![]()

The dollar is on everyone’s mind today, after a stunning 3.5% rally since July, the dollar index is taking a breather ahead of key resistance at 82.67 – the high from September 6th. In the short term, =we wouldn’t be surprised if we get below this level as the dollar index looks a little over-extended to the upside, we still think that any pullback will be short lived. Key support levels include:

81.73 – the 61.8% retracement of this month’s advance

81.18 – August 1st low.

However, last week’s break above 81.51 – the 61.8% retracement of the July 2013 – May 2014 bear trade, was a bullish development and we think any pullback will be short lived as the dollar’s pillars of support remain firm including:

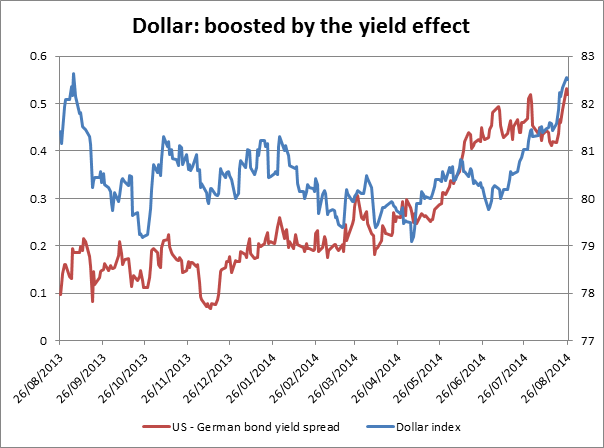

1, Rising 2-year bond yields, which have room for further upside. As you can see in figure 1, the short –term yield spread between the US and Germany is dollar positive.

2, Improving USD fundamentals – watch out for a stellar durable goods report later on Tuesday, the July data could be in the double figures although most of this could be due to airline orders.

3, The Eurozone: EUR is the second most traded currency in the world, and when it is struggling it can be good news for the buck. The fundamental picture is looking bleak for the single currency right now, the French government has been dissolved as divisions rise as France tries to re-boot its economy and embark on an austerity programme, and the ECB may have no choice but to embark on QE at its meeting next week if inflation for August falls to 0.3%, as the market expects.

If we can break above 82.67 resistance then we could see back to July 2013 highs, just below 85.00.

The EUR view:

As we mention above, the performance of the EUR can be critical for the dollar. EURUSD is extending its recent decline, and there is potential for further downside in the near term with supports at 1.3105, the September 6th 2013 low, and then 1.3038 – the 50% retracement of the July 2012 – May 2014 bull trade. Below here would open up the prospect of life below 1.30 – the lowest level since July 2013.

Conclusion:

The dollar may be pausing for breath today, but we continue to think that momentum is to the upside, especially if the EUR continues to come under pressure.

82.67 – the high from Sept 2013 – is key resistance in the dollar index. Above here opens the way to July 2013 highs just below 85.00.

If the EUR continues to come under pressure that could boost the buck.

In EURUSD, watch 1.3105 then 1.3038 – key support levels in the near term.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.