![]()

Yesterday we looked at gold and pointed to the fact that it hasn’t found much safe haven demand despite all the on-going geopolitical risks. What’s more, the strengthening of the US dollar and the resilience of the stock market has further discouraged demand for yellow metal. But gold is not the only metal struggling. Silver, platinum and copper have all come under pressure too. Other commodities such as crude oil have also failed to respond positively to the deteriorating geopolitical tensions, with both Brent and WTI contracts falling viciously since the start of the summer. However there has been at least one commodity that has bucked this trend: palladium (until today).

Palladium has been rising strongly of late and yesterday touched a fresh 13-and-a-half year high when it climbed to above $910 per troy ounce. It has been boosted, above all, by concerns over potential supply disruptions from Russia, the world’s biggest producer of platinum, due to the country’s involvement in the crisis in Ukraine. If Russia’s palladium exports were to be restricted then it would exacerbate the already large palladium deficit. However we don’t think this would be the case. As palladium is mainly used for catalytic converters in automobiles, any restrictions of the metal could increase the cost for Europe’s carmakers. Clearly this would not be in anyone’s interest. Therefore, I think palladium may be overpriced and overbought.

In fact palladium could not defend itself from the pressure excreted by the rallying US dollar today: it has dropped by more than $25 or 2.8% to $880 from its opening price of $908. It has underperformed all of the commodities mentioned above, as well as stocks and most FX pairs. So, why has it performed this badly? We think it may be because of the one-way speculation that has been on-going for weeks now, and today’s sell-off is probably caused by speculators closing some of those long positions.

Bets from hedge funds and other financial speculators on rallying palladium prices have been increasing for weeks now. In the week to 26 August, net long positions had climbed by a further 560 to 24,600 contracts – just below the record level achieved in April 2013. If the situation in Ukraine improves now, or otherwise speculators continue to book profit on their longs, then we could see a crude-style sell-off in palladium prices over the coming days and weeks.

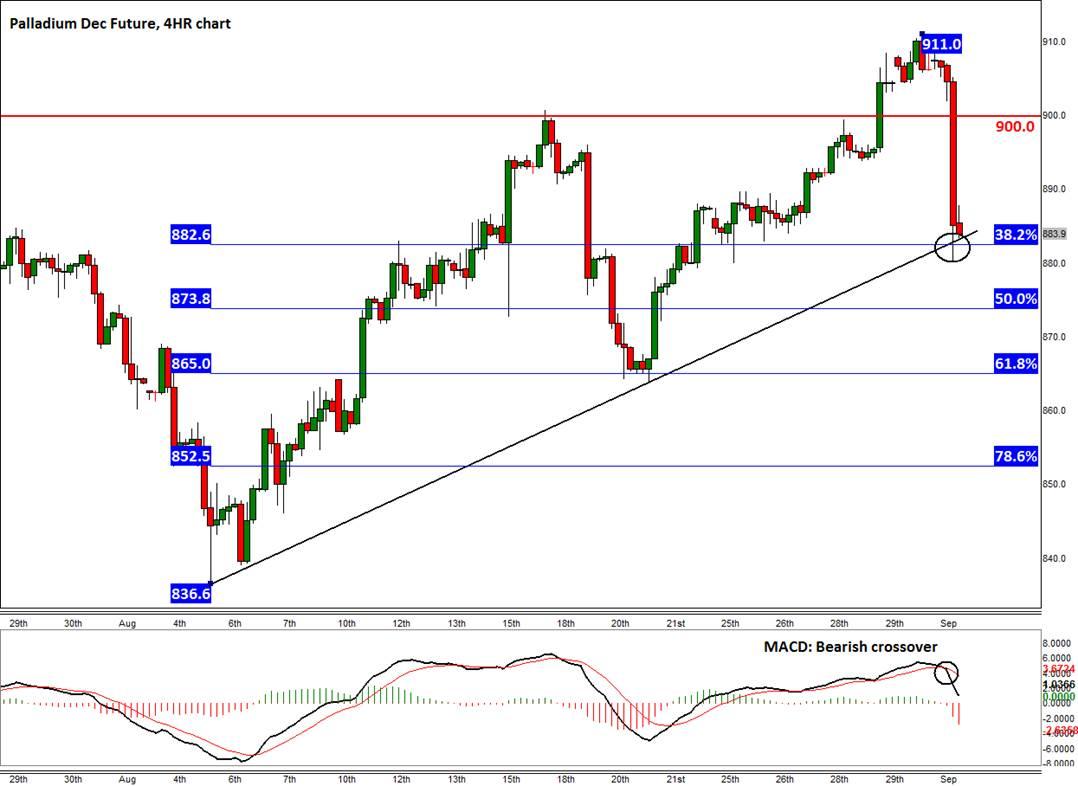

As the 4-hour chart of the December contract shows, the metal is currently trying to break below the $882 support level. This level ties in with a bullish trend line and also the 38.2% Fibonacci retracement level of the up move from the August low. If it breaks below here then the 61.8% Fibonacci retracement level at $865 could be the next stop. Further downside targets are $852 (78.6%), $836 and $800. A potential break below $800 could even reverse the long-term trend. On the upside, the next level of resistance is at $900, followed by $910 and then the December 2000 peak of $959.

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price treads water near $2,320, awaits US GDP data

Gold price recovers losses but keeps its range near $2,320 early Thursday. Renewed weakness in the US Dollar and the US Treasury yields allow Gold buyers to breathe a sigh of relief. Gold price stays vulnerable amid Middle East de-escalation, awaiting US Q1 GDP data.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.

_20140902162600.png)