![]()

This Wednesday sees the culmination of the FOMC’s latest 2-day meeting. At 1900 BST/1400 ET the market will receive the FOMC rate decision, the decision on tapering, the latest statement including the latest “dot plot” which includes FOMC members’ forecast for interest rates, and, last but not least, a press conference by Fed Governor Janet Yellen.

This meeting comes at a delicate time for Fed policy, its QE 3 programme is due to come to an end next month and the market is expecting details of a new and improved exit strategy. After years of uber-dovish commentary from the Federal Reserve, the market expects a more hawkish tone at this meeting, which could have major implication for the markets.

What to expect:

$15 billion reduction in the pace of QE3, bringing the total amount of monthly purchases to $10 bn.

Confirmation that QE3 will come to an end in October.

The “dot plot”, FOMC rate expectations, will include the first dots for 2017; we expect the 2017 dots to show monetary policy at neutral – 3-3.5% - with the dots for 2015 and 2016 basically unchanged.

Changes to language used in the Fed statement. A radical shift could include dropping the phrase that interest rates will remain low for a “considerable time”, we think the Fed could make a more subtle shift to its language, see more below.

A revision to the Fed’s exit strategy.

What’s different this time?

Last week the San Francisco Fed noted that the public were anticipating less rate hikes than FOMC participants. This caused a flurry of activity as market participants rushed to price in an earlier rate hike from the Fed.

This meeting has the potential to surprise the markets, especially if Fed Governor Janet Yellen gives it a steer on the timing of the next rate hike. We don’t expect the Fed to spell out its next policy move at this meeting, although the potential moves listed above may not seem like much, they could be potential market-moving events for multiple asset classes including government bonds, the dollar and equities.

Changing its exit strategy:

Back in May, senior Fed member Dudley suggested that the Fed should prioritise hiking interest rates over shrinking the Fed’s balance sheet. This compared to previous expectations that the Fed would sell the assets it has accumulated during its three QE programmes before embarking on a rate hiking cycle.

If Yellen and co. at the Federal Reserve want to maintain the Fed’s balance sheet at its current size ($4.4 trillion) then it could give the FOMC more flexibility to hike rates sooner than later. Thus Yellen could use this meeting to lay the foundations for a more hawkish stance down the line.

Potential outcomes and the market impact:

1, The Fed does nothing: this is the path of least resistance, but it could result in two dissents from Charles Plosser and Loretta Mester. An evasive Fed at this stage could annoy the markets, especially after the comments from the San Francisco Fed last week that seemed to prep the market for an earlier than expected rate hike. This would be the most dollar negative outcome from this meeting, but it could buoy global equity markets, particularly in the emerging world where stocks have come under pressure as expectations about a more hawkish Fed start to grow.

2, The removal of “considerable time” from the Fed statement: the big risk with this is that the removal of this language might cause the market to price in earlier rate hikes that work against the Fed’s current expectations. Thus, it could be replaced by equally economical language as the Fed tries to gently recalibrate market expectations. The removal of this phrase could trigger a knee jerk reaction higher in the dollar, and could weigh on equities, but we need to see what new language they use to replace “considerable time” to assess the long-term impact of this change.

3, The statement continues to include “considerable time” but also adds in a new section about future rate hikes being “economically dependent”: This is one of the more likely outcomes in our view as it could mollify the hawks on the FOMC while at the same time calming market fears over an earlier than expected rate hike. We think that this could be a good option for the FOMC as it is balanced and fairly neutral while also setting the stage for the Fed to remove the statement “considerable time” down the line. Although the immediate reaction to this change could be limited, in the long-term it could lay the foundations for a more hawkish response from the Federal Reserve, so it could be dollar positive.

One to watch:

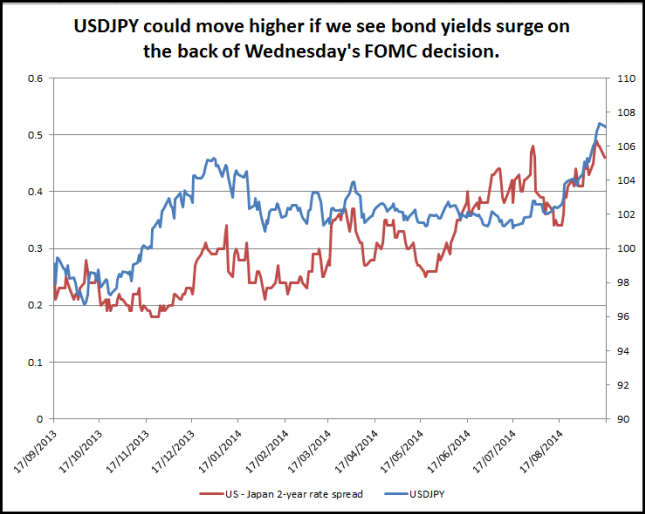

Whenever it comes to potential changes in Fed policy, it’s always worth looking at USDJPY, which tends to move in line with US Treasury yields. From a technical perspective, this pair has been consolidating so far this week, following a recent sharp advance. With momentum turning lower we could see further downside as we lead up to this Wednesday’s FOMC meeting. However, we expect any downside to be limited, with support at 106.64 – the low from 11th September.

However, we believe that the broader picture remains positive for USDJPY. The market has struggled around 1207.40, if we get above here then key psychological levels of resistance come into view including the 108.50, then 110.66 – the August 2008 high.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

AUD/USD could extend the recovery to 0.6500 and above

The enhanced risk appetite and the weakening of the Greenback enabled AUD/USD to build on the promising start to the week and trade closer to the key barrier at 0.6500 the figure ahead of key inflation figures in Australia.

EUR/USD now refocuses on the 200-day SMA

EUR/USD extended its positive momentum and rose above the 1.0700 yardstick, driven by the intense PMI-led retracement in the US Dollar as well as a prevailing risk-friendly environment in the FX universe.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Bitcoin price makes run for previous cycle highs as Morgan Stanley pushes BTC ETF exposure

Bitcoin (BTC) price strength continues to grow, three days after the fourth halving. Optimism continues to abound in the market as Bitcoiners envision a reclamation of previous cycle highs.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Federal Reserve might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.