![]()

Yesterday we looked at gold and pointed to the fact that it hasn’t found much safe haven demand despite all the on-going geopolitical risks. What’s more, the strengthening of the US dollar and the resilience of the stock market has further discouraged demand for yellow metal. But gold is not the only metal struggling. Silver, platinum and copper have all come under pressure too. Other commodities such as crude oil have also failed to respond positively to the deteriorating geopolitical tensions, with both Brent and WTI contracts falling viciously since the start of the summer. However there has been at least one commodity that has bucked this trend: palladium (until today).

Palladium has been rising strongly of late and yesterday touched a fresh 13-and-a-half year high when it climbed to above $910 per troy ounce. It has been boosted, above all, by concerns over potential supply disruptions from Russia, the world’s biggest producer of platinum, due to the country’s involvement in the crisis in Ukraine. If Russia’s palladium exports were to be restricted then it would exacerbate the already large palladium deficit. However we don’t think this would be the case. As palladium is mainly used for catalytic converters in automobiles, any restrictions of the metal could increase the cost for Europe’s carmakers. Clearly this would not be in anyone’s interest. Therefore, I think palladium may be overpriced and overbought.

In fact palladium could not defend itself from the pressure excreted by the rallying US dollar today: it has dropped by more than $25 or 2.8% to $880 from its opening price of $908. It has underperformed all of the commodities mentioned above, as well as stocks and most FX pairs. So, why has it performed this badly? We think it may be because of the one-way speculation that has been on-going for weeks now, and today’s sell-off is probably caused by speculators closing some of those long positions.

Bets from hedge funds and other financial speculators on rallying palladium prices have been increasing for weeks now. In the week to 26 August, net long positions had climbed by a further 560 to 24,600 contracts – just below the record level achieved in April 2013. If the situation in Ukraine improves now, or otherwise speculators continue to book profit on their longs, then we could see a crude-style sell-off in palladium prices over the coming days and weeks.

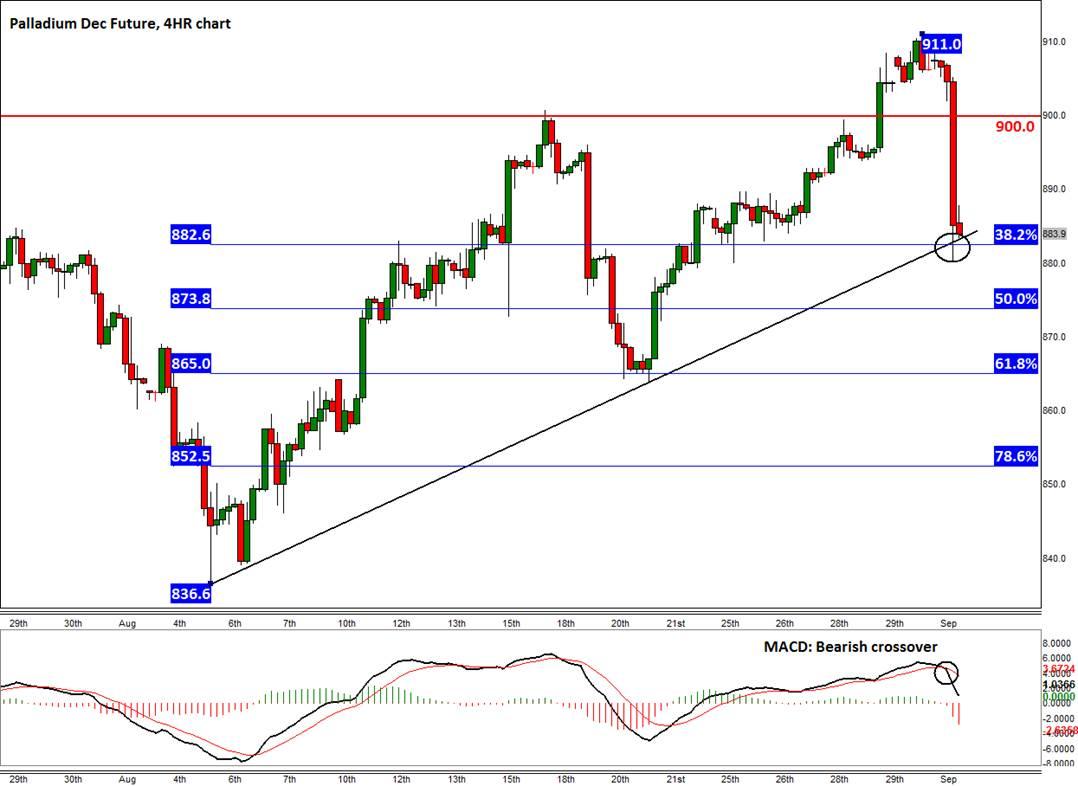

As the 4-hour chart of the December contract shows, the metal is currently trying to break below the $882 support level. This level ties in with a bullish trend line and also the 38.2% Fibonacci retracement level of the up move from the August low. If it breaks below here then the 61.8% Fibonacci retracement level at $865 could be the next stop. Further downside targets are $852 (78.6%), $836 and $800. A potential break below $800 could even reverse the long-term trend. On the upside, the next level of resistance is at $900, followed by $910 and then the December 2000 peak of $959.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.

_20140902162600.png)