![]()

One central bank ends QE, another increases it. This is not a trick but a treat for the markets. The global equity markets have surged higher after the Bank of Japan surprised the markets overnight by expanding its monetary easing programme to about 80 trillion yen a year, up from Y60tn-Y70tn previously. The BoJ will achieve this mainly by increasing its purchases of longer-term Japanese government bonds. The central bank is clearly worried about the impact of the April sales tax hike, the recent fall back in inflation and lower global oil prices. Indeed, the BoJ governor Haruhiko Kuroda himself thinks that the economy is at “a critical moment,” pointing out “there was a risk that despite having made steady progress, we could face a delay in eradicating the public’s deflation mindset.” That’s why they increased QE.

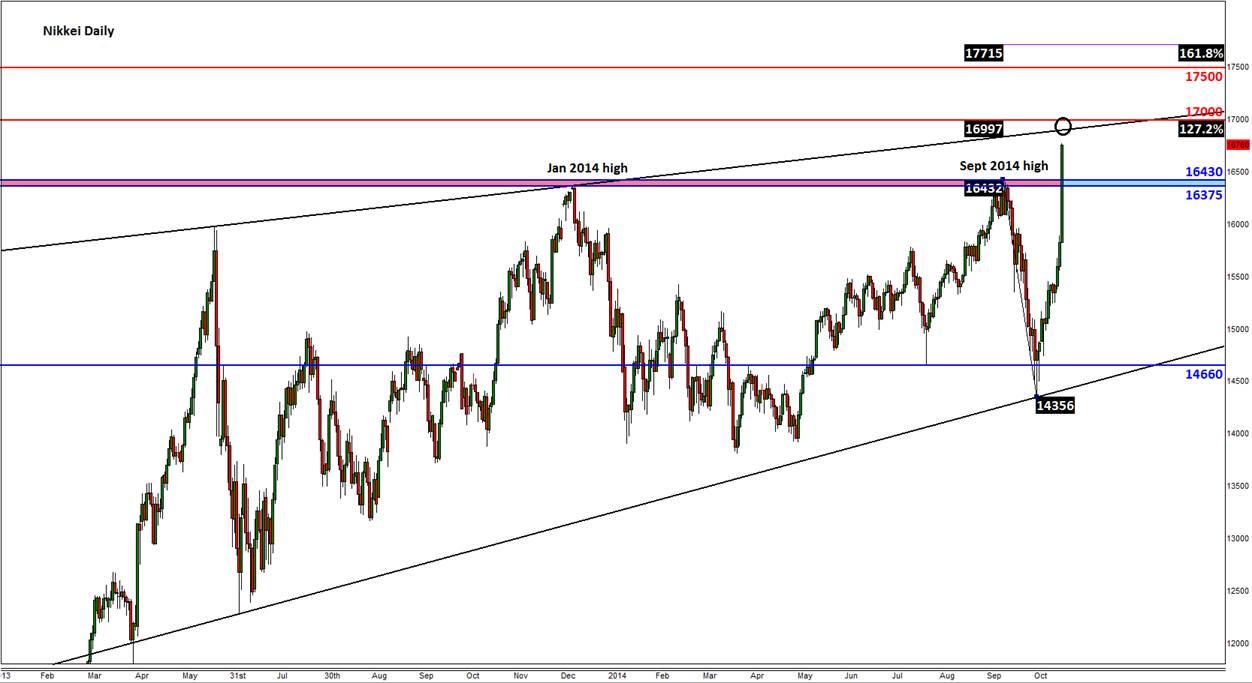

At the close of play on Friday, the Nikkei had already increased 4.8% to 16413. But in the index future has since gained further and at the time of writing it is hovering around 16760, representing a gain in excess of 2% from the official close. If the index future settles around the current levels, or better still, increase further during the New York session, then Monday could be another cheerful day for Japanese stocks.

The last time I covered the Nikkei index was at the end of September, when the index had just reached the previous 2014 high around 16375 but was struggling to hold above it. That led me to believe that a correction was imminent, which as it turned out was in fact the case. But like all the other major indices, the Nikkei has since bounced back very strongly and today it has decisively taken out the area around the previous 2014 highs, namely 16375 to 16430. This area is thus likely to turn into support if and when the index falls back. A potential break below this area would be very bearish. But the path of least resistance is clearly to the upside now, so let’s concentrate on finding potential resistance levels. The first such area is not too far off now: 16900-17000. This is where a resistance trend line meets the 127.2% Fibonacci extension level of the last correction. Not only is that, 17000 also a psychological level. Beyond there, 17500 could be the next target followed by the 161.8% Fibonacci extension at 17715.

Trading leveraged products such as FX, CFDs and Spread Bets carry a high level of risk which means you could lose your capital and is therefore not suitable for all investors. All of this website’s contents and information provided by Fawad Razaqzada elsewhere, such as on telegram and other social channels, including news, opinions, market analyses, trade ideas, trade signals or other information are solely provided as general market commentary and do not constitute a recommendation or investment advice. Please ensure you fully understand the risks involved by reading our disclaimer, terms and policies.

Recommended Content

Editors’ Picks

EUR/USD fluctuates in daily range above 1.0600

EUR/USD struggles to gather directional momentum and continues to fluctuate above 1.0600 on Tuesday. The modest improvement seen in risk mood limits the US Dollar's gains as investors await Fed Chairman Jerome Powell's speech.

GBP/USD stabilizes near 1.2450 ahead of Powell speech

GBP/USD holds steady at around 1.2450 after recovering from the multi-month low it touched near 1.2400 in the European morning. The USD struggles to gather strength after disappointing housing data. Market focus shifts to Fed Chairman Powell's appearance.

Gold retreats to $2,370 as US yields push higher

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

XRP struggles below $0.50 resistance as SEC vs. Ripple lawsuit likely to enter final pretrial conference

XRP is struggling with resistance at $0.50 as Ripple and the US Securities and Exchange Commission (SEC) are gearing up for the final pretrial conference on Tuesday at a New York court.

US outperformance continues

The economic divergence between the US and the rest of the world has become increasingly pronounced. The latest US inflation prints highlight that underlying inflation pressures seemingly remain stickier than in most other parts of the world.