![]()

The USD was the main driver of the G10 FX market last week as its general uptrend dominated across the board. Although, after such a strong run, the buck is at risk of a couple of set-backs at the start of the new week, as markets digest Fed chair Yellen’s comments from her Jackson Hole speech, we continue to think that any weakness in the dollar could be bought into. One reason why the dollar could sustain its recent uptrend is weakness in the EUR. Since EURUSD accounts for approx. 30% of daily FX trading volume, weakness in this pair could boost the dollar in the medium term. Thus, if you are looking for a dollar rebound, watch EURUSD in the coming days.

The single currency took another battering last week, and although the EUR has fallen for six straight weeks, we continue to think that there could be further downside to come as both the fundamentals and the technicals look stacked against the EUR.

The technical outlook: having broken below key pivotal support levels last week including the base of the weekly Ichimoku cloud at 1.3319 and at 1.3295 – the November 2013 low – we see little reason why the market should not continue rotating lower towards 1.3100 in the coming days.

The fundamental outlook: The first bearish development was the decline in the Eurozone’s PMI data for August. Although August’s decline only fell back to the June lows, Europe is now acting as a drag on the global economy. These surveys added to nervousness around the growth outlook generated by the weak Q2 GDP report and the recent slump in regional manufacturing production. Consumer confidence also fell this month, which could force the ECB staff to revise their September growth forecasts lower for the second half of this year. This could force investors to look elsewhere for growth, for

example the US, where the economy is rebounding sharply after the slump in Q1, and continue to weigh on EURUSD.

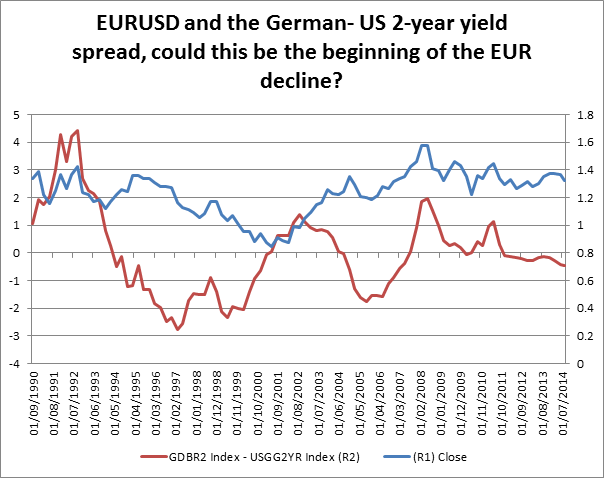

The second development was the yield spread. The German – US yield spread continues to fall deeper into negative territory, which is EUR negative. Although the spread between German and US bond yields is already -0.46 basis points and is back at 2007 lows, there is historical precedent for more downside (see chart below), in 2005 this spread fell to -1.75%, and in 1997 it was close to -3%. Thus, if the ECB is about to embark on QE, the EUR could lose even more yield support, particularly if the Fed starts to consider raising rates sometime in 2015, which is also EUR negative.

The last fundamental consideration is this week’s flash CPI release. This is, by far, the most important data release for the EUR this week. The market expects the currency bloc to take another step towards deflation, with CPI expected to fall to 0.3% from 0.4%. This could add fuel to the belief that the ECB will have to embark on a QE programme before too long. It may even happen at the September meeting since we get the latest release of ECB staff economic forecasts. If these forecasts show further declines in inflation, then the ECB may have no choice but to take action next month. European bond yields have declined further in recent days and the EUR also fell below 1.33 last week, the prospect of QE could trigger further EUR declines.

Of course, there is a risk that CPI could surprise on the upside, and that the US gets a spate of weak data. In that environment, we could see a bounce back to 1.3420 – a minor 38.2% Fib resistance on a short-term chart. However, we think that any move higher could be met with selling interest, and sellers could gather around 1.3320 – the base of the weekly Ichimoku cloud – initially, then at 1.3365 – the high from 18th August.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0650 after US data

EUR/USD retreats from session highs but manages to hold above 1.0650 in the early American session. Upbeat macroeconomic data releases from the US helps the US Dollar find a foothold and limits the pair's upside.

GBP/USD retreats toward 1.2450 on modest USD rebound

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold clings to strong daily gains above $2,380

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.