![]()

The dollar is one of the least loved currencies so far this year. It has only managed to make gains against two of its G10 peers, the CAD and the SEK, even though some were calling for a bull run in 2014.Frustration with the dollar’s seemingly inability to rally could also be simmering at the ECB. While some have said that China and Russia’s commitment to end currency intervention in the coming years means that currency wars are coming to an end, the mother of all battles could be about to start.

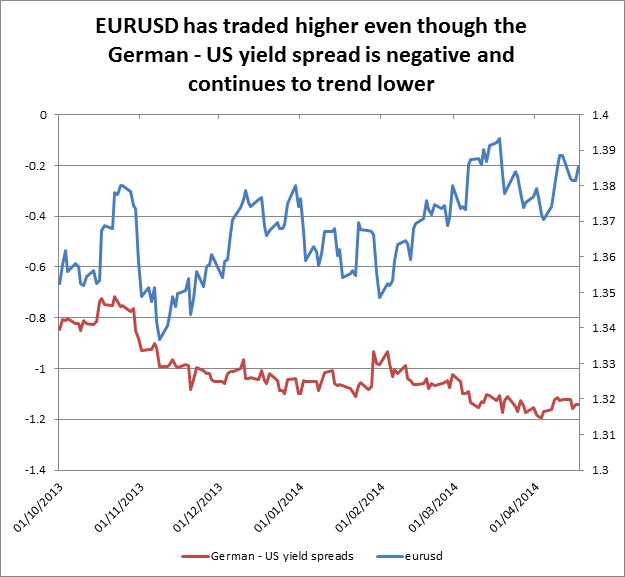

For the past month we have seen an escalation in rhetoric from ECB members who have sounded concerned about the strength of the EUR and the impact this is having on inflation in the currency bloc, which is currently a mere 0.5%. When EURUSD hit 1.3967 on 13th March ECB members including Mario Draghi spoke out against EUR strength. Although the ECB President said that the currency was not a policy tool, he did say that it could threaten price stability in the currency bloc, which could justify further policy measures.

On the other side of the Atlantic, the new Fed Governor Janet Yellen is doing nothing to help the ECB’s cause. Prices have been rising in the US and core inflation is now at 1.7%, the highest level of the year so far. However, in a speech in New York on Wednesday Janet Yellen said this wasn’t enough. She is concerned that the labour market will not be strong enough to boost prices above the Fed’s preferred level of 2%, which supports an accommodative stance of monetary policy for the long-term.

The ECB’s perspective:

A weaker EUR is fairly difficult for the ECB to manipulate. Apart from rhetoric from its members, implementing currency-negative policies such as QE or negative interest rates are fraught with difficulties for a 17 nation currency bloc. For example, QE is technically easy to implement but could be politically fractious. Meanwhile, negative deposit rates could hurt Europe’s fragile banking system as it embarks on the long road to recovery.

The dollar has declined nearly 6% on a broad-based basis since peaking in July last year, even though the Fed has started tapering its QE programme.

If the Federal Reserve could address the prospect of life after tapering (i.e., rate hikes) more directly then this could trigger a dollar rally, and a (much-needed) EUR decline, which could ease the pressure on the ECB to take more radical policy steps.

The Fed’s perspective

Although Yellen noted that the recent economic weakness could be weather related, the March data that has been released so far has been fairly mediocre and doesn’t suggest that the US economy is springing back to life.

The Fed governor said that the economy needs “extraordinary support for some time,” due to a weak jobs market and low inflation.

Yellen and co. at the Fed need to do what is best for the US economy, not what is best for the ECB, although Yellen did say that the Fed was mindful of the consequences of withdrawing its support on the global financial markets.

Traditionally we have associated currency wars with the Emerging world, however in this instance the Eurozone is at odds with emerging markets. The former are concerned that a fast withdrawal of US monetary stimulus could lead to capital outflows and currency weakness, while the latter may prefer if the Fed started to sound a bit more optimistic, which could trigger some USD strength.

The stealth currency war

Overall, an ECB vs. Fed currency war, if it happens, is likely to be cloak and dagger affair. From a diplomatic perspective the two largest central banks in the world can’t be seen to be at each-others’ throats, so don’t expect any explicit Fed bashing from the ECB.

The Fed could spur the ECB to action

However, if EURUSD continues to hover around 1.40 and the Fed sticks to its current message then the ECB may have to unleash the big guns in the form of negative deposit rates, or QE, to weaken the EUR once and for all. Ultimately, it could be the Fed, rather than weak inflation, that may force the ECB to embark on radical policy measures in the near term.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.