![]()

Background:

Traders often refer the impact of ‘month end flows’ on different currency pairs during the last few days of the month. In essence, these money ‘flows’ are caused by global fund managers and investors rebalancing their currency exposure based on market movements over the last month. For example, if the value of one country’s equity and bond markets increases, these fund managers typically look to sell or hedge their now-elevated exposure to that country’s currency and rebalance their risk back to an underperforming country’s currency. More severe the monthly changes in a country’s asset valuations lead to larger portfolio adjustments between different currencies.

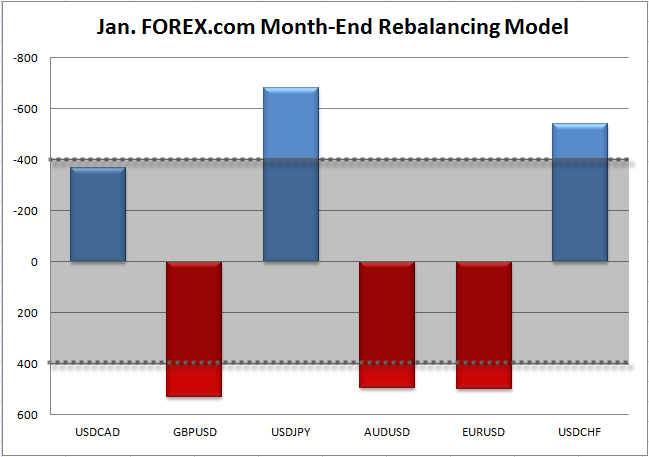

In order to predict these flows and how they impact FX traders, we’ve developed a model that compares monthly changes in total asset market capitalization in various countries. In our model, a relative shift of $400B between countries over the course of a month is seen as the threshold for a meaningful move, whereas monthly changes of less than $400B are often overwhelmed by other fundamental or technical factors. As a final note, the largest impact from month-end flows is typically seen heading into the 11am ET fix (often in the hour from 10 & 11am ET) as portfolio managers scramble to hedge their overall portfolio ahead of the European market close.

2015 kicked off with a bang as global central banks eased across the board. In addition to the ECB’s landmark decision to embark on a massive QE program, central banks in Canada, Switzerland, Denmark (three times!), Singapore, Turkey, India, Peru all cut interest rates. This surge of global liquidity had mixed effects: stocks in Europe surged (hitting new all-time highs in some cases), as did global bonds and gold, while US stocks struggled and oil extended its downtrend to a new 6-year low at $44.00.

In aggregate, the inflows into European stocks and bonds dwarfed those of the US this month, leaving traders underexposed the US dollar. As a result, our model is showing a strong bullish-USD signal in five of the six currency pairs we track; the lone exception is USDCAD, which just missed the $400B threshold. Traders should also note that tomorrow morning’s US Q4 GDP release comes near the peak month-end rebalancing time window, suggesting that we could see a particularly strong bullish reaction if GDP beats the 3.0% expected reading.

Source: FOREX.com

General Risk Warning for stocks, cryptocurrencies, ETP, FX & CFD Trading. Investment assets are leveraged products. Trading related to foreign exchange, commodities, financial indices, stocks, ETP, cryptocurrencies, and other underlying variables carry a high level of risk and can result in the loss of all of your investment. As such, variable investments may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall Witbrew LLC and associates have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to investment trading or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold drops below $2,320 as US yields shoot higher

Gold lost its traction and turned negative on the day below $2,320 in the American session on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, weighing on XAU/USD.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.