![]()

The bond market seems to be pricing in the prospect of QE from the European Central Bank in the coming months after a weaker than expected reading of German CPI. Spanish and Italian yields have fallen today, while German and French bond yields fell to record lows earlier. But, the EUR and Greek bond yields are bucking the trend.

Greek concerns are brewing

While other Eurozone members states are seeing their yields fall, Greek yields are at their highest levels for a month and are getting close to 8.5%. Concerns about an early election next February, could propel the anti-austerity SYRIZA party to power (they are about as controversial as UKIP here in the UK, except they actually stand a chance of winning the election). If SYRIZA gain power then we could see Greece exit the Eurozone if they don’t agree to the terms of the bailout. Greece also suffered a set-back in trying to exit its bailout problem, with talks breaking down between Athens and the Troika last night. Since Greece has been able to regain access to capital markets and its economy looks like it’s over the worst, Athens have been pushing for an end to the bailout and the Troika-led austerity programmes. The troika needs to tread carefully over the coming months; if Greece is forced to stay in its bailout programme then it could make SYRIZA an even more attractive option for the electorate, which could threaten the whole existence of the currency bloc if they win power next year.

A double whammy for the EUR

From a fundamental perspective there are some potent reasons to sell the EUR in the coming days. The first is the resurfacing of Greek political tensions and the rise in bond yields back to danger territory as we mention above, the second is the prospect of a disappointing November CPI estimate for the currency bloc. The flash CPI reading is released on Friday at 1000 GMT, and the market expects a decline to 0.3% from 0.4%. However, the risks are to the downside after German November price data fell to 0.5% from 0.7% in October. This is the lowest reading since February 2010. We mentioned earlier this week that Germany was importing deflation after the import price index fell 0.3% in October.

The OPEC effect

After OPEC decided not to cut production at its recent Vienna meeting, the price of Brent crude oil has slipped to $75 per barrel. The decline in the price of oil is one reason why import prices and overall CPI have plunged in the currency bloc. While falling prices support further accommodative action from the ECB, it needs to weigh up whether it will look through falling oil prices before embarking on a radical step like QE. The problem for the ECB is that core prices that strip out energy tend to move in line with headline prices, albeit with a lag, hence at the same time as headline prices have fallen, core prices have been subdued and currently hover around the lowest levels since the inception of the currency bloc at 0.7%.

Core vs. headline:

The ECB tends to look at headline prices, however because of the 30% drop in oil prices since June; we think it may shift its focus to core prices at next month’s meeting. If we see core inflation drop below 0.7% on Friday and make a fresh historic low then it could heap the pressure on the ECB to signal further accommodative actions at its meeting next week. This could also trigger a sell-off in the EUR.

The technical picture:

EURUSD is mostly range bound today, which is unsurprising since the US is out on holiday. In the G10 FX space EUR is mostly being ignored as the commodity currencies come under attack after OPEC decided not to cut production at its meeting in Vienna. But the EUR bears will be on full alert on Friday as we wait to see the currency bloc’s CPI estimate for November.

EURUSD seems to have lost the 1.25 handle in recent days, although the technical signals are fairly directionless today on the back of US Thanksgiving holiday. We continue to think that any upside in EURUSD will be short-lived and resistance at 1.2616 – the 50-day sma – could scupper the bulls’ party. This pair still looks like it is breaking down, and any move above 1.25, the high so far this week has been 1.2532, could be sold into. A weak CPI reading on Friday may trigger a move back to 1.20.

The longer term outlook:

Once we get passed the CPI report, the next event will be the ECB meeting on 4th Dec. Draghi has been speaking today and sounded a note of caution about getting too excited about QE. He said that inflation expectations are just within the ECB’s price stability goal. He also said that he is confident that the ECB’s current stimulus will affect inflation. While he hinted that the ECB is still open to the possibility of QE, he said that the ECB has entered a quiet period of not elaborating on monetary policy. This sounds like he has been gagged, maybe by the Bundesbank who are opponents of QE, and makes next week’s press conference even more important.

Thus, if CPI is in line tomorrow, EURUSD could hover around recent ranges as we wait for the ECB press conference next Thursday.

Takeaway:

- Greek concerns and weak inflation continue to brew.

- Draghi seemed to back track on the QE idea at a speech today, which has helped to support the EUR.

- OPEC’s decision not to cut oil production could lead to further declines for the EUR in the medium-term as the Eurozone continues to import deflation.

- There could be further downside for this pair if Friday’s Eurozone CPI estimate falls below 0.3%.

- From a technical perspective, the EUR still looks weak and we could see back to 1.20 in the medium term.

- With Draghi tight-lipped about the future of ECB monetary policy, this makes next week’s ECB press conference critical for the single currency.

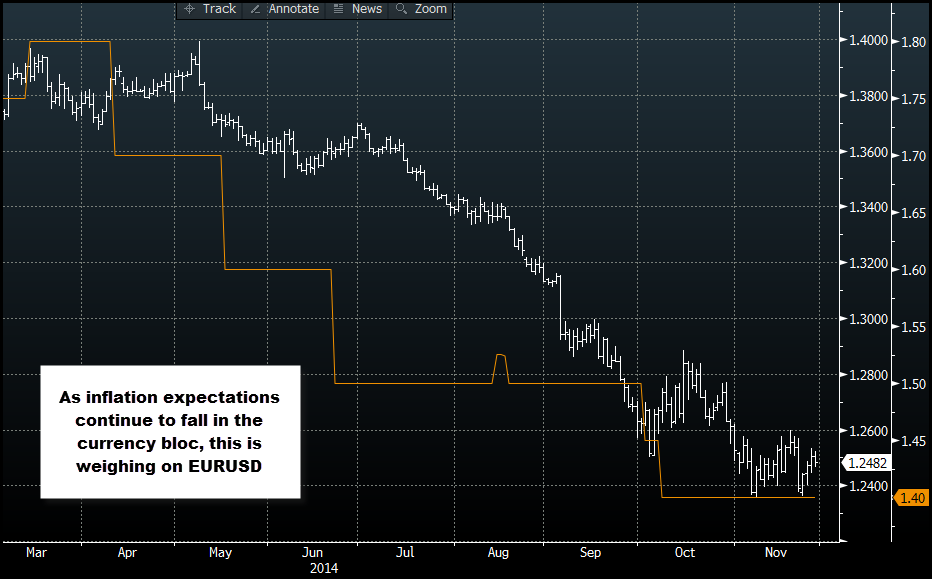

Figure 1:

The importance of Inflation on the EUR

SOURCE: THIS CHART DOES NOT REFLECT THE PRICES OFFERED BY FOREX.COM

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.