![]()

Risk is off the menu today with stocks plunging and the safe haven yen and gold rising. It is not clear what exactly has caused this latest rise in risk aversion. After all, the conflicts in the Middle East had been on-going but ignored by the financial markets for months now and so the bombing of Syria by the US and its Arab allies is unlikely to be the sole reason boosting demand for safe haven assets. For stocks, there have been numerous individual company or sector news that has helped to add to the selling pressure. In London, for example, Barclays, Tesco, Tate and Lyle have all suffered in this regard, while drug makers are down after the US government's tax inversions plans that were announced last night have made them appear less attractive takeover targets. Meanwhile the dollar is also weaker following recent gains. It looks like it is the lack of any major US data today and also yesterday’s release of disappointing existing homes sales data that are both helping to encourage some profit-taking.

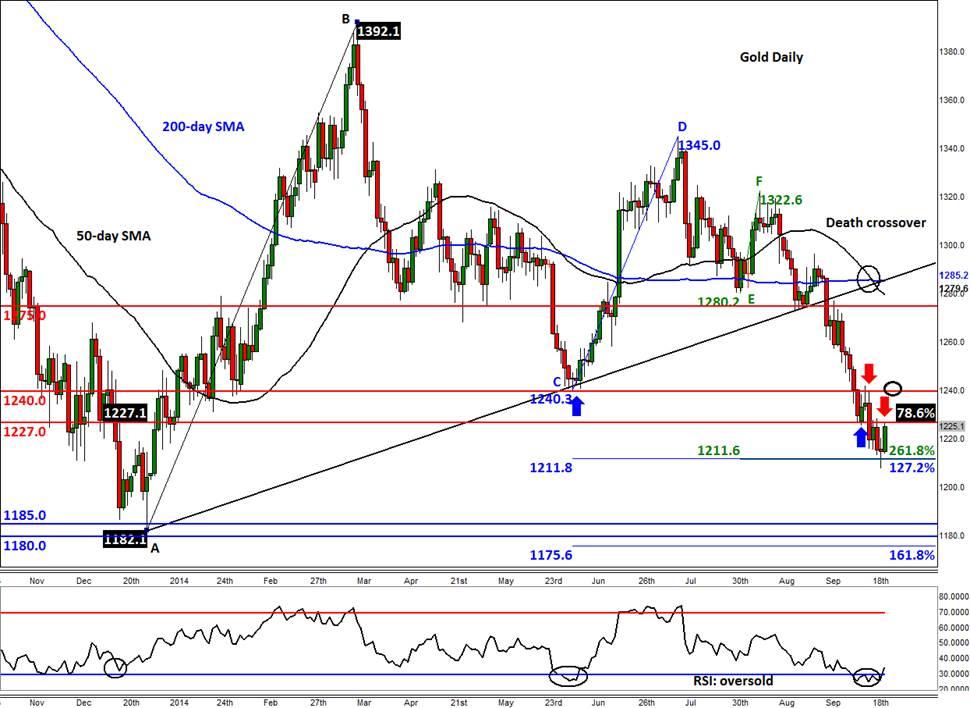

So, with stocks and dollar both lower today it has been a perfect opportunity for the gold bears to book profit and the bulls to take advantage of the weaker prices to establish some long positions. The yellow metal has bounced off the $1210/12 Fibonacci-based support area and is now testing the next hurdle around $1227, which is a support-turned-resistance level. If the bulls manage to push price beyond this area then that could pave the way for a potential move towards $1240 in the short-term (area circled on the chart). The $1240 mark is a more profound level of resistance and so a potential break above it could give rise to follow-up technical buying. Meanwhile the RSI has started to climb above the oversold threshold of 30, suggesting the momentum is shifting into the bulls’ favour. However, for as long at the RSI is below the key 60 level, this would indicate that gold is in an overall downward trend. Indeed, the metal has been making lower lows and lower highs recently, and so this latest bounce could just be a correction. Nevertheless, the technics appear more constructive today and we could see some healthy gains in the very near-term. Silver meanwhile has also bounced back from a key Fibonacci support level, as we pointed out yesterday.

Trading leveraged products such as FX, CFDs and Spread Bets carry a high level of risk which means you could lose your capital and is therefore not suitable for all investors. All of this website’s contents and information provided by Fawad Razaqzada elsewhere, such as on telegram and other social channels, including news, opinions, market analyses, trade ideas, trade signals or other information are solely provided as general market commentary and do not constitute a recommendation or investment advice. Please ensure you fully understand the risks involved by reading our disclaimer, terms and policies.

Recommended Content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Runes likely to have massive support after BRC-20 and Ordinals frenzy

With all eyes peeled on the halving, Bitcoin is the center of attention in the market. The pioneer cryptocurrency has had three narratives this year already, starting with the spot BTC exchange-traded funds, the recent all-time high of $73,777, and now the halving.

Billowing clouds of apprehension

Thursday marked the fifth consecutive session of decline for US stocks as optimism regarding multiple interest rate cuts by the Federal Reserve waned. The downturn in sentiment can be attributed to robust economic data releases, prompting traders to adjust their expectations for multiple rate cuts this year.