![]()

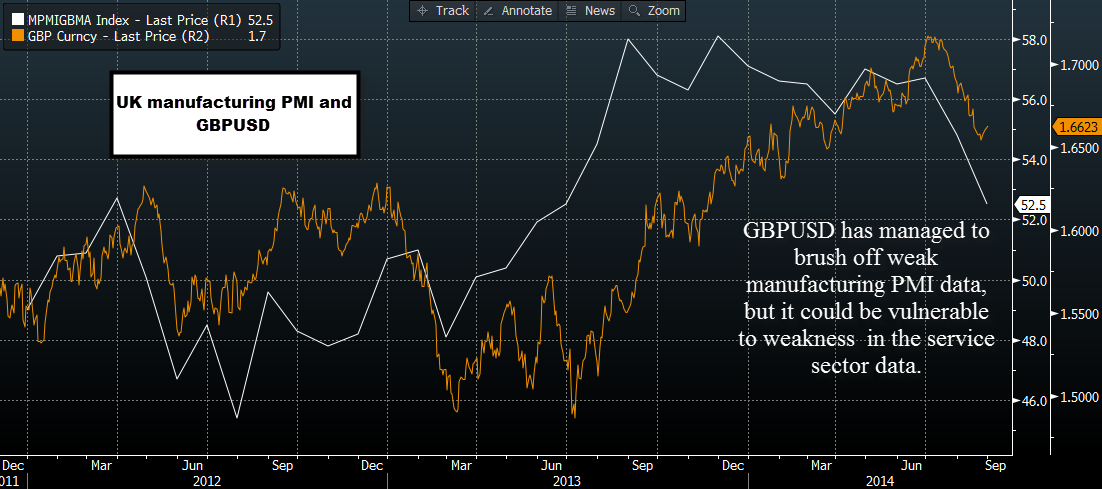

Although the UK manufacturing PMI for August fell to its lowest level since June last year, the pound’s reaction has been fairly muted, and GBPUSD remains at its highest level since 20th August. So why was the reaction so muted?

From a fundamental perspective, GBPUSD’s reaction this morning wasn’t too surprising since consumer credit and mortgage approval data was better than expected. Since consumption and the housing market are important components of the UK economy, the market may have been willing to turn a blind eye to the weak PMI. However, history tells us that if we continue to see disappointing PMI data then this could spell bad news for the pound (see figure 1). If we get weak service sector data on Wednesday then the mini recovery in the cable could be jeopardised.

The technical view:

Having posted a fresh low last Monday, GBPUSD has been in recovery mode since then, and momentum has started to point to the potential for further upside. However, we continue to think that this is still a recovery within a down-trend; hence, we believe that future upside potential is fairly limited.

1.6695 – the 200-day sma – is a key resistance level, and as we get closer to this level then we may see some caution (and some potential selling) set in. Above here 1.6765 – the 38.2% retracement of the July – August decline could stem the recovery. As long as these two levels hold then we could see a resumption of the downtrend, opening the way to key support at 1.6460 – the March low.

Takeaway:

GBPUSD had a fairly muted reaction to the weak PMI data, although the consumer credit and mortgage approval helped to sweeten the blow from the PMI news.

This pair is still consolidating after reaching a five month low, although we continue to think that this pair remains in a downtrend.

In the long-term, PMI data tends to move in the same direction as the pound, so if we see weak service sector PMI later this week then we could see a resumption of GBP weakness.

Key resistance lies art 1.6695 – the 200-day sma, a failure to break above this level could signal further weakness.

Initial support lies at 1.6563 – the August 29th low, then 1.6460 – the low from March 24th.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.