![]()

Following a sluggish start, the FTSE has turned higher along with the other European markets. Sentiment has been boosted, above all, by the surprisingly good economic data from China and Europe and as corporate earnings from the US continues to surprise to the upside with Facebook posting strong quarterly numbers overnight. Compared to some of the other European indices, the FTSE’s gains have been somewhat mild however. Not only is this because of the direct impact of better eurozone data on European shares, but also due to the fact we had a disappointing retail sales number out of the UK. Nevertheless, it is a bullish day for stocks and it could get even better if data and company earnings from the US also top expectations.

Overnight, HSBC’s manufacturing Purchasing Managers Index (PMI) for China came out ahead of the estimates. It printed 52.0 versus 51.2 expected, and was up from 50.7 in June. A PMI reading above 50 indicates growth and this is the second month that it has remained above that threshold, which bodes well for the world’s second largest economy. While Japan’s PMI was weaker, this was completely overshadowed this morning by European numbers. The eurozone composite PMI climbed to a three-month high of 54.0 in July from 52.8 the month before. This was driven by the services sector, whose PMI rose to 54.4, its highest level for more than three years, from 52.8 in June. The economic power house of the eurozone, Germany, didn’t disappoint. Both of its PMIs climbed higher, with the services sector to 56.6 and manufacturing to 52.9. Likewise, the French services PMI was stronger as it jumped to 50.4 from 48.2 previously, but unfortunately its manufacturing sector PMI fell to 47.6, its lowest level since December. In Spain, the labour market showed signs of recovery at long last as it posted its first annual increase in jobs in six years. On top of this, the unemployment numbers recorded their biggest fall since 2006, causing the jobless rate to fall to 24.5% in the first quarter from 25.9% the previous. In the UK consumer spending is moderating somewhat. Although the underlying trend remains strong with sales volumes up 3.6% year-over-year, the month-over-month growth of 0.1% in June was not strong enough to make back the 0.5% decline from the previous month. Still, expectations were for a meagre 0.2% growth, so this was by no means a massive disappointment.

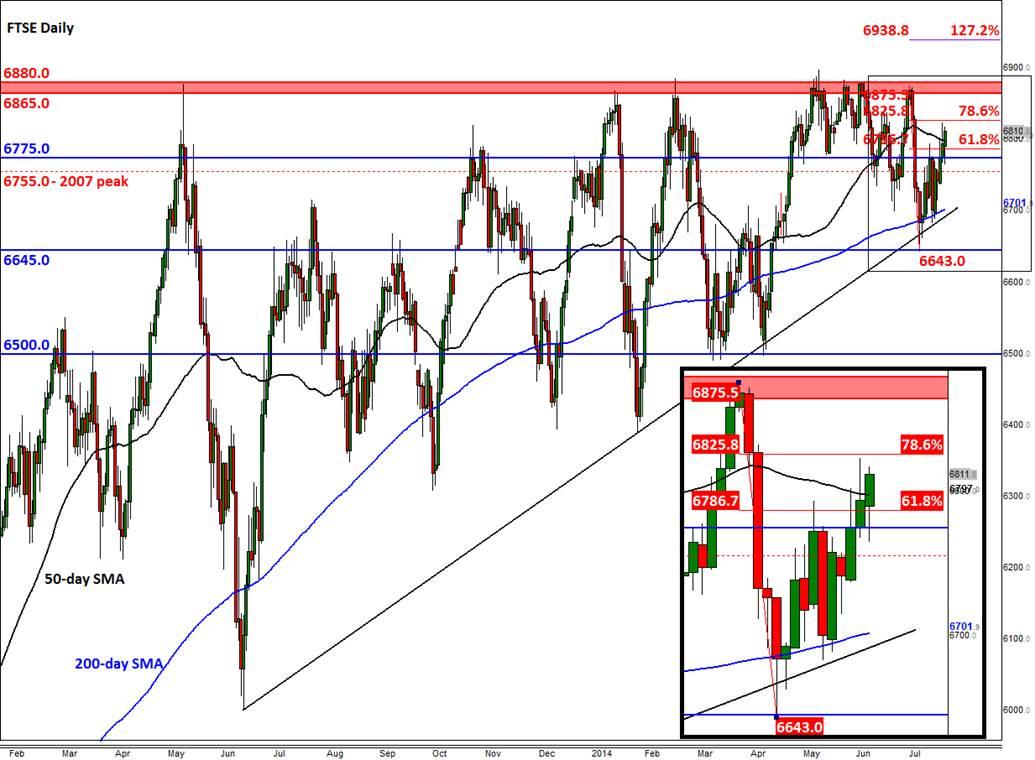

The FTSE’s technicals still point higher in the near-term following the sellers’ inability to hold it below the 200 day moving average (6700) following the recent sell-off. But for as long as it remains below the 6880 mark on a daily closing basis, the index is still in a longer term consolidation phase. The bulls can take heart from fact that the downward pressure has been progressively weaker in recent months. This suggests that an eventual breakout still looks likely which could lead to some significant gains. However a decisive break below 6700 would invalidate this potentially bullish scenario, for this would also break a long-term bullish trend line which as we had expected held firm earlier in the month.

Trading leveraged products such as FX, CFDs and Spread Bets carry a high level of risk which means you could lose your capital and is therefore not suitable for all investors. All of this website’s contents and information provided by Fawad Razaqzada elsewhere, such as on telegram and other social channels, including news, opinions, market analyses, trade ideas, trade signals or other information are solely provided as general market commentary and do not constitute a recommendation or investment advice. Please ensure you fully understand the risks involved by reading our disclaimer, terms and policies.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.