![]()

The dollar is in demand today as the euro and the pound give back their recent gains, this was triggered by ECB President Mari Draghi who was speaking at the European Banking Conference in Frankfurt. He focused on inflation and said that some inflation expectations are excessively low. This is significant since the ECB’s mandate is to promote price stability in the medium-term. If inflation expectations are also falling then the ECB should feel motivated to take more accommodative policy action. Draghi is chomping at the bit to take steps towards QE, and for the second time this week he has said that the ECB would broaden its purchases (of bonds) if its current policy to boost inflation does not work.

QE in December anyone?

While the ECB never pre-commits to policy (or, so they say), the fact that Draghi openly touted the prospect of QE in Frankfurt is worth noting, since the Bundesbank has been resistant to the idea of sovereign bond purchases. If Draghi is able to persuade the Germans that QE is the only answer to the ECB’s problems then QE could be on the cards for early 2015. This is what the market is currently pricing in, and why the euro is under pressure and the USD is clawing back some lost ground.

The technical picture: could 90.00 be on the cards?

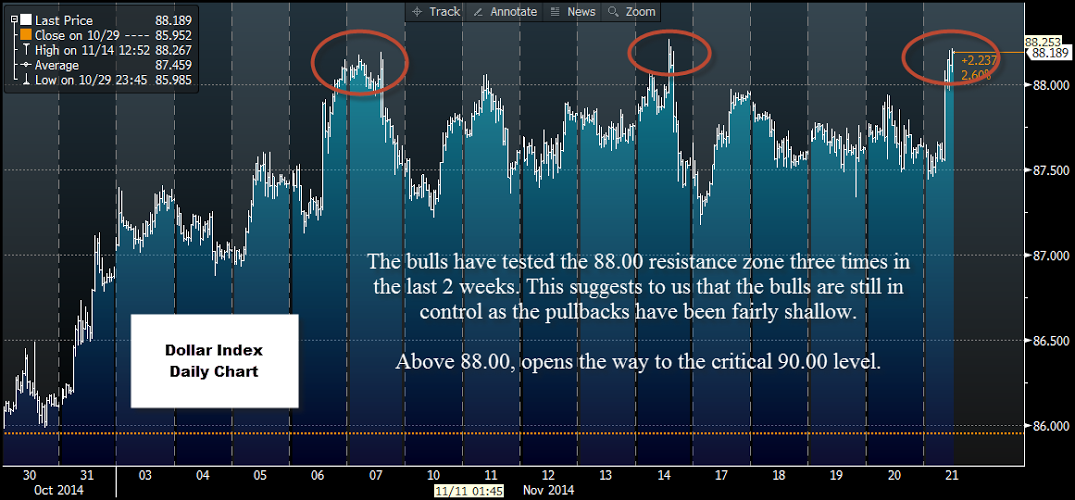

The fundamental picture is supportive for the buck right now, and the technical picture also suggests that the dollar index could make a decisive break of 88.00. The dollar index has tested resistance at 88.00 three times since the 7th November, as you can see in the chart below. The pullbacks have been shallow, suggesting that the bulls still have control; they are just taking a breather. Since this level has been tested repeatedly in the last two weeks, we believe it could eventually be broken, which would open the way to 90.00 – a key psychological level and the highest level since 2006.

If we get a weekly close above 88.00 later today then it could herald another leg higher for the dollar against the EUR and the GBP, with 1.55 a possibility in GBPUSD, and 1.20 a potential for EURUSD.

Conclusion:

ECB President Mario Draghi has been touting the prospect of QE once again, which is weighing on EURUSD.

The dollar index is testing a critical level of resistance.

The market is making its third attempt to take 88.00 in DXY. This suggests to us that the bulls have control and we could clear this level in the coming days, which may open the way to 90.00.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Bitcoin price could be primed for correction as bearish activity grows near $66K area

Bitcoin (BTC) price managed to maintain a northbound trajectory after the April 20 halving, despite bold assertions by analysts that the event would be a “sell the news” situation. However, after four days of strength, the tables could be turning as a dark cloud now hovers above BTC price.

Bank of Japan's predicament: The BOJ is trapped

In this special edition of TradeGATEHub Live Trading, we're joined by guest speaker Tavi @TaviCosta, who shares his insights on the Bank of Japan's current predicament, stating, 'The BOJ is Trapped.'