![]()

US stock markets have got off to a fairly good start today. After the S&P 500 fell through its 200-day sma on Monday, the first time it has fallen through this key support level in 2-years, some investors may be taking profit after a fierce sell-off since peaking on 19th September. However, this week could prove pivotal for the S&P since it is the start of earnings season with over 50 companies releasing their Q3 results and outlooks for the rest of the year.

So far, the major banks including Citi Bank, JP Morgan and Wells Fargo have either beaten or met analyst expectations. This is significantly better than last year when the JP Morgan reported a loss. Other corporate earnings releases to watch out for this week include:

Wednesday:

Bank of America

Ebay

American Express

Thursday:

Goldman Sachs

United Health

Google

Friday:

General Electric

Bank of New York Mellon

Morgan Stanley

Corporate outlooks for the rest of the year are the most important thing to take away from the earnings, if banks sound upbeat then that could limit further downside for US stocks.

Aside from corporate earnings there are a few other fundamental factors that could limit the sell-off in stocks:

The consumer: falling gas prices and a strong jobs market should benefit consumer discretionary stocks.

The US consumer is a $11 trillion monster, thus fears that the Eurozone growth slowdown could cross the Atlantic may be exaggerated if domestic demand can remain solid.

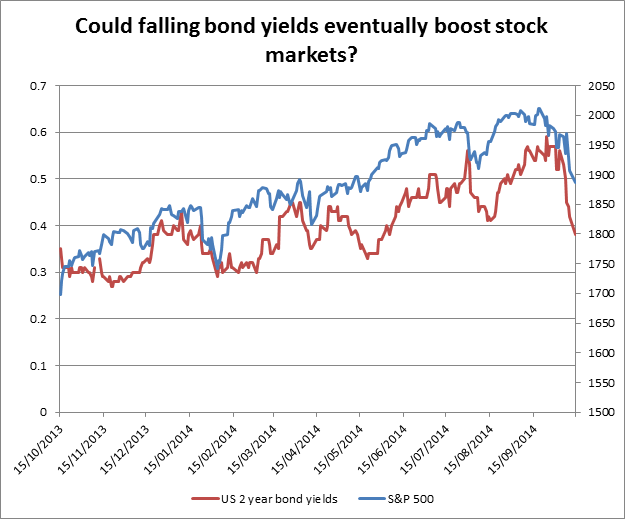

The Fed has shifted its tone recently and started to concentrate on the lower price pressures that have started to develop. If the Eurozone does start to export disinflation to the US then the Fed could delay its first rate hike, which is expected in mid-2015.

We believe that the Fed will only adjust interest rates when the time is right, which could sooth the markets.

The technical view:

From a fundamental perspective, things could start to brighten up for US stocks in the next day or so. But what about the technical outlook? The market can’t keep that pace of selling pressure up forever, especially if the market starts to think that there is a chance that the Fed will delay its rate hiking plans for mid-2015. We may hear more on this theme when the Federal Reserve Governor, Janet Yellen, speaks on Friday. However, the longer the S&P 500 stays below the 200-day sma, the more vulnerable it becomes, which makes 1,905 (200-day sma) a key resistance level to watch out for.

On the downside, the next support level to watch is 1,814 – the low from 11th April. So far today, sellers have emerged at 1,890, which is short term resistance, a daily close above this level would be necessary to signify a short-term change in trend.

Takeaway:

The pace of selling in the S&P 500 has slowed down on Tuesday.

Better than expected Q3 earnings from some large banks has helped to boost sentiment towards stocks.

Over 50 companies report earnings this week, so if we get some more positive surprises, it could place a temporary floor under US stocks.

There has been a subtle shift in the Fed’s rhetoric of late, with more members expressing concern about weak price pressures.

We believe that the Fed will only adjust interest rates once the time is right, which should sooth markets.

To conclude, although the technical picture is still bleak, the fundamentals are starting to shift and we could see the sell-off in stocks slow down, and potentially reverse in the coming days.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.