![]()

It’s been another quiet start to the trading week, with by far the most interesting move developing in the AUDUSD. Just two weeks ago, we highlighted the big Head-and-Shoulders pattern on the pair, concluding that, “…bears may eventually look to target the 61.8% retracement of the H1 rally at .8980 or the measured move target projection of the H&S pattern at .8950†as a result of the pattern (see “AUDUSD on the Verge of a Major Breakdown – Could .8950 Be Next?†for more). Since that post, the pair has collapsed over 300 pips, reaching both of the targets outlined two weeks ago, but the current fundamental and technical developments suggest the pair could see more downside before finding a floor.

From a fundamental perspective, AUDUSD bulls have been hit from both sides. The US dollar has continued to rally, with the widely-followed USD index now closing higher for 10(!) consecutive weeks, its longest streak since President Richard Nixon officially put an end to the gold standard all the way back in 1973. The latest bullish catalyst for the greenback was this weekend’s decision by ratings agency Fitch to reaffirm the United States’ creditworthiness at AAA, its top rating.

Meanwhile, the Australian dollar has been beaten down by its own idiosyncratic developments. The export-dependent currency has been particularly hard hit by the recent decline in commodity prices; the popular Reuters/Jefferies CRB index of commodities has fallen nearly 10% from its June high, hurting Australia’s terms of trade. More immediately, traders are also growing uneasy about tonight’s Chinese HSBC Manufacturing reading, which may fall back below the 50 boom-bust level for the first time since May.

Technical View: AUDUSD

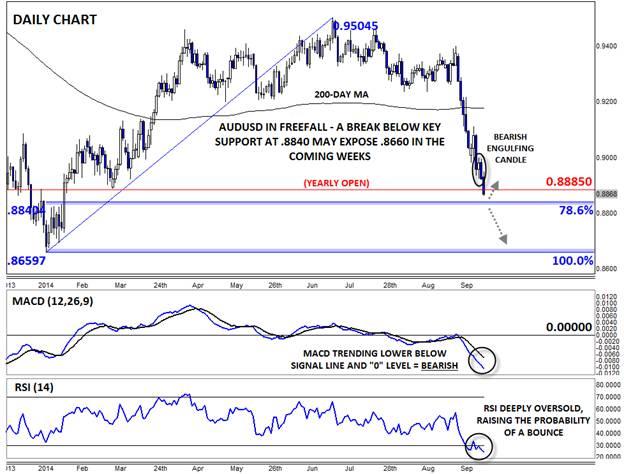

Unfortunately, the chart is not offering any solace to AUDUSD bulls either. The pair put in a clear Bearish Engulfing Candle* on Friday, suggesting that the sellers eager to sell on any short-term bounces. From a wider perspective, rates just dropped below the 2014 open at .8885 a few hours ago, meaning that the Aussie is now trading down against the greenback in 2014.

The secondary indicators are suggesting about you’d expect after such a large drop: the MACD shows strongly bearish momentum, though the RSI is deeply oversold. As a reminder, oversold RSI readings are not necessarily an immediate signal for a bounce; it is generally considered prudent for traders to wait for a bullish candlestick pattern or strong level of support before picking a bottom.

Moving forward, the sellers clearly remain in control of AUDUSD. The next level of support to watch for a possible bounce is the 78.6% Fibonacci retracement at .8840, but if that floor is broken, the Aussie could drop all the way to the yearly low at .8660 before buyers emerge.

*A Bearish Engulfing candle is formed when the candle breaks above the high of the previous time period before sellers step in and push rates down to close below the low of the previous time period. It indicates that the sellers have wrested control of the market from the buyers.

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price treads water near $2,320, awaits US GDP data

Gold price recovers losses but keeps its range near $2,320 early Thursday. Renewed weakness in the US Dollar and the US Treasury yields allow Gold buyers to breathe a sigh of relief. Gold price stays vulnerable amid Middle East de-escalation, awaiting US Q1 GDP data.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.