![]()

Market sentiment is back at the end of the week, stocks in Europe are higher, oil prices are rising and even Greek bond yields are falling. Central bankers from the US and UK have saved the day, but will volatility recede from here?

Although Fed Governor Yellen did not mention Fed policy or the economic outlook during her speech on Friday, it seems she left the talking to other members of the Fed, Thursday’s comments from Bullard, a member of the Federal Reserve and a noted dove, said that inflation was a “little off target” and the Fed should consider delaying the end of QE at this month’s meeting. While Bullard is a non-voter on this year’s Federal Reserve Board, and he won’t actually have a say in monetary policy changes until 2016, we still think that his thoughts reflect a majority of views at the Fed.

Staying the Fed’s hand

We mentioned recently, that there was a subtle shift in the rhetoric coming from the Federal Reserve recently, from employment growth to weak inflation. Prices are king for the Fed these days, and if prices continue to fall then we could see the Fed delaying the end of QE3, or even extending the programme through to the end of the year. The Fed’s Rosengren, another noted dove, told CNBC this afternoon that he does not want to see the inflation rate going down. However, unless we see a prolonged recovery in the oil price, global disinflation pressure could continue to weigh on US prices, which could stay the Fed’s hand.

BOE follows Fed’s lead

The prospect of central bank support, in particular Fed support, has boosted the markets. However, other central bankers have joined in the Fed’s chorus. The Bank of England’s chief economist has joined in the fray, and said that interest rates could stay lower for longer in a “gloomier economy”. He also mentioned the low inflation pressure in the UK as a cause for concern for the BOE, and said that the BOE could be on the “back foot” (a cricket analogy), when it comes to raising interest rates, due to the weakening economic data.

The Bundesbank bucks the dovish trend

The ECB is the one exception to the rule. Even though some of this week’s volatility was caused by rising sovereign fears (Greek bond yields surged to nearly 9% on Thursday, they have since fallen on Friday), the ECB is not singing from the same dovish hymn sheet. The head of Germany’s Bundesbank, Jens Weidmann, has said that deflation risks to the Eurozone are low, and he also voiced his concern about ABS asset purchases (the ECB’s version of QE-lite), saying that it is a move towards a “QE philosophy”, and he didn’t mean it as a complement. Weidmann is also not in favour of giving Germany any more stimuli, saying that it could backfire, even though the currency bloc’s largest economy is showing signs that growth contracted last quarter. His comments were reflected by ECB member Nowotny, who also dismissed inflation fears, saying that low inflation due to oil is actually positive.

The comments from Weidmann and Nowotny are in contrast to other ECB members, including Coeure, who said that the ECB is committed to taking additional measures if necessary. A split at the ECB, with the powerful Northern bloc sounding hawkish, and other members sounding dovish, could cause trouble if we see further sovereign fears.

One to watch: EURUSD

While the Fed is in focus this is helping markets to stage a recovery. However, if Eurozone sovereign fears rise once more, loggerheads at the ECB could hurt market sentiment, and European assets in particular, which is why we expect EUR to trade back towards 1.25 in the coming days. Although EURUSD has bounced in the last 5 days, the retracement of the May – October down-move has been shallow so far, suggesting that the bears are in control and this recent pullback will be temporary only.

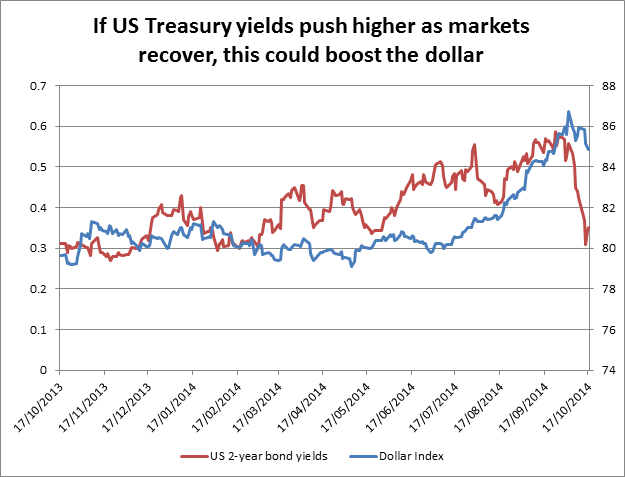

A dovish Fed could be dollar positive…

This may sound odd, but if Fed members stick to their dovish mantras then it could benefit the US dollar. If volatility continues to recede US Treasury yields may move higher, as the markets breathe a sigh of relief, which may also be dollar positive. If this plays out, then it could boost our view that the EUR could come under pressure in the coming days.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.