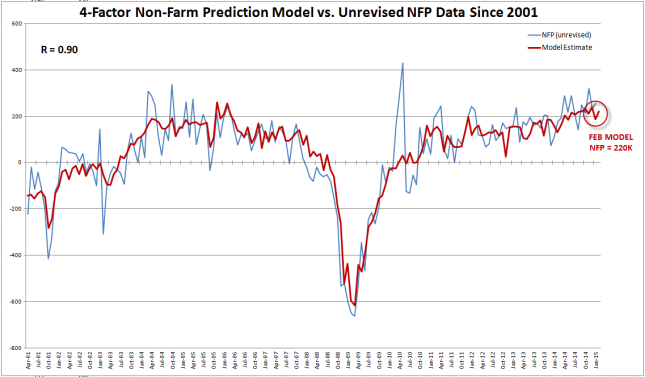

The February Non-Farm Payroll report will be released tomorrow at 8:30 ET (13:30 GMT), with expectations centered on a headline reading of 241k. My model suggests that the report could print a tick below these expectations, with leading indicators suggesting a February headline NFP reading of 220K.

The model has been historically reliable, showing a correlation coefficient of .90 with the unrevised NFP headline figure dating back to 2001 (1.0 would show a perfect 100% correlation). As always, readers should note that past results are not necessarily indicative of future results.

Source: Bureau of Labor Statistics, FOREX.com

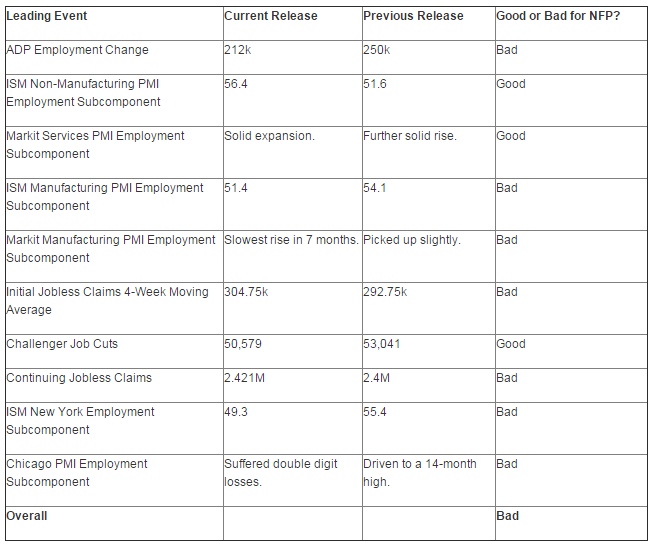

The major labor market indicators tracked by the model generally improved last month. Service PMI Employment improved substantially, rising nearly five points from 51.6 to 56.4, though Manufacturing PMI Employment gave back three points (from 54.1 in January to 51.4 in February). On the bright side, the ADP Employment report showed a gain of 212k, while Initial Jobless Claims in the survey week dropped back down to 283k from last month’s unusually-elevated 308k reading.

Trading Implications

As ever, the jobs report will be interpreted through the lens of Federal Reserve policy. While the total number of jobs created is always important, the central bank has pivoted to focusing on inflation instead of inflation of late. Therefore, there are a broad range of NFP outcomes that could be deemed “acceptable” by the market. Three possible scenarios for this month’s NFP report, along with the likely market reaction, are shown below:

Instead of focusing exclusively on the overall quantity of jobs, traders should also monitor changes in the quality of those jobs. In particular, the market will be hyper-focused on the average hourly earnings measure of wages, which surprised traders by rising at an elevated 0.5% rate last month. If wages continue to show strong growth, it could set the set the scene for the Fed to remove its patient pledge (before raising interest rates) at its policy meeting later this month.

February also featured exceptionally cold weather and a abnormal number of winter storms in the economically vital Northeast US, so there may be some element of weather distortion in this month’s employment reading. Indeed, optimistic traders may even discount any initially disappointing figure as attributable to the poor weather, creating a potential “Heads I win, tails you lose” scenario for dollar bulls. Historically, USD/JPY has one of the most reliable reactions to payrolls data, so traders with a strong bias on the outcome of the report may want to consider trading that pair.

Though this type of model can provide an objective, data-driven forecast for the NFP report, readers should note that the U.S. labor market is notoriously difficult to foretell and that all forecasts should be taken with a grain of salt. As always, tomorrow’s report may come in far above or below my model’s projection, so it’s absolutely essential to use stop losses and proper risk management in case we see an unexpected move. Finally, readers should note that stop loss orders may not necessarily limit losses in fast-moving markets.

Another View: We’re Going Streaking!

By: Neal Gilbert, Senior Market Analyst

This month my Non-Farm Payroll model is forecasting an extremely positive increase of 310k jobs in February 2015, which would be the best initial result since November’s 321k surprise. If this were to be the result, it would continue the hot streak that US data has been enjoying as NFP has been north of 200k (including revisions) for TWELVE STRAIGHT MONTHS, a feat that was last seen from 1993 to 1995 when there were 19 straight months of 200k+ results.

To be honest, when I initially calculated this result, I was a little skeptical; we’re just not used to seeing such strong initial figures since the Great Financial Crisis took hold in 2008. However, after looking a little closer at late 2014, readings in the high 200s and low 300s are becoming more of the norm than the exception. A result like that my model is forecasting would be likely very positive for the USD as it would seem nothing (not even a short month) can stop the streak the US economy is enjoying currently. It would also increase the odds that the Federal Reserve could raise interest rates in the summer.

Using my forecast model had previously required me to take last month’s result and either add to or subtract from it based on ten employment reports released before NFP; however, all of the weather related craziness in the first quarter of 2014 created a challenge to that doctrine in that previous results were anticipated to be revised substantially higher. While that anticipation turned out to be inherently incorrect, my forecast was actually fairly accurate utilizing the average calculation. Therefore, I will continue to repeat the method of using a three-month average which takes into consideration the possibility of a revision. So instead of using 257k as my baseline (last month’s result), it will now be 336k (an average of 423k November, 329k December, and 257k January).

Here is the breakdown of the leading employment reports:

Even though a majority (7 out of 10) of the leading reports before NFP are showing a negative outcome, the string of good results over the last three months is so strong that it could help maintain more than decline. Taking all these results together, I came up with my NFP estimation of 310k new jobs created in February 2015. This is much better than the consensus estimate of 240k, and could send the USD flying higher against its rivals, particularly the USD/JPY which has recently made another run above 120.

Last month’s NFP release was nearly a perfect release as Average Hourly Earnings were strong, NFP beat consensus, and the two previous months were revised higher. The only drag on the day was the Unemployment Rate that ticked 0.1% higher, but was forgiven due to the 0.2% increase in the Participation Rate. If my forecast is anywhere near what the actual result ends up being, we may see a similar reaction in markets, which means the USD could be the star of the day.

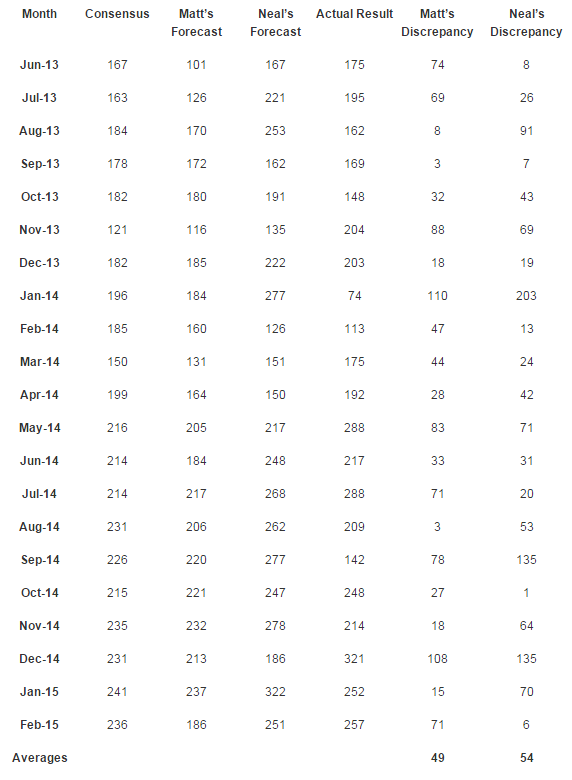

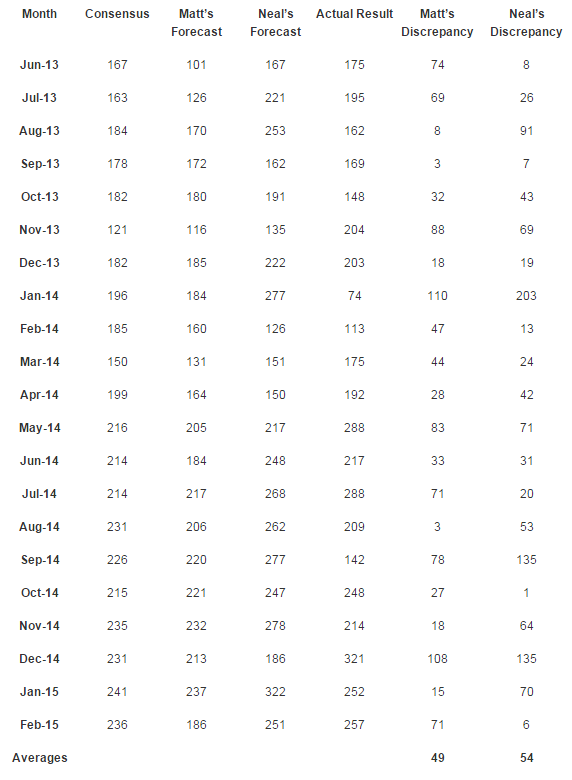

See How Our Forecasts Compare

*all numbers in thousands of net new jobs

Recommended Content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.