The XAU/USD pair (gold price in terms of USD) extended its bearish run for the third day in a row on Thursday, breaching the hourly 200-SMA support then located at 1235.54 to hit daily lows at 1223.80, before recovering some ground to close the day at 1229.30. The metal gave a daily closing below crucial 50-DMA support at 1232.50 and remained heavily offered, with the bulls failing to find support from poor US inflation report. The bullion took a beating for the third straight session on the back of extended broad based US dollar advance and risk-on rally in the global equities. A number of Fed officers hit the wires over the past week and hinted at atleast 2-3 rate hikes this year, which weighed heavily on the non-interest paying gold.

The yellow metal attempted a tepid-bounce from ahead of 1220 levels this Friday, although remains set to book first weekly loss in three. However, over the last few hours, the prices are seen oscillating in a tight range amid subdued trading on the global equities and a broadly mixed US dollar. The calm has spread across the financial markets as traders remain unnerved and refrain from creating fresh positions ahead of this Sunday’s oil producers’ meeting held in Doha to reach a deal on output freeze. Looking ahead, the bullion also awaits fresh incentives from a fresh batch of US macro data due later in the NY session for further direction. The US calendar offers the industrial production, consumer sentiment and regional manufacturing index for the gold traders. Markets are expecting the US economic releases to put up a positive show, providing renewed impetus to the greenback at the expense of gold.

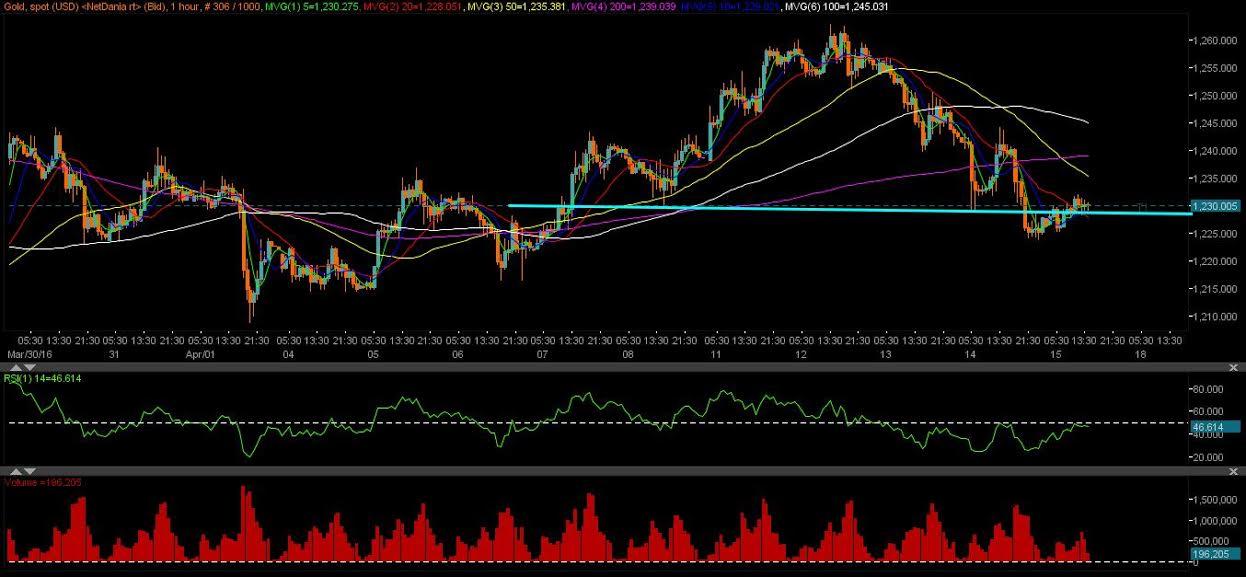

Technicals – Gold could drop further to test $ 1220 once again

The hourly chart for gold displays a clear bearish picture, with the prices having displayed a head and shoulders bearish breakout earlier today. The metal trades below most major hourly moving averages, while the RSI lies below the mid line and aims lower, suggesting further scope for declines. Should the US data better estimates, we could see the prices tumbling to $ 1220 support, below which selling pressure will intensify drowning the bullion to March lows around 1207 levels. A break below the last, the prices could sink further for a test of $ 1200 – key psychological mark. In case the data surprises to the downside and weighs on the Fed rate hike prospects, gold could witness a minor rebound towards hourly 200-SMA now located at 1239.04. However, the upside looks limited looking at the technical set up on the 1hr charts.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD mired near 1.0730 after choppy Thursday market session

EUR/USD whipsawed somewhat on Thursday, and the pair is heading into Friday's early session near 1.0730 after a back-and-forth session and complicated US data that vexed rate cut hopes.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Ethereum could remain inside key range as Consensys sues SEC over ETH security status

Ethereum appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the US SEC and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.