![]()

This week we get the latest quarterly changes to the FTSE 100. This index is based on the market capitalisation of the 100 largest companies listed on the London Stock Exchange; as the value of a company changes, so can its position on the UK’s top flight index.

So long, farewell…

It looks like the 50% decline in the oil price is coming home to roost for Tullow Oil, after reporting its first loss in 15 years for 2014; the company is expected to be thrown out of the FTSE 100. Replacing Tullow in the top-flight index is expected to be Hikma Pharmaceuticals. This company is a specialist chemical company that was founded in Jordan in 1978.

The implications for the rest of the index:

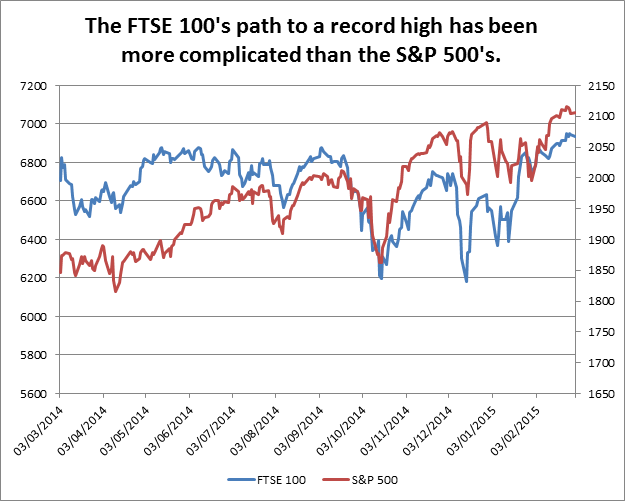

The FTSE 100 may have made a fresh record high earlier on Monday, however, its performance over the past 12 months has been marked by some sharp draw-downs, as you can see in the chart below. The chart shows the FTSE’s performance over the past year next to the S&P 500’s performance, and as you can see, the S&P 500 has had a smoother ride compared to the FTSE 100.

One reason for volatility in the FTSE 100 has been its sensitivity to the energy sector, which makes up nearly 15% of the entire index. Tullow may be the smallest of the five energy companies listed on the FTSE 100, however the 60% drop in its share price since May 2014 has undoubtedly weighed on the sector, and thus the index.

Even without Tullow, the energy sector will still have a sizeable weighting in the FTSE 100, however, the fact that Tullow is being replaced by a pharma company is worth noting as pharma is considered less volatile than the energy sector.

Could the FTSE 100 become less volatile?

Currently, healthcare makes up less than 10% of the FTSE 100. Hikma Pharmaceuticals has a market cap of GBP 4.9bn, which will make it roughly 0.1% of the FTSE 100. Although larger than Tullow’s GBP 3.3 bn market cap, Hikma will still be fairly small for the pharma sector, for example Astra Zeneca has a market cap worth GBP 56 bn. Thus, this change is unlikely to boost the FTSE 100’s stability overnight. Instead, it could mark a structural shift that could impact the FTSE in the coming quarters. As energy companies come under more scrutiny from regulators and a volatile oil price, their weighting in the FTSE could come under pressure. In contrast, sectors with more stable earning streams, like healthcare, could benefit.

Worth watching elsewhere:

In the FTSE 250, Game Digital, Oxford Instruments and Arfen are expected to be relegated. While Virgin Money, AA and B&M European Value Retail are expected to join the FTSE 250 mid-cap index.

Conclusion:

This week sees quarterly changes to the FTSE indices.

Tullow Oil is expected to be relegated from the FTSE 100, replaced by Hikma Pharmaceuticals.

The sharp oil price decline is finally starting to bite the FTSE 100’s large energy sector.

Hikma Pharmaceuticals’ weighting in the index is expected to be very small, approx. 0.1%.

However, if the oil price continues to remain volatile then we could see the energy sector’s weighting in the FTSE 100 come under pressure in the coming months, while more stable sectors like healthcare could see their weighting in the index rise.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold stays in consolidation above $2,300

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.