![]()

It’s been a busy morning for US dollar traders, with an onslaught of data releases all hitting at 8:30 ET. In probably the most important report, the Consumer Price Index (CPI) fell by -0.7%, more than the 0.6% that traders and economists had been expecting. However, the Core CPI figure, which filters out volatile energy and food prices, actually came in above expectations at 0.2%. Given the Federal Reserve’s repeated comments that the fall in oil prices should only have a temporary impact on inflation, the stronger-than-expected Core CPI figure is more relevant for traders and a marginal positive for the US dollar.

Today’s other US economic reports were similarly mixed: the always-volatile Durable Goods Orders report beat expectations, but Core Durable Goods Orders missed, and Initial Unemployment Claims also edged up to a 6-week high of 313k. After throwing all this data in a blender and setting it to puree, traders have come to the conclusion that this morning’s reports represent a small positive for the world’s reserve currency, and the dollar index is now edging up back up to the mid-94.00s.

Technical View

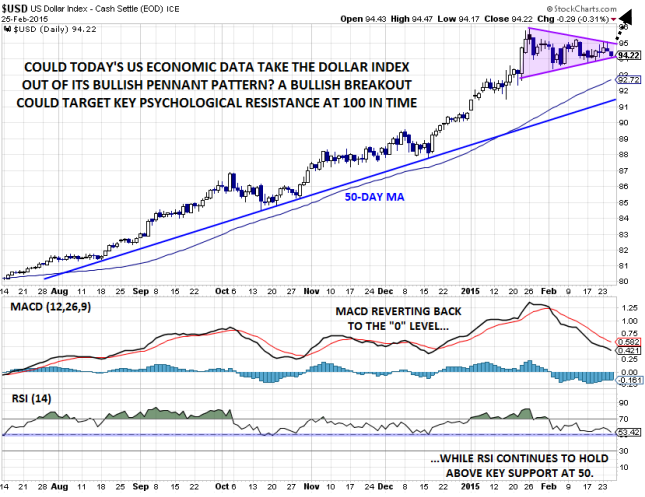

On a technical basis, the US dollar remains firmly within its recent consolidation pattern. Over the last month, the dollar index has formed a clear bullish pennant formation at the top of its uptrend, and the classic interpretation is that this pattern shows a brief pause in the trend before an eventual continuation higher. As always though, it’s important to wait for price to confirm the pattern and break out before trading too aggressively to the long side. Meanwhile, the secondary indicators are also painting a mixed picture. The MACD continues to revert back to the 0 level, showing waning bullish momentum, while the RSI has pulled back from overbought territory but is still holding above the 50 level that has provided support throughout the entire uptrend.

At this point, it’s difficult to say whether today’s US economic data will be enough to break the dollar out of its sideways range. If the index can break the 2-week high at 95.00, then bulls may cautiously start to dip their toes in to buy the dollar, but it will take a conclusive break above 96.00 to reinvigorate the uptrend for a possible move up to key psychological resistance at 100 next. Conversely, a break below 93.50 support could signal at a medium-term top in the index for a possible pullback toward the 50-day MA in the mid-92.00s, but based on the current fundamental and technical situation, we view that as a lower probability outcome.

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price treads water near $2,320, awaits US GDP data

Gold price recovers losses but keeps its range near $2,320 early Thursday. Renewed weakness in the US Dollar and the US Treasury yields allow Gold buyers to breathe a sigh of relief. Gold price stays vulnerable amid Middle East de-escalation, awaiting US Q1 GDP data.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.