![]()

The global oil and equity markets are continuing to shrug off geopolitical risks stemming from the Middle East and Ukraine. Fears over the economic impact of sanctions imposed on Russia for its involvement in the crisis in Eastern Ukraine have so far been largely confined to domestic markets with Russian equities and the Ruble both tumbling. Despite the announcement of fresh EU sanctions today that target the country’s oil sector, defence equipment, technology and some banks, Brent crude is trading lower. Indeed, financial speculators are continuing to flee the oil market: in the week to 22 July, net long positions in Brent were trimmed for the third straight week by a further 35,100 to 128,600 contracts. As a result, net longs have been cut in half since hitting a record high just a month ago. But with the geopolitical tensions still elevated and further troubles hitting Libya and Gaza, among other places, the market may now be underestimating the supply-side risks – the same way it was overstating it when the situation Iraq, for example, first unfolded. Thus the risk is that we may some sort of a short squeeze in the price of Brent from these oversold levels.

In the US, investors will look to crude inventories data over the next couple of days for clues on the supply of the black stuff. The American Petroleum Institute (API), an industry group, will publish its usual weekly report tonight while the more closely-followed official stockpiles data from the US Department of Energy’s Energy Information Administration (EIA) will be released tomorrow. As well as the changes in overall oil stock levels and those at Cushing, the focus will also be on refinery utilization rate after crude processing reached a record level this month. The higher crude runs caused oil inventories to fall particularly sharply over the past couple of reporting weeks. But for this time, the market anticipates only a marginal fall in EIA crude stocks, namely of 0.5 million barrels. This is probably because of the fact oil processing has neared its seasonal peak and as gasoline stocks are in the upper half of the average for this time of the year. If confirmed, the price of WTI could head further lower in the near-term. But given that it is nonfarm payrolls week, crude stockpiles data may not be the only thing that oil traders will be watching. As well as these, we will have several other important data releases this week too which include the US GDP on Wednesday and China’s manufacturing PMI on Friday. So, there’s plenty to look forward to over the coming days.

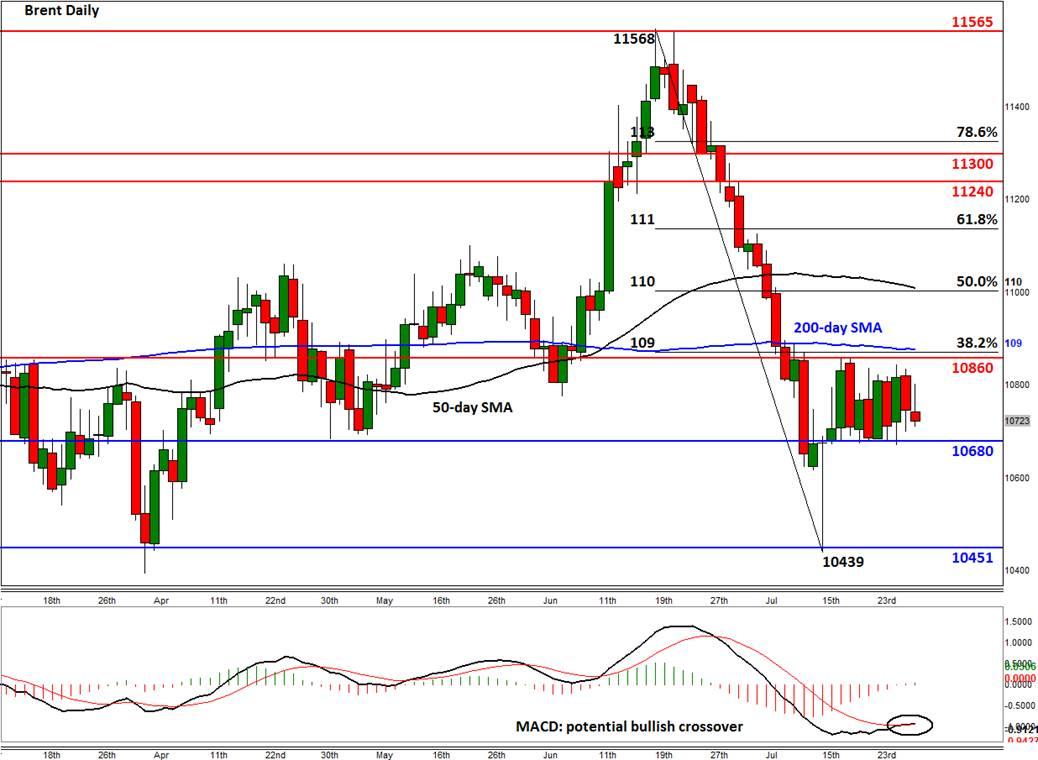

Thus there’s increased chance oil prices will break out of their consolidative ranges this week, for Brent has been stuck inside a tight $2 dollar range for several days now. The key support to watch is around $106.80 – if this breaks then we could easily see another run towards this month’s low of around $104.50. Resistance comes in between $108.60 and $108.90. The upper end of this range ties in with 200-day SMA and also the 38.2% Fibonacci retracement level of the down move from the June peak. Thus, a break above that area could lead to some sharp gains as it would also force many of the existing sellers to exit their trades. WTI on the other hand has already started to move lower after it broke support at $101.50. This has potentially paved the way for a drop towards the $99.70 area where the convergence of the 200-day average with a bullish trend is likely to lead to at least a short-term bounce. On the upside, the key level to watch is around $103.80/90 which corresponds with old resistance and the 50-day SMA. Ahead of that, resistance is seen around $101.50 and the $103.00.

Figure 1:

Source: FOREX.com. Please note this product is not available to US clients.

Figure 2:

Source: FOREX.com. Please note this product is not available to US clients.

General Risk Warning for stocks, cryptocurrencies, ETP, FX & CFD Trading. Investment assets are leveraged products. Trading related to foreign exchange, commodities, financial indices, stocks, ETP, cryptocurrencies, and other underlying variables carry a high level of risk and can result in the loss of all of your investment. As such, variable investments may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall Witbrew LLC and associates have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to investment trading or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold rebounds to $2,320 as US yields turn south

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.